The Hidden Costs of Spreadsheets in Compliance and Risk Management

2 minute read

December 2015

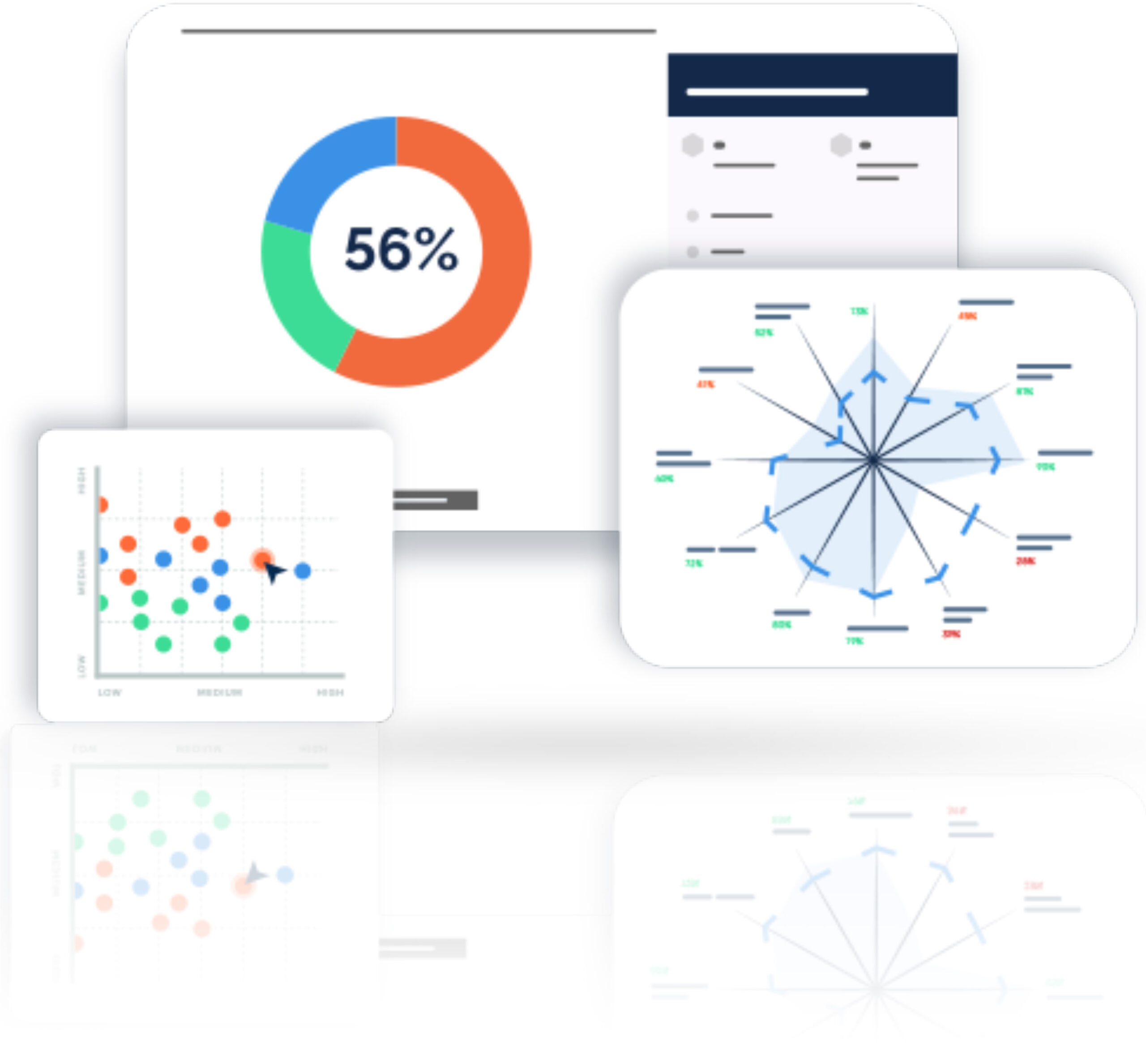

While spreadsheets are a widely-accepted go-to for compliance and risk management activities, findings from Blue Hill Research present a number of considerations for the limitations they pose. Most of these issues are related to challenges supporting multi-stakeholder activities, manual processes, and difficulty in scaling and adapting to meet expansions in stakeholders, regulatory complexity, and changing business needs.

Blue Hill Research’s whitepaper identifies spreadsheet alternatives, particularly software-based governance, risk and compliance (GRC) solutions. While investing in software can initially seem like a costlier alternative to spreadsheets, Blue Hill explains that as organizations encounter increasingly complex and changing regulatory and business environments, the limitations posed by spreadsheets begin to generate costs in the form of the productivity of compliance and risk staff and risk exposures.

The report’s author, Principal Analyst David Houlihan, also noted the following feedback from the study’s participants, which included senior compliance and risk function owners: “Overall, research participants reported that while the implementation of GRC entails the additional expenses of software investment, its corresponding reduction in the costs generated by spreadsheet-based processes provided significant improvement in enterprise value.”

In conclusion, the Blue Hill Research report tracked comparisons of participants’ experiences both prior to and after GRC implementation with the following findings: (1) reductions in report generation time from a matter of days to hours, (2) increases in reporting frequency from monthly or quarterly to weekly, (3) 25% to 30% reductions in time required to execute compliance and risk activities, and (4) “near real-time” awareness of risk and compliance performance.

Click here to download “The Impact of GRC in Spreadsheet-Driven Compliance and Risk Management Environments.”

Related Articles

Top 5 Features to look for...

Third-party vendor breaches are escalating at an alarming rate. In 2023, 61% of organizations reported..

Learn More

The Evidence Overload Problem: Why Third-Party...

In third-party risk management (TPRM), evidence documentation is everything. It’s how third parties prove they..

Learn More

5 Critical Regulations Reshaping TPRM in...

The pressure on financial institutions to manage third-party risk is mounting — and the stakes..

Learn More

Closing the Gaps: 8 Third-Party Risk...

Third-party relationships are a double-edged sword: opportunity and business functionality on one side, but an..

Learn More

ProcessUnity’s UNITE 2025 San Diego Sets...

Last week, ProcessUnity hosted UNITE 2025 San Diego, our trailblazing customer summit. This edition of..

Learn More

How Third-Party Vendor Risk Disrupts Business...

Your third-party vendors are delivering on time, business operations are efficient and planned, and customers..

Learn More

Mapping Assessments Across Standard Frameworks More...

Maintaining a standard security framework has become increasingly crucial for businesses in today’s digital age...

Learn More

Third-Party Risk Management ROI Calculator: Measuring...

Imagine starting your day knowing exactly where your vendor risks lie and the status of..

Learn More

10 Critical Third-Party Risk Management Challenges...

Every vendor relationship can introduce potential vulnerabilities to your business, and in today's hyperconnected business..

Learn More

How to Choose the Right Third-Party...

The clock is ticking, and your team is buried under a pile of vendor risk..

Learn More

How to Facilitate Third-Party Risk Assessments...

Managing third-party risk is a complex and resource-intensive challenge for most organizations. Traditional risk assessments..

Learn More

Ensure Ongoing DORA Compliance Across Your...

The Digital Operational Resilience Act (DORA) is a regulatory framework established by the European Union..

Learn More

Predicting Global Trends for 2025: What...

Read our 2025 predictions for regulatory impacts, from ProcessUnity VP of Product Management Sandeep Bhide...

Learn More

Bridging the Third-Party Vulnerability Gap: Four...

Third-party risk management is at a tipping point when it comes to vendor assessments. Organizations..

Learn More

The AI Advantage for TPRM: Turning...

As AI technology advances, security leaders in third-party risk management (TPRM) face a stress-inducing choice:..

Learn More

Third-party risk: Re-thinking vendor assessments

Third parties can introduce substantial risk into global supply networks, but rigorous vendor risk assessments..

Learn More

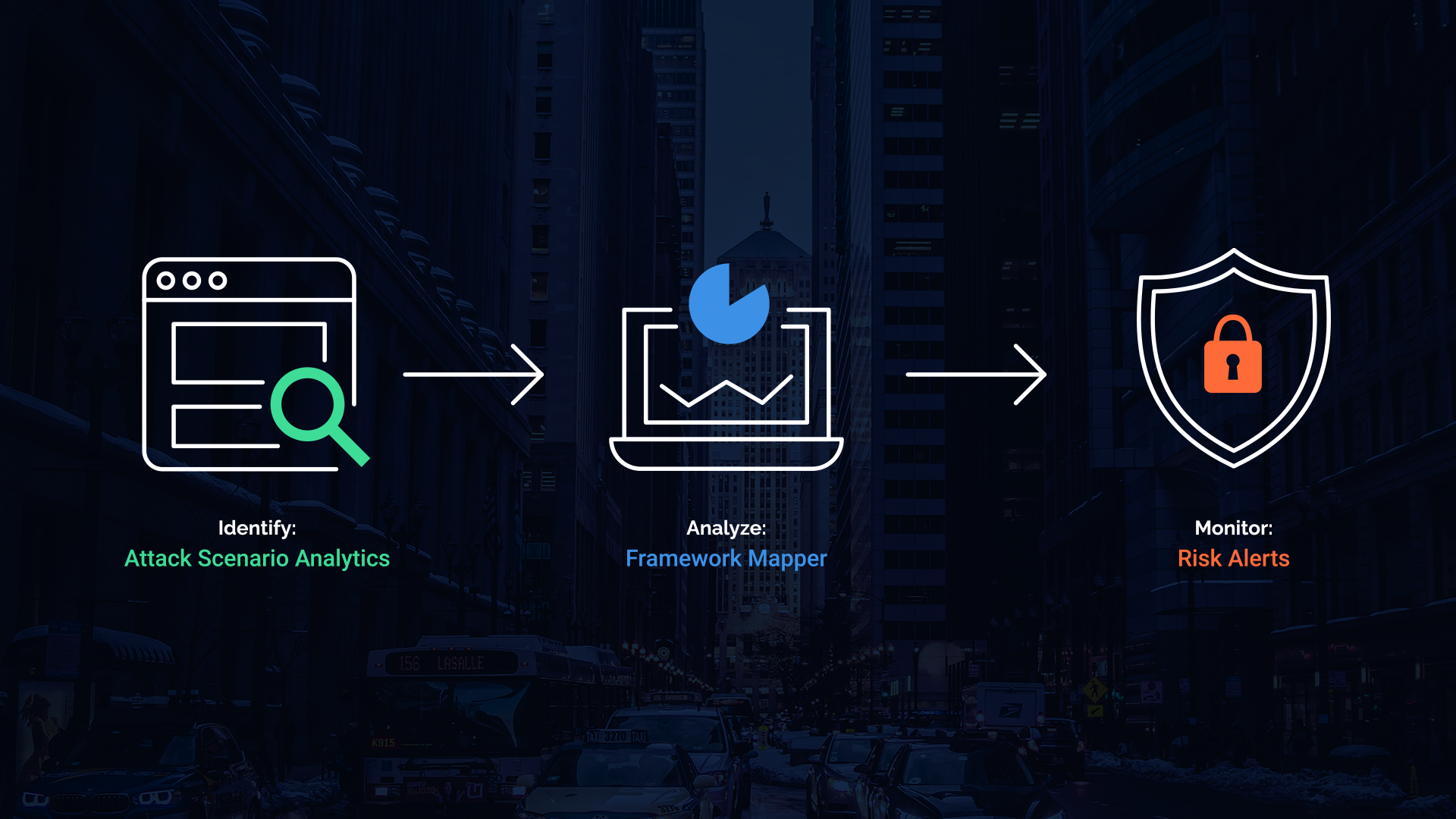

Revolutionizing Response to Emerging Third-Party Cybersecurity...

Introducing ProcessUnity’s New Threat and Vulnerability Response Platform to Quickly Identify Emerging Threats and Assess..

Learn More

Best Practices for DORA Preparation

The enforcement deadline for the EU Digital Operations Resilience Act (DORA) is approaching fast—as of..

Learn More

Key Provisions for DORA Preparation

The EU’s Digital Operations Resilience Act (DORA) will be enforceable starting January 27th 2025, and..

Learn More

ProcessUnity DORA Enhances Operational Resilience

As the January 2025 DORA enforcement deadline approaches, regulated entities and their ICT suppliers face..

Learn More

July 19, 2024 - The CrowdStrike...

Introducing Threat and Vulnerability Response for quick and efficient third-party risk management of emerging threats ..

Learn More

How Organizations and Vendors Use a...

A third-party risk exchange is a transformative concept designed to make third-party risk management (TPRM)..

Learn More

Implementing Advanced Third-Party Risk Management Workflows...

According to Gartner, 60% of organizations work with more than 1,000 third parties. With ecosystems..

Learn More

Managing Third-Party AI Risk

Artificial Intelligence presents third-party risk management (TPRM) professionals with a serious challenge and a profound..

Learn More

Ransomware Attacks in Healthcare: How to...

Healthcare organizations are common targets for cyber and ransomware attacks. Because organizations in this industry..

Learn More

5 Red Flags by Third-Party Risk...

Third-party risk management (TPRM) teams have a challenging job: they must evaluate a large volume..

Learn More

Deploying an AI-powered Third-Party Risk Management...

Artificial Intelligence (AI) impacts third-party risk management (TPRM) practices, whether or not your TPRM team..

Learn More

ProcessUnity is a Leader in the...

The results are in: ProcessUnity is a Leader in the 2024 Forrester Wave™ for Third-Party..

Learn More

Quantify Financial Risk to Prioritize Third-Party...

When you quantify financial risk across your third-party ecosystem and prioritize the most critical remediation..

Learn More

FDA Cybersecurity Regulations Add Medical Device...

As more medical devices are produced to function wirelessly and with network capabilities, the risk..

Learn More

NIST CSF 2.0 Draft Emphasizes Cybersecurity...

The National Institute of Standards and Technology’s Cybersecurity Framework (NIST CSF) has helped organizations of..

Learn More

Mature Your Cyber Program with a...

Risk-based cybersecurity risk management is the process of identifying, tracking and mitigating the risks to..

Learn More

The Relationship Between Privacy vs Security...

30 years ago, privacy, security, and risk management were rarely used in the same sentence...

Learn More

3 Practices to Ensure Supply Chain...

Supply chain resilience, or the ability to withstand and manage disruptions to your supply chain..

Learn More

Electric Utilities and the Domino Effect...

A few years ago, cyberattacks with physical effects, like Stuxnet, were relatively unheard of. In..

Learn More

Inside the Breach: Unraveling Iconic Data...

If you were to Google “cyber attacks on critical infrastructure,” you would get over 27..

Learn More

How the SEC Cybersecurity Rule Impacts...

As of July of 2023, public companies are subject to new cybersecurity disclosure requirements from..

Learn More

From Infiltration to Execution: Understanding the...

There is no silver bullet, although, believe it or not, there is a silver lining..

Learn More

Unveiling the Power of a Risk...

If you feel overwhelmed by bespoke security questionnaires, you're in good company. Many understand the..

Learn More

Controls-Based Versus Risk-Based Cybersecurity Programs

In the face of an escalating regulatory burden and increasingly common data breaches, many teams..

Learn More3 Key Takeaways from ICON plc’s...

ICON Plc recently received the award, “Best in Class Third Party Risk Management—Large Enterprise,” from..

Learn More

Manage Cybersecurity Risk with the SCF...

The Secure Controls Framework (SCF) Risk Management Model can be a powerful tool for teams..

Learn More

CyberGRX Ranked on the 2023 Inc....

It’s been said that good things happen in three’s, and that’s certainly true with the..

Learn More

Use Software to Follow OCC 2023-17...

The Federal Reserve, Federal Deposit Insurance Corporation (FDIC), and the Office of the Comptroller of..

Learn More

21 Cybersecurity Training Resources

According to Statistica, the global cost of cybercrime is expected to reach a staggering $24..

Learn More

The SEC Cybersecurity Rule and the...

When the government perceives those entrusted to its care are in danger, it takes action—..

Learn More

What Role Does AI Play in...

Would you use AI to support your third-party risk decisions? We’ve recently witnessed AI morphing..

Learn More

Cybersecurity Through the Years and How...

“Security is a process, not a product.” - Bruce Schneier From the mainframes of..

Learn More

3 Takeaways from Retail Cybersecurity Breaches

Retail businesses process large quantities of transactions and customer data, making them common targets for..

Learn More

CyberGRX and ProcessUnity Combine to Form...

July 12, 2023 – CyberGRX and ProcessUnity announced today that the Third-Party Risk Management (TPRM)..

Learn More

ADP Reaches CyberGRX Exchange Risk Assessment...

ADP has reached a significant assessment-sharing milestone, sharing its validated cyber risk assessment over 1,000..

Learn More

Optimize Vendor Onboarding by Aligning with...

During the vendor onboarding process, both cybersecurity and procurement manage the amount of risk brought..

Learn More

How ISO 27002 Prepares You for...

ISO 27002 is a powerful tool to demonstrate your information security commitments to customers, investors..

Learn More

CyberGRX Enables Microsoft to Expedite Risk...

We are pleased to recognize Microsoft for expediting the sharing of risk assessments and merging..

Learn More

MOVEit Breach Fallout | LastPass Regrets...

In this episode of GRXcerpts: The MOVEit Breach Fallout Continues LastPass Reflections and Regrets Updates..

Learn More

Align Your Organization with the NYDFS...

The NYDFS Cybersecurity Regulation (23 NYCRR 500) is a set of rules designed to enforce..

Learn More

Malicious Chrome Web Extensions | Cyber...

In this episode of GRXcerpts: Malicious extensions found on the Chrome Web Store Cyber insurers..

Learn More

Mitigate Shadow IT Risk Internally and...

Shadow IT, or technology that’s used without being documented or vetted by cybersecurity personnel, poses..

Learn More

Navigating the Supply Chain Risk Landscape...

The supply chain risk landscape continuously changes, posing constant cyber risks and threats to manufacturers...

Learn More

Manufacturing Under Attack: Unmasking the Risks...

According to the World Economic Forum, manufacturing is one of the most targeted sectors by..

Learn More

Inside the Breach: Why & How...

One single vulnerability is all a hacker needs. In 2022, manufacturing firms suffered more than..

Learn More

Standing Tall: The Role of Security...

A resilient security posture shouldn’t be taken for granted, especially with a constantly changing threat..

Learn More

Align Your Cybersecurity Program with NIST...

Aligning your cybersecurity program with NIST 800-53 involves mapping your controls and policies to the..

Learn More

3 Ways to Prepare Your Cybersecurity...

SOC 2 compliance can be a powerful tool for all aspects of your business—it can..

Learn More

Google's New Top-Level Domains | Microsoft...

In this episode of GRXcerpts: Google’s top-level domains open doors to new attack vectors Warnings..

Learn More

Navigating the Cybersecurity Landscape of Energy...

Cyber threats pose a serious risk to energy systems globally, potentially bringing critical energy infrastructure..

Learn More

Responsibly Defend Cybersecurity's Budget

Though the cybersecurity function is as crucial as ever, recession, inflation and widespread layoffs have..

Learn More

The Risk Reporting Dilemma: Balancing Transparency...

No one likes to be the bearer of bad news, but even though it’s a..

Learn More

3 Features to Look for in...

Choosing the right third-party risk management tool for your organization requires identifying the functionality that..

Learn More

The State of Cyber Risk Management...

In the financial services industry, cyber risks and threats have become an inherent part of..

Learn More

Rising Threats & Risk Management Challenges...

In 2023 the insurance and finance industries were the second-most targeted sector in terms of..

Learn More

Inside the Breach: Understanding Patterns &...

Insurance and financial companies, with thousands of corporate and private clients, are lucrative targets for..

Learn More

The Top Risk Management Challenges Facing...

Retail and hospitality organizations now find themselves in the cybersecurity line of fire. According to..

Learn More

QR Code Scams | Q1 Cyber...

In this episode of GRXcerpts: Alarming new QR code scams Cyber attack stats for Q1..

Learn More

Inside the Breach: Unmasking the Types...

Without question, technology has revolutionized how we do business today. But with great power comes..

Learn More

The State of Cyber Risk Management...

Risk represents the potential for damage when a threat source exploits a vulnerability. In the..

Learn More

The State of Cyber Risk Management...

Risk is an ever-present threat, capable of inflicting substantial harm when vulnerabilities are exploited by..

Learn More

Managing Cyber Risk in the Digital...

The increasing demand for technology solutions in an era of digital transformation presents both opportunities..

Learn More

How to Choose Trust Service Criteria...

Selecting Trust Service Criteria (TSC) is a crucial step in achieving SOC 2 compliance: the..

Learn More

CyberGRX Ranks Among Highest-Scoring Businesses on...

Inc. Magazine has recognized CyberGRX as a Top Workplace 2023, honoring 591 exceptional companies from..

Learn More

Inside the Breach: Analyzing Iconic Data...

The US hospitality market was worth $4.1 trillion in 2022 and will see strong growth..

Learn More

Why Ignoring TPRM is Increasing Your...

It seems that not a week goes by without a data breach or cyber attack..

Learn More

3CX Hackers Target Critical Infrastructure |...

In this episode of GRXcerpts: 3CX hackers target critical infrastructure A warning to critical infrastructure..

Learn More

Using Third-Party Risk Management Software for...

Third-party risk management (TPRM) is an umbrella term for the process of tracking and mitigating..

Learn More

CyberGRX Announces Winners of the Inaugural...

April 26, 2023 – CyberGRX, provider of the world’s first and largest global risk exchange,..

Learn More

CyberGRX Named Winner In 11th Annual...

April 24, 2023: Cyber Defense Magazine announced today that CyberGRX won a 2023 Global InfoSec..

Learn More

Nth Party Relationships and Supply Chain...

No person–or company–is an island. In today’s interconnected, digital world, most, if not all, organizations..

Learn More

A Control Metaframework Can Unify NIST,...

Cybersecurity teams often need to achieve compliance with multiple regulations, standards and frameworks. The sheer..

Learn More

The Impact of the SEC Cyber...

In this special edition of GRXcerpts, we’re diving into the pending SEC cybersecurity regulation and..

Learn More

Pushing Boundaries: Accelerating Risk Decisions With...

The alarming volume of cyber attacks that businesses and organizations face today emphasizes the need..

Learn More

Prepare for DORA with a Cyber...

Cyber risk management is now a requirement for financial organizations in the EU and the..

Learn More

3 Takeaways about Anti-Bribery and Corruption...

Anti-bribery and corruption programs grant businesses visibility into their internal practices and third-party networks to..

Learn More

How Well Do You Know Your...

How well do you know your third parties? Are your records accurate and up-to-date? Modern..

Learn More

CyberGRX Named Security Visionary in EMA...

April 4, 2023 - Enterprise Management Associates (EMA), a leading IT and data management research..

Learn More

QR Code and PDF Scams, ChatGPT...

In this episode of GRXcerpts, we’ll cover technologies you thought were relatively safe but might..

Learn More

3 Due Diligence Obligations for the...

The German Supply Chain Act (LkSG), effective as of January 1, 2023, imposes new due..

Learn More

Your TPRM Program Must Account for...

Global conditions, from civil unrest and political turmoil to questionable government practices, can affect operations..

Learn More

Managing Cyber Risk Amidst a Growing...

As the world becomes more interconnected, businesses increasingly rely on third-party vendors to provide essential..

Learn More

The Impact of SVB on Cybersecurity,...

In this episode of GRXcerpts: The Impact of SVB on Cybersecurity New TSA measures for..

Learn More

Show Executives that Cybersecurity Drives Operational...

One strong approach to justifying your cybersecurity budget to executive leadership is to show how..

Learn More

Add Data and Risk Intelligence to...

CyberGRX is proud to announce the launch of our ServiceNow VRM integration, designed to provide..

Learn More

CyberGRX Integrates with ServiceNow to Streamline...

March 15, 2023 – CyberGRX, provider of the world’s first and largest global risk exchange,..

Learn More

CyberGRX Recognized for Innovation and Collaboration...

CyberGRX has been named the recipient of eight awards from the 2023 Cybersecurity Excellence Awards..

Learn More

Third-Party Risk Management: the Key to...

Scroll through social media, and you’ll come across many motivational tips and challenges about..

Learn More

Maturing Your Program with a Cyber...

Many organizations spread their cybersecurity budget between a variety of technologies, services and vendors: they..

Learn More

Discover Hidden Portfolio Vulnerabilities and Evolve...

Portfolio Risk Findings highlights the risk hidden inside your portfolio when analyzed through a specific..

Learn More

New Rules Strengthen SEC Cybersecurity Oversight...

The United States Securities and Exchange Commission (SEC) has recently announced a set of new..

Learn More

Data Risk Management Challenges and Best...

Protecting your data against unauthorized access and cyberattacks is hard. And, cybersecurity teams often question..

Learn More

CISO Stress Report, Dole Supply Chain...

In this episode of GRXcerpts: Are CISOs too Stressed? The Dole Supply Chain Disruption Ongoing..

Learn More

New FSRA Guidance Emphasizes Operational Risk...

The Financial Services Regulatory Authority of Ontario (FSRA) recently released guidance for credit unions and..

Learn More

4 Tips for Justifying a Bigger...

Economic uncertainty presents cybersecurity teams with new challenges: while each round of big tech layoffs..

Learn More

Diversity in Cybersecurity: What It Means...

In 2020, a reckoning emerged in the wake of several high-profile racial incidents. As the..

Learn More

Overcoming TPRM Shortages with Risk Prioritization

It is not uncommon for organizations to have hundreds of third-party relationships. And, a..

Learn More

3 Tips for Aligning Internal and...

While cybersecurity traditionally owns control assessments, they need help from procurement to get a true..

Learn More

CyberGRX Launches Portfolio Risk Findings to...

February 22, 2023 – CyberGRX, provider of the world’s first and largest global risk exchange,..

Learn More

Clop Ransomware, New Credential-Stealing Malware, Prioritizing...

In this episode of GRXcerpts, get updates on: Clop Ransomware and GoAnywhere MFT Vulnerabilities New..

Learn More

Are Third-Party Social Engineering Gaps Leaving...

Phishing is one of the top ploys used by cybercriminals to gain access to your..

Learn More

How Healthcare Security Leaders Can Mitigate...

Healthcare organizations have faced serious challenges in recent years, and while the pandemic has been..

Learn More

How to Be Proactive About Incident...

Let’s face it, the threat of cyber attacks is a constant concern. No matter what..

Learn More

Cybersecurity News: Hive Ransomware Takedown, APT29...

In this episode of GRXcerpts: Hive Ransomware Takedown Russian-Linked APT29 Malware Breach Notifications Closing the..

Learn More

New Year, More Complex Threat Landscape

Wouldn’t it be nice to start a new year and think to yourself, “THIS will..

Learn More

Do Security Ratings Give a False...

Security ratings are a hot, yet controversial topic. They provide a quantifiable assessment of risk,..

Learn More

Cybersecurity News: ChatGPT Concerns for Cybersecurity,...

As attacks on critical infrastructure have increased around the globe, the US Department of Energy..

Learn More

Drive Action Through Third-Party Risk Insights

There are many third-party risk management options on the market, and while some can give..

Learn More

CyberGRX Leverages MITRE Techniques to Uncover...

Denver, CO -- January 18, 2023 – CyberGRX, provider of the world’s first and largest..

Learn More

Properly Scoping Vendor Due Diligence Drives...

Properly Scoping Vendor Due Diligence Saves Both Time and Money One of the costliest mistakes..

Learn More

Security Assessments 2.0: The Next Generation...

The more things change, the more they stay the same. It's a well-worn adage that..

Learn More

Next-Level Strategies for an Efficient Third-Party...

How to Optimize Third-Party Due Diligence for Cybersecurity According to IBM’s Cost of a Data Breach..

Learn More

Don’t Treat Third-Party Risk Management as...

Beyond Basic Compliance: Achieving True Resilience Requires Third-Party Risk and Cybersecurity Alignment Between SOC audits,..

Learn More

Reflections on Cybersecurity Events from 2022...

Hear from CyberGRX staff as they reflect back on the notable cybersecurity events from the..

Learn More

How the Role and Priorities of...

The role of a Chief Information Security Officer (CISO) is changing. While 76% of CISOs..

Learn More

How to Conduct Third-Party Due Diligence

Identifying and engaging with the right partners is essential to the success of most businesses...

Learn More

Cybersecurity News: Cuban Ransomware, Healthcare Vendor...

Trending headlines in cybersecurity: Microsoft Warning for European Organizations Cuban Ransomware Attacks World Cup Phishing..

Learn More

Inherent Risk & Residual Risk...What's the...

You’ve worked hard to develop, implement, and continually improve your cybersecurity program, recognizing your organization..

Learn More

Ho Ho HACKED! Ransomware Awareness for...

‘Tis the season for ransomware awareness because, for hackers, ‘it’s the most wonderful time of..

Learn More

Cybersecurity News: The Impact of our...

Trending headlines in cybersecurity: The 8th Google Zero Day Threat of 2022 An Aggressive Qakbot..

Learn More

How Automated ESG Due Diligence Makes...

Over the past few years, Environmental, Social, and Governance (ESG) regulations have become increasingly rigorous..

Learn More

Keep the Cyber Grinch Out: Holiday...

The holidays are just around the corner– and so are the cyber grinches, waiting for..

Learn More

Cybersecurity News: Mandates for Financial Services,...

Trending headlines in cybersecurity from the week: State of Industrial Cybersecurity New Regulations for Financial..

Learn More

Cybersecurity News: Education Grants, Twitter Phishing...

Trending headlines in cybersecurity from the week: Cybersecurity Clinics Program Act Phishing Caution to Twitter..

Learn More

Cybersecurity News: Twitter Phishing Cautions, Passwordless...

Trending headlines in cybersecurity from the week: Cybersecurity Clinics Program Act Phishing Caution to Twitter..

Learn More

Security Assessments: Waste of Time or...

It’s the million-dollar question: is the juice from security assessments worth the squeeze? We all..

Learn More

What Classic Rock Teaches Us About...

It’s well documented that music generates an emotional response for most people. And there’s actual..

Learn More

Creating a Culture of Security: Best...

We all know zero risk is impossible, but there’s still plenty of room for improvement,..

Learn More

CyberGRX Ranked No. 220 Fastest-Growing Company...

Denver, Co. -- November 16, 2022 -- CyberGRX, provider of the world’s first and largest..

Learn More

New Artificial Intelligence Regulations Will Require...

The frontier is closing on artificial intelligence: Where AI once represented the “Wild West” of..

Learn More

Cybersecurity News: Cyber Insurance, Media Supply...

Trending headlines in cybersecurity from the week: Cyber insurance rates stabilizing and decelerating in 2023..

Learn More

Cybersecurity News: Ransomware Summit, SEC Regulations...

Trending headlines in cybersecurity from the week: The second annual global Ransomware Summit Changes to..

Learn More

Diaxin Ransomware, Windows Zero-Day Threat, 6G...

In this episode of GRXcerpts, we keep you updated on interesting and trending headlines in..

Learn More

CyberGRX Spotlighted in TAG Cyber Analysis...

Denver – October 18, 2022 – CyberGRX, provider of the world’s first and largest global..

Learn More

Budgeting for Your TPRM Program

With two consecutive drops in real GDP in 2022, 1.6% and 0.9% for the first..

Learn More

Deepfakes, Zoom High-Priority Patch, Authentication Updates

Welcome to GRXcerpts, highlighting interesting and trending headlines in cybersecurity. Stay informed in less than..

Learn More

Security Shift: From Cyber Threat Intelligence...

The traditional approach to cybersecurity is broken. Data tells the tale: Despite the development and..

Learn More

Checklist: TPRM Budget Preparation

Download Now Considerations to assist in preparing for your annual third-party risk management (TPRM) budget..

Learn More

What Cyber Risk Isn’t Third-Party Risk?

We thought 2021 was a record-breaking year for cyberattacks. And it was. Compared to 2020,..

Learn More

CyberGRX Named Winner in ‘Threat Intelligence...

DENVER - Oct. 6, 2022 – CyberGRX, provider of the world’s first and largest global..

Learn More

Trust: A Hidden (Yet Valuable) Benefit...

Trust is one of the most powerful currencies in business, but it’s hard to earn..

Learn More

ProcessUnity Customer Summit: Experts Advocate for...

At the 2022 ProcessUnity Customer Summit, experts from a variety of industries and organizations convened..

Learn More

10 Ways to Make your TPCRM...

It seems that not a week goes by without a data breach or some other..

Learn More

CyberGRX Recognized with Frost & Sullivan’s...

Denver, CO -- September 27, 2022 – CyberGRX, provider of the world’s first and largest..

Learn More

The 4 Essential Pillars of a...

Toyota’s factories, which pump out over 10 million vehicles every year, screeched to a halt..

Learn More

If Total Risk Elimination is Impossible,...

Zero isn't possible. No matter how much money you spend on cybersecurity, how many people..

Learn More

Infographic: The Dark Side of Digital...

According to Tech Pro Research, 70% of organizations either have or are working on a..

Learn More

Evolving TPCRM with a Data-Driven Approach

Likely no one in our industry will dispute the traditional approach to third-party cyber risk..

Learn More

5 Tips for CISOs About the...

To quote Bob Dylan, "the times, they are a-changin'." A decade ago, all eyes were..

Learn More

Evaluating Security Risk When Onboarding New...

In today’s tightly interwoven supply chains and highly competitive markets, organizations must continuously evaluate and..

Learn More

Accelerating Machine Learning Pipelines with AWS...

"Work it harder, make it better. Do it faster, makes us stronger. More than ever,..

Learn More

How Risk Managers Are Reducing Enterprise...

“Take calculated risks. That is quite different from being rash.” These words of wisdom from..

Learn More

Third-Party Risk Assessments: Are They Effective...

It’s the million dollar question every cybersecurity practitioner has in the back of their minds…do..

Learn More

The Human Impact of a Cyber...

News flash! Headlines about cyber attacks don’t tell the whole story. The world is in..

Learn More

Which Cybersecurity Certification Does Your Business...

More customer wins. Better organizational security. Efficient compliance management. These are just a few of..

Learn More

Why You Need Continuous Monitoring of...

Working with a third-party vendor is a lot like inviting someone into your home during..

Learn More

3 Business Benefits of a Cybersecurity...

Cyber risk is a top concern for businesses today thanks to the ubiquity of the..

Learn More

How Does Third-Party Risk Fit Into...

In today’s digital economy, it’s rare to find an enterprise or corporation that manages every..

Learn More

RSA Conference 2022: Transformation, TPCRM, and...

What. An. Event! Imagine…26,000 cybersecurity professionals learning and networking IRL for the first time since..

Learn More

GRC 20/20 Quantifies Return on Investment...

Independent research examines the measurable benefits of ProcessUnity VRM Imagine what business results you could..

Learn More

Zero Trust as a Third-Party Risk...

According to a Microsoft survey, more than 40% of workers are considering quitting their jobs..

Learn More

CyberGRX Use Case Guide

CyberGRX is the Cyber Risk Intelligence industry leader. Within the CyberGRX Exchange, we have an..

Learn More

CyberGRX Named Winner In 10th Annual...

CyberGRX recognized as Hot Company in the Third-Party Cyber Risk Management (TPCRM) category for its..

Learn More

CyberGRX and Google Cloud Collaborate to...

Google Cloud to satisfy risk and procurement needs across wide customer base and deliver a..

Learn More

How a Data-Driven Approach to TPCRM...

When it comes to TPRCM (Third-Party Cyber Risk Management), the scope of potential threats outside..

Learn More

How an Exchange Supports an Effective...

According to a recent report by Deloitte, organizations spend 10.9% of their IT budgets on..

Learn More

Building a TPCRM Program: Where to...

Today's organizations have become increasingly reliant on third-party vendors to help them grow and sustain..

Learn More

How Common Are Third-Party Security Breaches?

In terms of operational agility and cybersecurity, third-party service providers can be a double-edged..

Learn More

Cyberattacks and Breaches can Severely Damage...

Cybercriminals want your data and they don’t care about the fallout for your organization. The..

Learn More

CyberGRX recognized by EMA as a...

We are proud to announce that CyberGRX has been named as one of the top..

Learn More

3 Questions Healthcare Organizations Should Consider...

Did you know that 33% of third-party data breaches in 2021 targeted healthcare organizations? In..

Learn More

ProcessUnity is a Leader in the...

The results are in: ProcessUnity is a Leader in The Forrester Wave™: Third-Party Risk Management..

Learn More

Can You Apply Zero-Trust to Your...

The federal government shifted to a zero-trust strategy in 2022 to bolster its cybersecurity posture; private..

Learn More

CyberGRX Redefines Third Party Cyber Risk...

Company experiences three-digit customer and revenue growth in Q1 alone; brings first-of-its-kind features to market..

Learn More

The ONE Thing All Modern Third-Party...

At CyberGRX, we’re fortunate to engage with the brightest minds in the third-party cyber risk..

Learn More

Managing the Security Risks in Third-Party...

While the average cost of a data breach, $3.86 million, is alarming, another statistic also..

Learn More

Why Third-Party Risk Management Saves Businesses...

Small to midsize companies are increasingly feeling financial pressure on their operations. According to Harvard..

Learn More

How Remote Work Has Changed On-Site...

The pandemic caused a shift in how we think about the modern workplace. Pew Research found that..

Learn More

Are Your Suppliers Putting You at...

Global events, such as the Ukraine-Russia conflict, are driving increased risk levels in nearly every..

Learn More

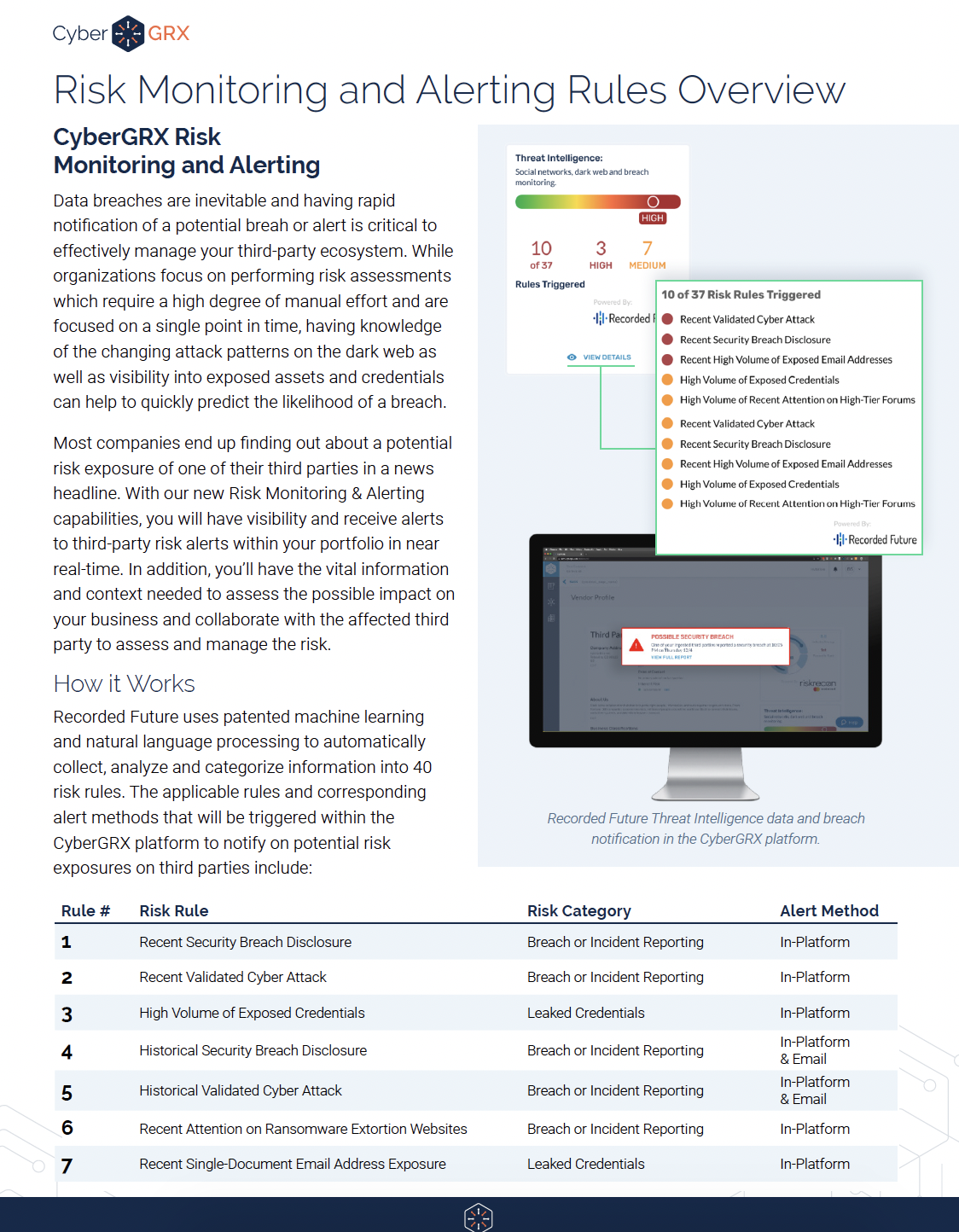

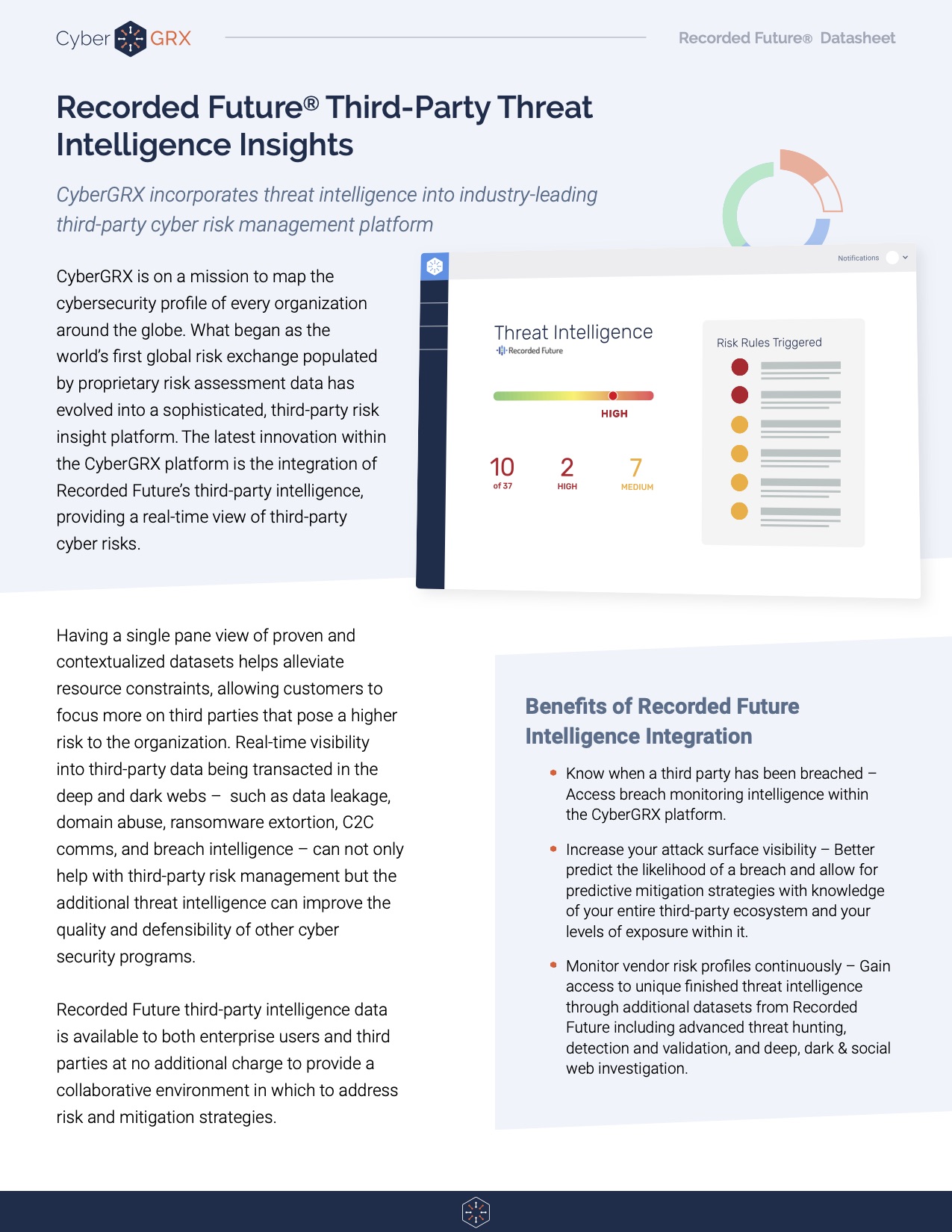

Recorded Future Third-Party Threat Intelligence Insights

Having a single pane view of proven and contextualized datasets helps alleviate resource constraints, allowing..

Learn More

CyberGRX Product Guide

CyberGRX brings a revolutionary approach to third-party cyber risk management. Using sophisticated data analytics, real-world..

Learn More

3 Third-Party Risk Lessons from the...

Proactively mitigate third-party risks with vendor engagement and issue response strategies Lapsus$, a criminal hacking..

Learn More

The 6 Most Common Third-Party Security...

Businesses today are increasingly reliant on third-party vendors to help them run their operations. These..

Learn More

Protecting Your Network From the Increased...

By the start of 2022, about 30% of all employees in the U.S. were working..

Learn More

Why You Need Total Transparency with...

Cybercriminals know only too well how lucrative targeting third parties can be. They have honed..

Learn More

Social Engineering: How to Not Be...

Remember the time you received a phone call from a disgruntled customer or employee that..

Learn More

Leveraging Predictive Risk Profiles for Greater...

With cyber-attacks escalating daily and a constant flow of headlines about ransomware demands bringing supply..

Learn More

Understanding Your Cybersecurity Risks During the...

Cybersecurity experts warn that conflict in Ukraine presents ‘perhaps the most acute cyber risk U.S...

Learn More

War in Ukraine: Monitoring Resiliency in...

As the world turns its attention towards the escalating conflict between Russia and Ukraine, companies..

Learn More

5 Areas to Mitigate Risk in...

If you work within a Vendor Risk Management (VRM) team, you know that third-party risk..

Learn More

Beyond Risk Management: How Cyber Risk...

Definitions of the word intelligence include a collection of information of military or political value..

Learn More

Are You Ready for the PRA's...

The clock's ticking. If you're a financial services institution regulated by the Prudential Regulatory Authority,..

Learn More

Why Retailers Need Cyber Risk Intelligence...

The retail industry is one of the biggest contributors to the Gross Domestic Product (GDP)..

Learn More

How to Improve Your Vendor Due...

You can't do business without your vendors. They support critical elements of your organization, from..

Learn More

Building Your Intelligent Risk Portfolio

Companies increasingly rely on third parties to do business. With this, comes an increased vulnerability..

Learn More

3 Reasons to Align Cybersecurity and...

In the face of increasingly common and costly data breaches, your organization needs to know how..

Learn More

Log4j: How Organizations Address Cybersecurity with...

The discovery of the Log4j vulnerability is the latest incident to send organizations into panic about..

Learn More

Log4j Vulnerability: A Lesson in Third...

A vulnerability was recently detected in Log4j, an open-source logging framework web developers use to..

Learn More

Log4Shell and Threat Profiles

The Log4Shell attack has shown, once again, how important it is to know the cybersecurity postures..

Learn More

Log4Shell and Third-Party Vendors: How Will...

With the whole world losing their marbles over the Apache Log4Shell vulnerability (and rightfully so),..

Learn More

The Difference Between Third-Party Cyber Risk...

Major security incidents have shed light on the cyber risks associated with third-party suppliers and..

Learn More

How To Create a Results-Driven Supplier...

Seventy percent of organizations have under-invested in their supplier risk assessments. This fact is startling given the growing reliance organizations have on..

Learn More

2021 and Beyond: Financial Viability Trends...

Experts from ProcessUnity and RapidRatings recently got together to discuss why world-class third-party risk management programs are leveraging financial health ratings for onboarding, due..

Learn More

5 Easy Ways to Increase Your...

We want all members of our exchange to leverage their completed CyberGRX assessment as their..

Learn More

How Predictive Analytics Will Keep You...

The GDPR Threat With the Information Commissioner's Office's (ICO) ever increasingly active enforcement of the..

Learn More

4 Reasons to Manage Cybersecurity Controls...

The modern cybersecurity program faces more challenges today than ever before. New worldwide directives and increased cyberattacks put pressure..

Learn More

Predictive Risk Profiles Data Sheet

Predictive Risk Profiles from CyberGRX revolutionize the approach to third-party cyber risk management. By applying..

Learn More

5 Tips to Improve Your Vendor...

Vendor due diligence is essential to any third-party risk management program. However, no two due diligence processes are..

Learn More

How Dynamic Scoping Can Improve Your...

Vendor risk assessments help third-party risk management (TPRM) teams understand the risk their third parties,..

Learn More

Third-Party Vendor Risk Management Challenges for...

Today’s financial institutions face an incredible challenge when it comes to managing their third-party vendor..

Learn More

Build a Better Vendor Due Diligence...

Take a deep dive into vendor due diligence with ProcessUnity’s in-house due diligence specialist, James Goncalves. This interview..

Learn More

3 Steps to Better Vendor Risk...

Creating and distributing vendor risk assessments is a key part of any third-party risk management program. As organizations utilize third-party services to..

Learn More

Expert Interview: Continuous Monitoring of Third-Party...

ProcessUnity discusses best practices for continuous monitoring of third-party vendor risk with BitSight, a leading..

Learn More

Managing Third-Party Cyber Risk

Each day organizations face new threats that jeopardize their critical networks. Standard cybersecurity practices help mitigate the..

Learn More

Why Organizations Automate Vendor Risk Assessments

It’s a fact increasingly validated with each third-party data breach: when an organization brings on..

Learn More

CyberGRX vs. Competitors: A Comparison Chart

Selecting an effective TPCRM program can be a daunting task. While there may be similarities..

Learn More

Inherent Risk vs. Residual Risk in...

Conducting a thorough vendor risk analysis is an integral step in Vendor Risk Management. However,..

Learn More

ProcessUnity Team Kicks Off National Day...

On August 20th, 2021, ProcessUnity hosted its inaugural Day of Giving to provide our team with the..

Learn More

UK PRA Guidelines: New Strategies for...

It goes without saying that operational resiliency and supplier risk management go hand in hand. Organizations need to adapt, respond to, and..

Learn More

What the Biden Administration's Executive Order...

The Biden Administration is prioritizing the nation’s cybersecurity with an executive order to modernize cybersecurity defenses and protect..

Learn More

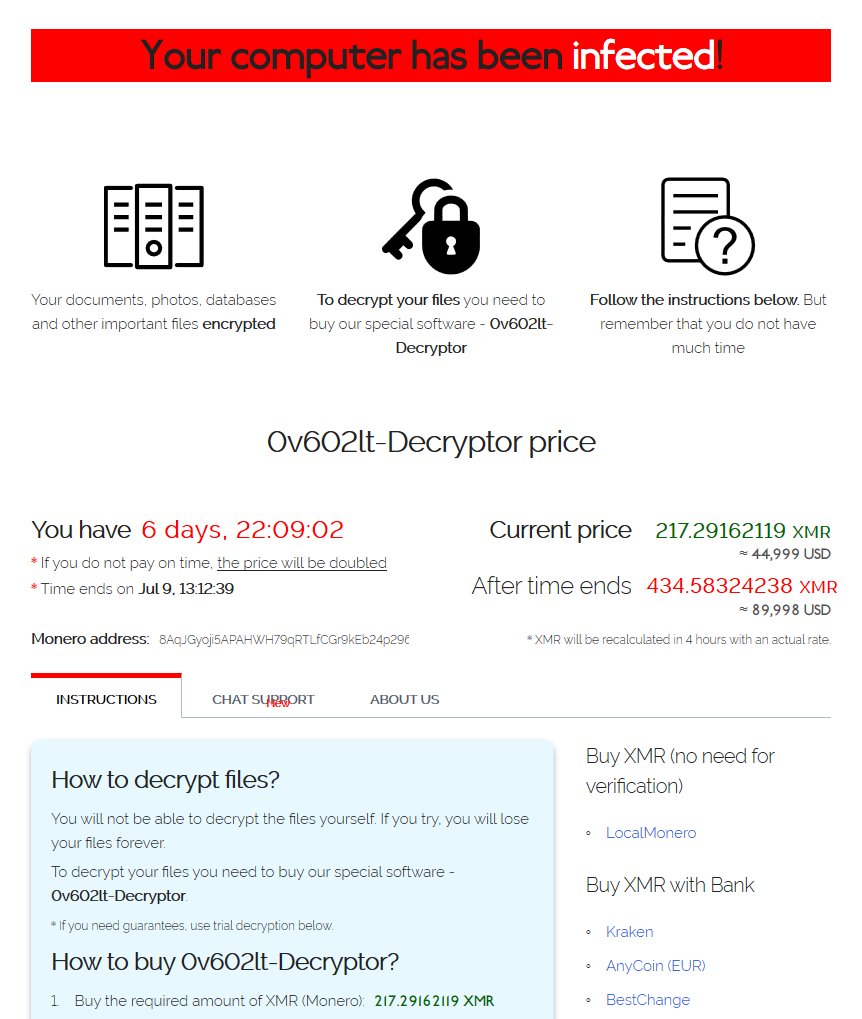

Ransomware & Your Third Parties: A...

Ransomware continues to dominate headlines with no sign of slowing down. What started more than..

Learn More

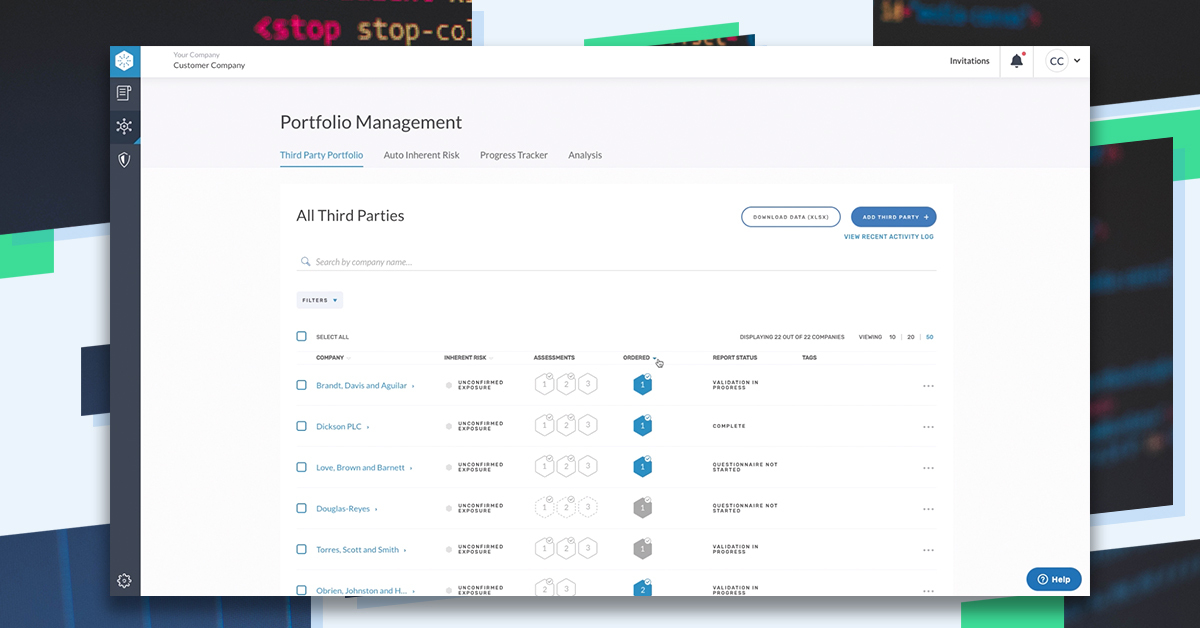

Introducing Enhanced Portfolio Management Features

We know that successful third-party cyber risk management requires a collaborative, comprehensive approach. With three..

Learn More

How to Create a Mature Third-Party...

Whether building a program from scratch or improving an existing program, third-party risk management (TPRM)..

Learn More

What is Third-Party Risk Management?

Third-Party Risk Management is the process of identifying, managing and mitigating risks present in a vendor relationship. This..

Learn More

ESG Reporting Mandates to Know for...

Third-Party Risk Management in today’s regulatory landscape is difficult – and it is about to..

Learn More

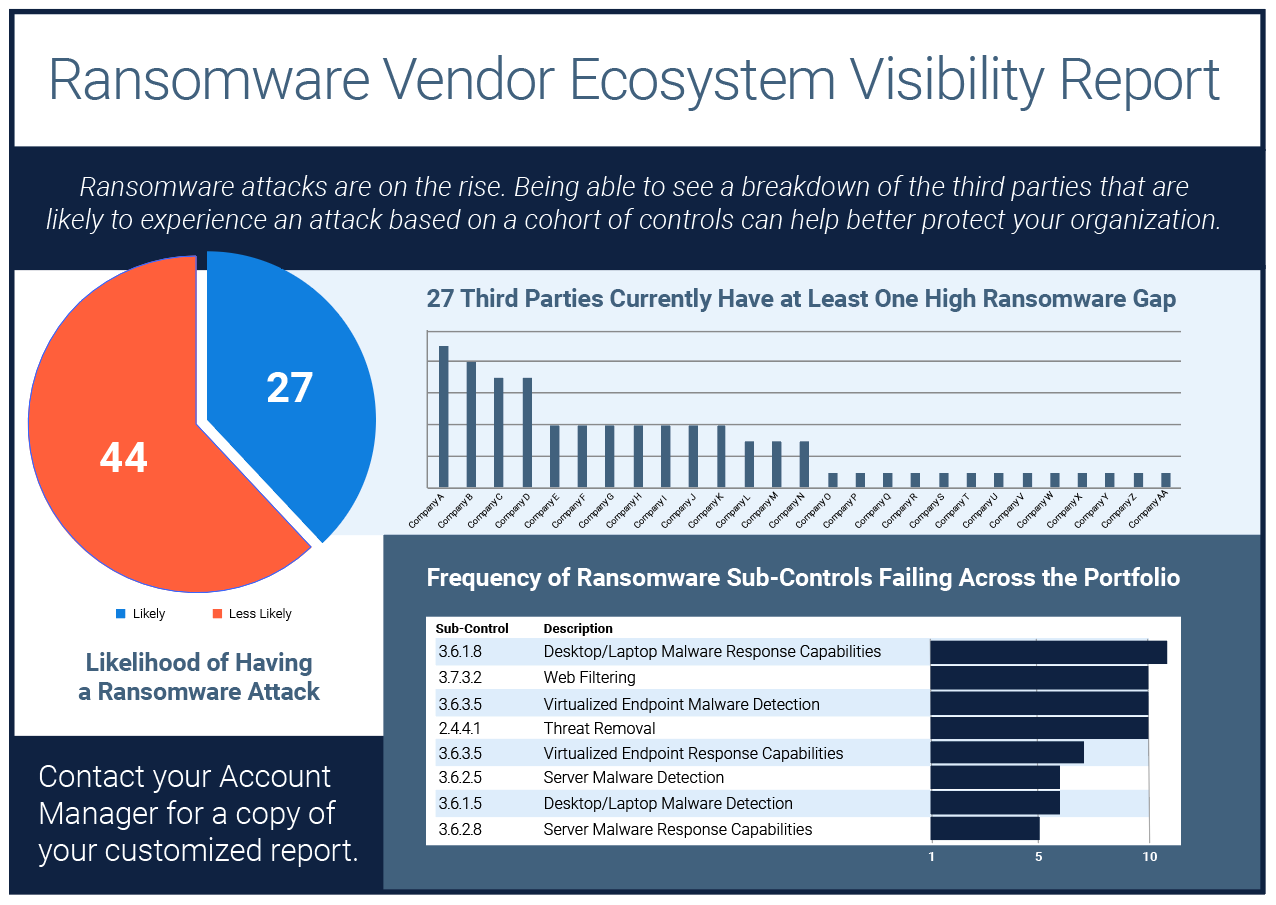

Ransomware Vendor Ecosystem Visibility Report

If knowledge is power, then visibility is the secret weapon against ransomware and extortionware.With our..

Learn More

7 of the Most Notable Ransomware...

As we mentioned in a previous post, ransomware attacks have been happening for many years..

Learn More

Diversity and Inclusion as a Third-Party...

Diversity and inclusion initiatives are helping organizations to increase profitability, boost their reputation and even..

Learn More

The Evolution of Ransomware

Ransomware is a type of malware that when deployed, encrypts files on a victim’s computer..

Learn More

What is Fourth Party Risk and...

As we’ve seen in recent events such as the SolarWinds hack, third-party risk poses a serious threat to business continuity. What the..

Learn More

CyberGRX Ransomware Threat Profile & Ecosystem...

In order to fight ransomware, companies need a methodology that combines a wide range of..

Learn More

Exchanges, GRC Tools, and Risk Scans:...

It’s like comparing apples to baseball stadiums: If you are (or will be) evaluating solutions..

Learn More

Supplier Risk Management Strategies for Healthcare...

The COVID-19 pandemic served as a wake-up call for supplier risk management programs globally. Formerly reliable..

Learn More

REvil’s Reign: Kaseya VSA Ransomware Supply...

Recently, thousands of Kaseya VSA servers were exploited using a malicious update payload. Bypassing access..

Learn More

The Next Kaseya Breach is Around...

While the July 4th weekend meant celebrating the United States’ Independence Day holiday for some,..

Learn More

Setting Up A Cybersecurity Assessment Schedule

Building an Informed Cybersecurity Assessment Schedule Managing a cybersecurity program demands regular reviews of key..

Learn More

Risk Assessment Methodology Data Sheet

CyberGRX cloud-based assessments are the industry’s only comprehensive assessment methodology to manage risk across security,..

Learn More

Managing a Cybersecurity Budget: Where to...

As humans, we all have fight or flight instincts that kick in during dire situations...

Learn More

How To Create A Barebones Production...

I’ve recently had the opportunity to step into a tech lead role at CyberGRX, and..

Learn More

The Impact of NERC and FERC...

Cyber threats and their subsequent attacks are dominating news headlines globally. The recent SolarWinds attack..

Learn More

Your Cybersecurity Budget is a Top...

Cybersecurity is recognized as an increasingly important annual budget spend, with many organizations declaring their cybersecurity..

Learn More

Anatomy of a Third-Party Data Breach

According to research done by the Ponemon Institute, third-parties are involved in over half of..

Learn More

Why Vendor Risk Management is Essential...

Third-Party Risk in Healthcare When it comes to vendor risk management in healthcare, regulators increasingly..

Learn More

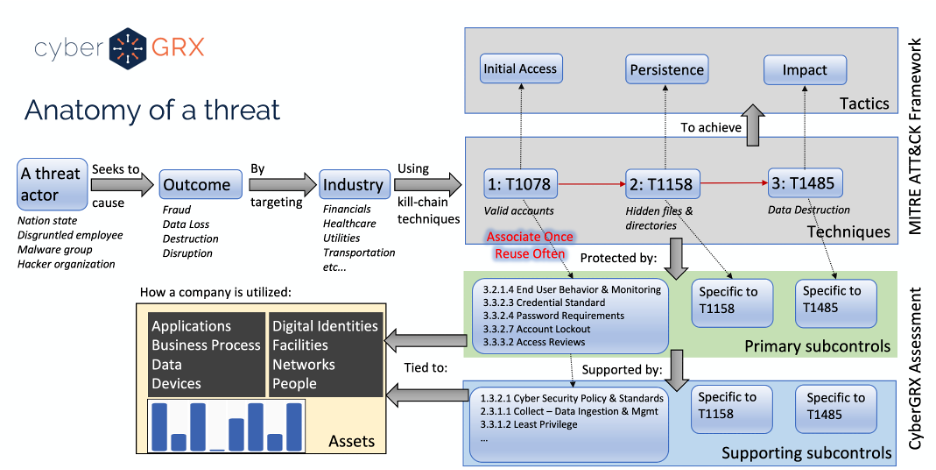

Cybersecurity Analytics: Integration With the MITRE...

Deriving insights from a cybersecurity assessment requires the structure of real-world threat narratives. Companies in..

Learn More

The Benefits of a Centralized Cybersecurity...

Implementing a centralized Cybersecurity Program Management platform can pay dividends for your organization by protecting high-value..

Learn More

Do You Really Know Who Your...

Money laundering; bribery and corruption; drug trafficking; and terrorism financing are issues that are rapidly infiltrating business operations. In recent years,..

Learn More

3 Secrets to Building a Winning...

Did you know third-party breaches account for over half of all data breaches in the..

Learn More

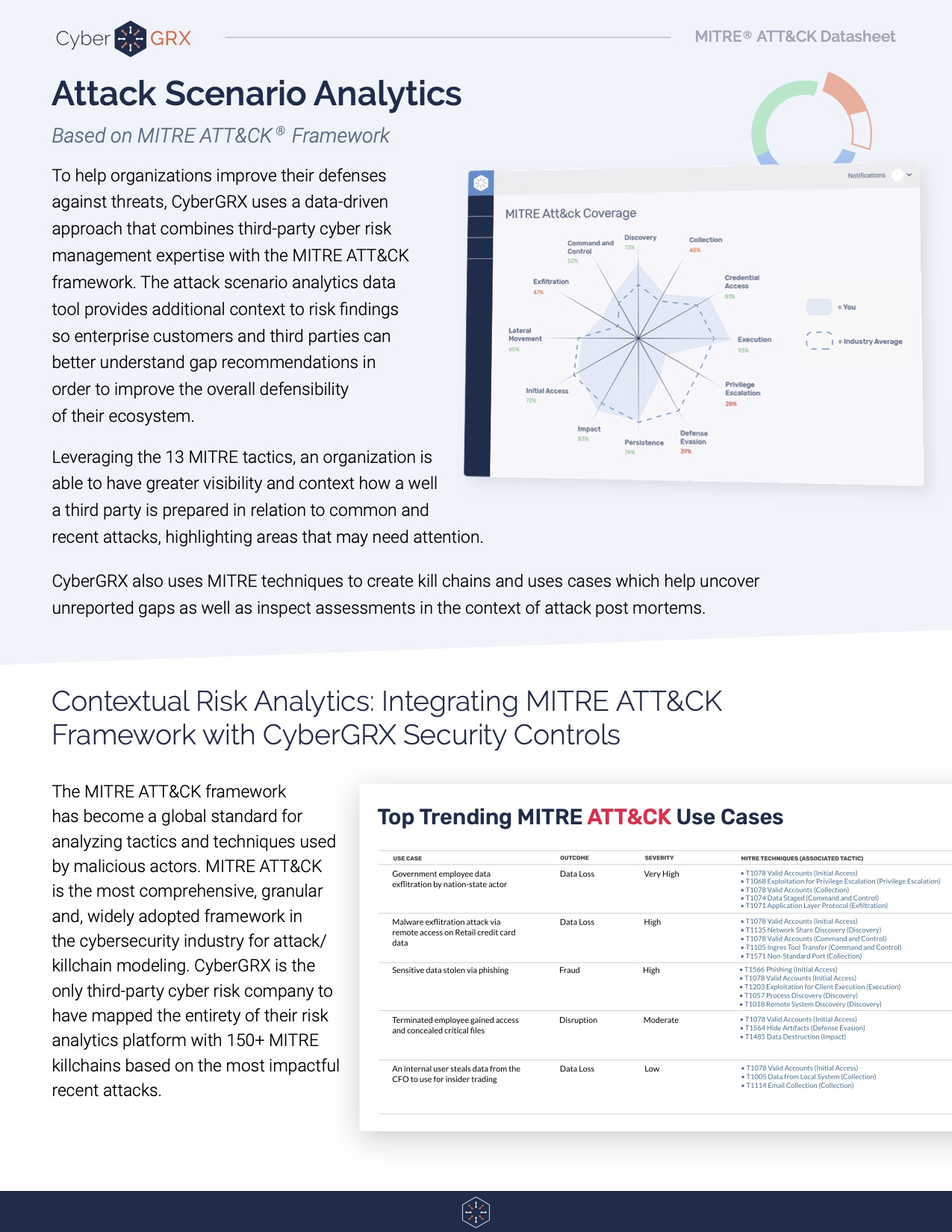

Attack Scenario Analytics: A Datasheet Reference

The MITRE ATT&CK framework has become a global standard for analyzing tactics and techniques used..

Learn More

Expert Tips for Setting up a...

Assessing Third Party Risk with a Vendor Questionnaire Vendors deliver reduced costs and increased productivity, making them very advantageous for business strategy...

Learn More

Vendor Risk Management & ESG Related...

The Emerging Importance of ESG-Related Risk Environmental, social, and governance (ESG) and its role in vendor..

Learn More

CyberGRX Partners with Recorded Future to...

We're excited to announce we've formed a strategic partnership with Recorded Future, the world’s largest..

Learn More

What’s the Difference? Vendor Risk vs...

The words are frequently used interchangeably. Is there a difference between them? The Basics of Third Party..

Learn More

The Intersection of Third-Party Risk and...

According to a recent BlueVoyant, Opinion Matters global study of 1,500 CISOs, CIOs, and CPOs, 29 percent say they have..

Learn More

Solarwinds Hack: The Intersection of Cybersecurity...

The continuing fallout from the SolarWinds hack is creating a mashup of Cybersecurity Program Management stuffed..

Learn More

Anti-Bribery & Corruption (ABAC) in Business...

The impacts of corruption can be very severe and have been historically well documented. On a political level, corruption – however and wherever..

Learn More

The Cyber Info Exchange Episode 7:...

The world of technology and security covers a magnitude of critical topics in all things..

Learn More

Cybersecurity Accountability Requires Enterprise-Wide Involvement

Cybersecurity is every employee’s responsibility. To ensure success, organizations today need to weave cybersecurity accountability into the..

Learn More

8 Key Reports You Need for...

The foundation for an effective vendor risk program starts with solid reporting. As your vendor..

Learn More

Stay Ahead of the Cybersecurity Threat...

Understanding today’s ever-evolving cybersecurity threat landscape is essential for developing strategies and taking action to..

Learn More

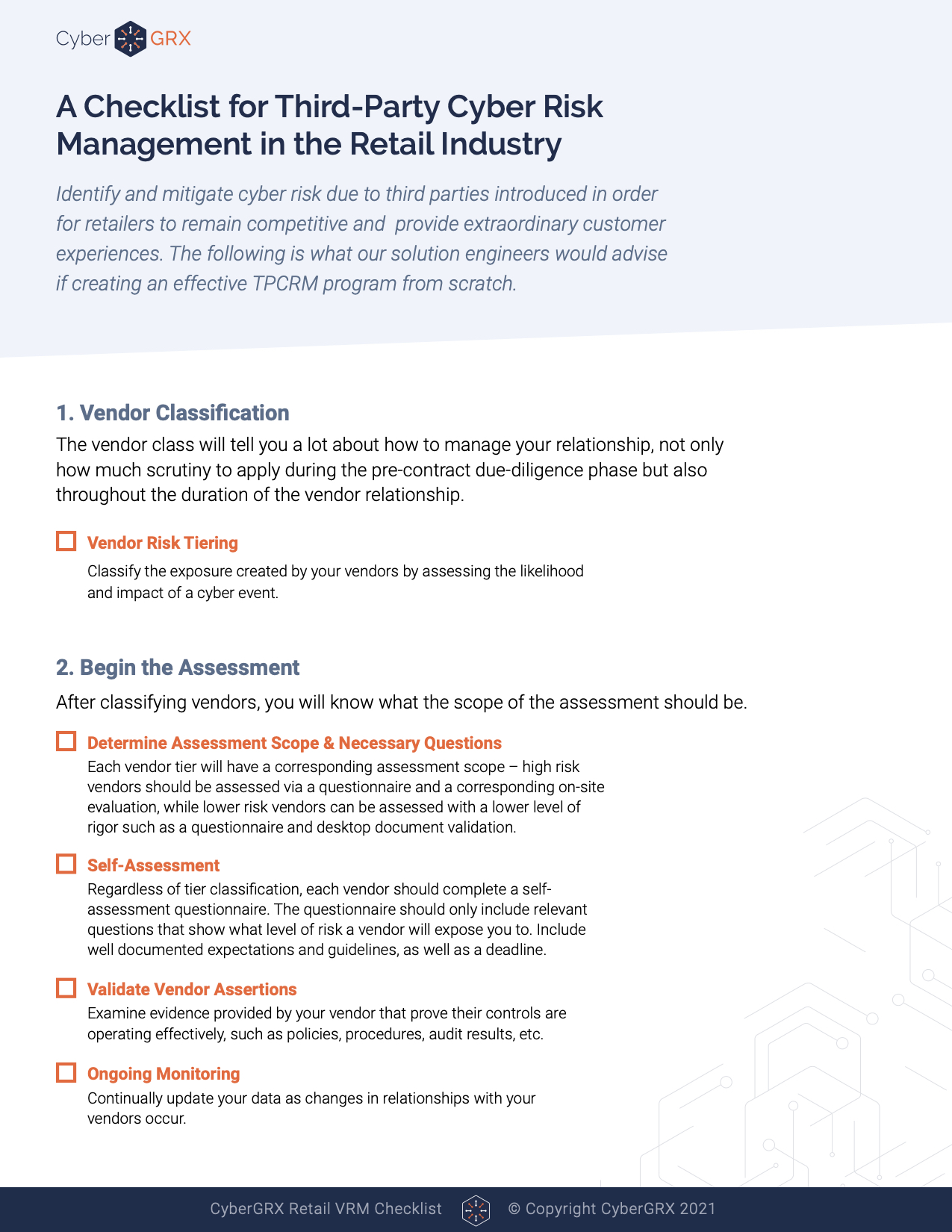

Checklist: TPCRM in the Retail Industry

The CyberGRX platform brings visibility, scalability, and accuracy to third-party cyber risk management programs (TPCRM)..

Learn More

Stop Wondering if You're Compliant: The...

Regulations and compliance requirements are constantly changing, and this can make it challenging to efficiently maintain compliance...

Learn More

Tips for Quantifying Inherent Risk for...

Quantifying inherent risk for third parties is one of the most important aspects of a..

Learn More

The Cyber Info Exchange Episode 6:...

The world of technology and security covers a magnitude of critical topics in all things..

Learn More

What Is Third-Party Risk Management: The...

The recent SolarWinds breach has reminded news organizations, businesses, and leadership teams around the world..

Learn More

The Importance of a Flexible Cybersecurity...

It goes without saying: Your cybersecurity threat landscape is continually evolving, and new risks emerge each day. Trends..

Learn More

EBA Guidelines and Supplier Risk Management

Today’s distributed, business environment is defined by third-party relationships. The boundaries of the organization have..

Learn More

How to Stop the Next SolarWinds...

The SolarWinds breach, while incredibly serious, is a flash in the pan brought upon by..

Learn More

Reporting on the State of Your...

The CISO’s Role and Cybersecurity Program Evolution As the role of the CISO changes and..

Learn More

Cybersecurity Risk has Changed the Chief...

In the past, the Chief Information Officer (CIO) was responsible for all things technology, but..

Learn More

How to Address The Top Third-Party...

Third-party risk management, or TPRM, is a critical part of keeping your company’s and customers’..

Learn More

What is a Cybersecurity Framework?

A cybersecurity framework is the foundation on which your program is built. It documents the..

Learn More

8 Benefits of Completing a CyberGRX...

CyberGRX modernizes and streamlines redundant and inefficient processes that come with shared and static..

Learn More

Are Third-Party Cloud Applications Putting Your...

In May of 2017, it was discovered that an exposed data repository, an AWS S3..

Learn More

Third-Party Risk Management Best Practices

New Guide Offers Expert Advice for Effective and Efficient Vendor-Risk Processes A robust, effective, and..

Learn More

TPCRM 101 Guidebook

In the cyber sphere, NIST, ISO, AICPA, and DHS are among the multiple organizations that..

Learn More

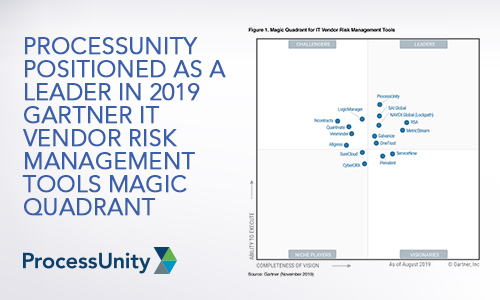

Gartner Names ProcessUnity a Leader in...

The title says it all – Gartner has again recognized ProcessUnity as a Leader in..

Learn More

Why Vendor Risk Management Should Be...

As the severity and cost of data breaches continues to increase, Vendor Risk Management has never been..

Learn More

What is Data Privacy and How...

The General Data Protection Regulation (GDPR) brought data privacy issues to the doorstep of organizations..

Learn More

The Evolution of the Third-Party Due...

To compete in today’s marketplace, companies routinely engage third parties to provide all manner of..

Learn More

QBE: Improving Oversight of Third Parties...

As a major insurer operating in 27 countries, QBE has a large vendor footprint and..

Learn More

Procurement or Information Security: Who Owns...

There is no right answer to which team should own Third-Party Risk Management, but effective..

Learn More

Auto Inherent Risk Data Sheet

If you’re still using static assessments, you’re likely missing out on vital risk intelligence. CyberGRX..

Learn More

Compliance Week Recognizes Abercrombie & Fitch’s...

Congratulations to Rob Seibel, Director of Legal Compliance at Abercrombie & Fitch Co., for receiving..

Learn More

7 Security Controls You Need For...

It’s no secret that data protection and security has become a hot topic in recent..

Learn More

Revolutionizing Third Party Risk: How to...

Despite their best efforts to administer an efficient and effective process, many organizations spend an..

Learn More

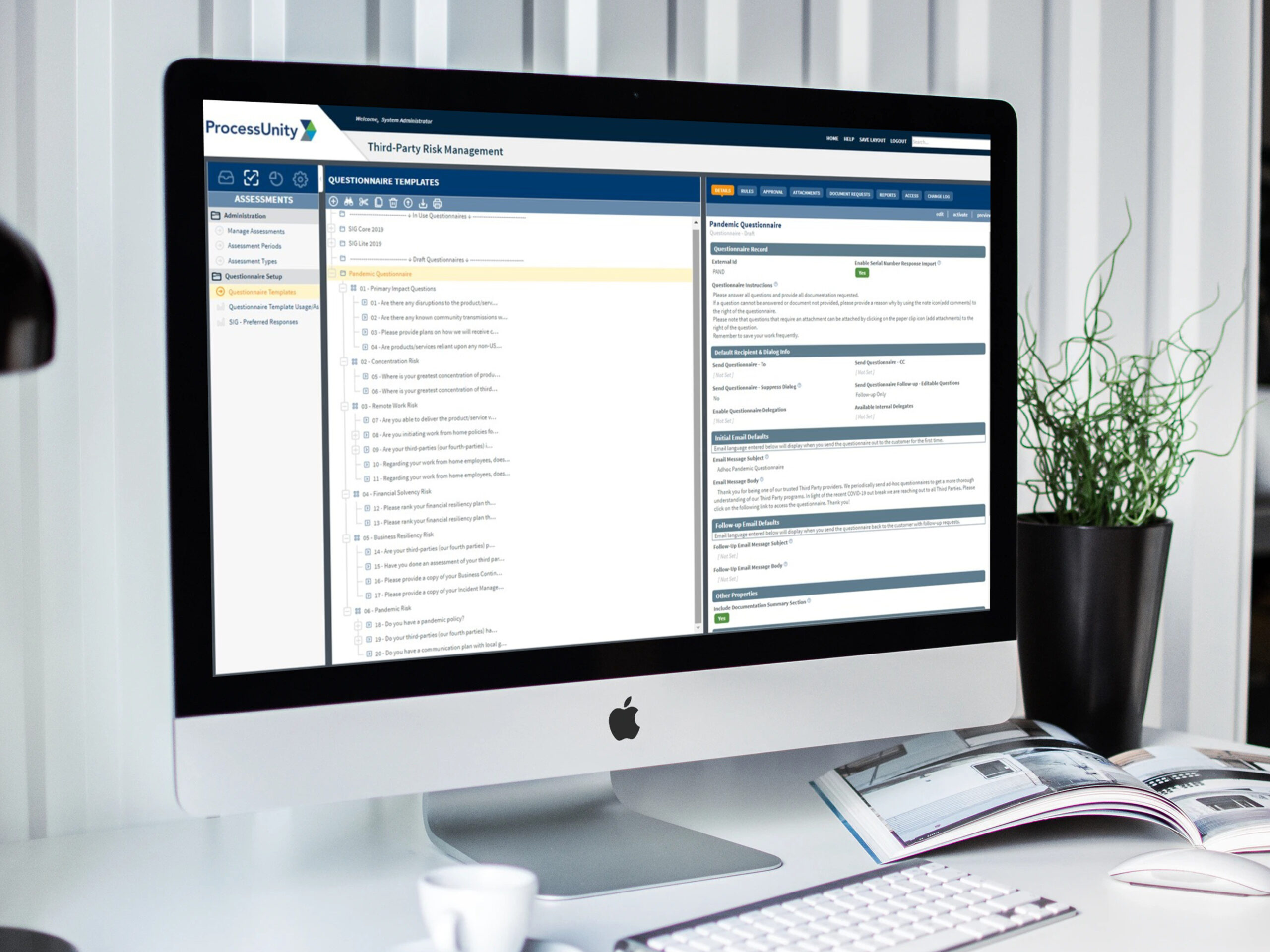

Pandemic Questionnaire Guidance & Vendor Assessment...

Before the emergence of COVID-19, third-party risk management programs were executing in a business-as-usual mode,..

Learn More

The Cyber Info Exchange Episode 5:...

The world of technology and security covers a magnitude of critical topics in all things..

Learn More

The Cyber Info Exchange Episode 4:...

The world of technology and security covers a magnitude of critical topics in all things..

Learn More

How Third-Party Risk Management Can Help...

This post originally appeared on LinkedIn. To view the original article, click here. We understand the..

Learn More

How to Spot Your Riskiest Vendors:...

Maintaining strong relationships with third parties is critical to business success. Yet too often, does..

Learn More

Third-Party Risk Management: From A to...

Just as the mind, body and spirit are intertwined, there are several interconnected pillars to..

Learn More

APRA CPS 234: Everything You Need...

The Office of the Australian Information Commissioner reported that there were over 950 data breaches..

Learn More

Metrics to Avoid When Discussing Cybersecurity...

Chief Information Security Officers (CISOs) have one of the toughest jobs in the C-Suite. They..

Learn More

2019 Was A Banner Year for...

ProcessUnity just finished up another banner year – it’s an exciting time to be in..

Learn More

Outside-In Scanning Is Not Cyber Risk...

Risk management is fairly straight-forward as a strategic concept but is complicated by a myriad..

Learn More

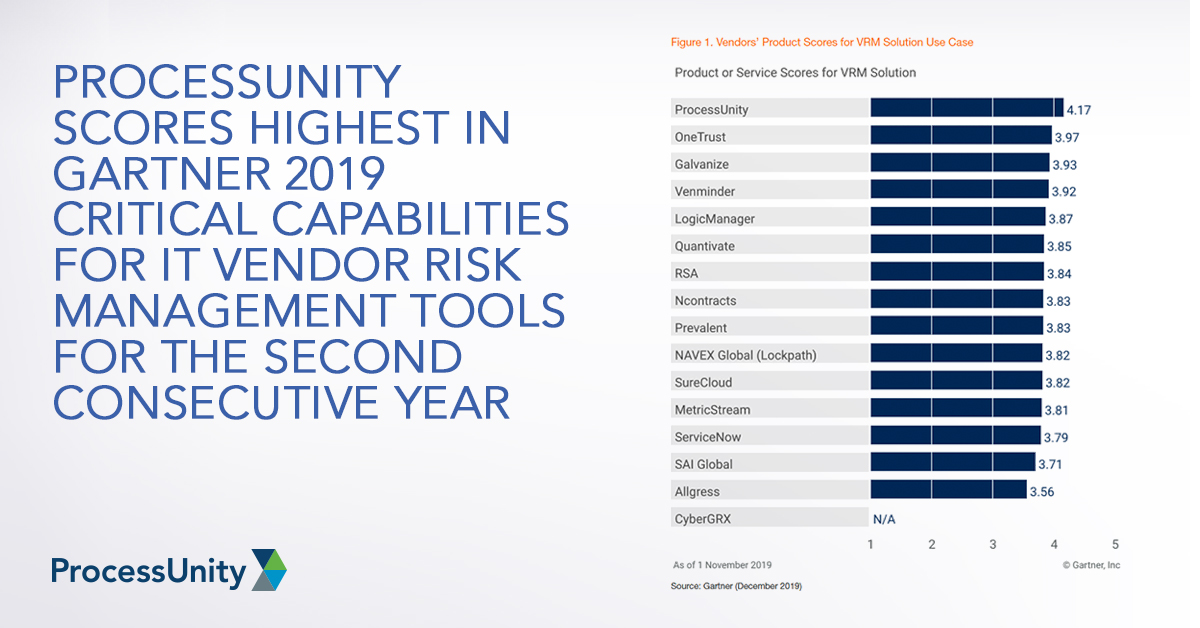

ProcessUnity Scores Highest in Gartner 2019...

Gartner recently published the 2019 Critical Capabilities for IT Vendor Risk Management Tools, and we..

Learn More

CPG Case Study

With an extensive portfolio of third-parties, a leading CPG company needed a streamlined third-party cyber..

Learn More

ProcessUnity Positioned as a Leader in...

We have great news. Today, Gartner published the 2019 Magic Quadrant for IT Vendor Risk..

Learn More

What the European Banking Authority Guidelines...

Using the European Banking Authority (EBA) guidelines to streamline your supplier risk management program Simply..

Learn More

Solix Case Study

Solix Shares the CyberGRX Assessment Driving Business and Saving Time One Assessment For All After..

Learn More

The Latest CCPA Update: Amendments to...

As we learned from, “A Finance Exec, A Real Estate Developer, And a Former CIA..

Learn More

Why Your Third-Party Risk Management Program...

The vast majority of people get annual physical examinations and automotive tune-ups – why shouldn’t..

Learn More

How To Improve Your Third-Party Inherent...

More than two-thirds of companies are cutting corners when it comes to third-party due diligence..

Learn More

The Latest Retail Breaches: Third-Party Data...

Third-party data breaches have been dominating the headlines in 2019, with a lot of the..

Learn More

CCPA and GDPR Compliance for IT...

For many of us that work in IT Fields, the requirements of privacy bills like..

Learn More

Sarbanes-Oxley Compliance: Five Steps to Cleaning...

While Sarbanes-Oxley (SOX) compliance management may be old hat for some, organizations today continue to..

Learn More

CyberGRX Enriches Third-Party Cyber Risk Management...

CyberGRX Auto Inherent Risk Automates a Time-Consuming, but Critical Step, Bringing Immediate and Valuable Insights..

Learn More

Hey Third Parties! Here's How to...

If you have a partner that trusts you with their business – and therefore, data..

Learn More

Tips for Preparing For Your Third-Party...

Being the target of a cybersecurity assessment can be frightening. Cybersecurity covers a broad set..

Learn More

How Financial Ratings and Cybersecurity Scores...

RapidRatings, Security Scorecard and BitSight Enhance Vendor Risk Management Process As a standalone solution, ProcessUnity’s..

Learn More

Poll: Over Half of Risk Managers...

ProcessUnity recently participated in a live webinar with IT GRC and other leading Vendor Risk..

Learn More

First GDPR, Now CCPA: Manage Your...

One year ago, organizations of all sizes were scrambling to comply with the pervasive General..

Learn More

Essential Technical Security Controls to Promote...

One of the most impactful regulations in the U.S. is the Health Insurance Portability and..

Learn More

Evaluating Third-Party Risk Management Software? Speed...

Good vendor risk management practices are good for business. Unfortunately, most organizations today continue to..

Learn More

It’s a Wrap: Four Takeaways from...

The 2019 ProcessUnity Customer Summit is a wrap and what a week it was. We..

Learn More

Creating a Third-Party Cyber Risk Management...

I’ve spent almost 30 years in the IT security space and half of that engaged..

Learn More

Cyber Risk: What is it and...

Cyber risk is a hot topic these days, and rightfully so. By 2025, Gartner estimates that “45%..

Learn More

The Cost of Third-Party Cybersecurity Risk...

Third parties are inundated with assessments and enterprises aren't getting the insights they need -..

Learn More

Trust, But Validate: Building Confidence in...

Overview Security assessments come in all shapes and sizes. Some have tightly defined scopes and..

Learn More

How ComplySci Spends Less Time on...

ComplySci Proactively Shares CyberGRX Helps ComplySci Reduce Time Spent on Assessments with Proactive Sharing Proactive..

Learn More

How Blackstone Assessed 3x More Vendors...

Blackstone Assesses 3x More Vendors CyberGRX Is A Force Multiplier for Third-Party Cyber Risk Management..

Learn More

5 Reasons to Share Your CyberGRX...

One of the greatest benefits of having a CyberGRX assessment on the Exchange is the..

Learn More

5 Reasons to Accept a CyberGRX...

A partner wants to share a CyberGRX assessment with you, why should you accept? Step..

Learn More

Third-Party Management Maturity Model White Paper:...

ProcessUnity’s recent white paper, the “Third-Party Risk Management Maturity Model,” helps you understand where your..

Learn More

New Gartner Report: Evaluates Capabilities and...

Gartner Research recently published The 2018 Critical Capabilities for IT Vendor Risk Management, and we are extremely excited..

Learn More

Technology Case Study

After a technology company doubled the size of their vendor ecosystem, they sought to secure..

Learn More

Third-Party Risk: Reduce Vendor Fatigue &...

You’ve likely heard before that “one size does not fit all” when it comes to..

Learn More

ComplySci Case Study

ComplySci Proactively Shares CyberGRX Helps ComplySci Reduce Time Spent on Assessments with Proactive Sharing Proactive..

Learn More

New Report Predicts Significant Market Growth

MarketsandMarkets has published a new report that states that the global Vendor Risk Management market..

Learn More

Vendor Onboarding Best Practices: ProcessUnity Webinar...

Vendor Onboarding Best Practices: To contract a vendor is to initiate a relationship: when you..

Learn More

Think GDPR (General Data Protection Regulation)...

Do you collect, store or process EU citizen or resident data? Does anyone in your..

Learn More

Risk & Compliance – The Build...

We’re not seeing it as much as we used to, but some companies are still..

Learn More

Incorporating Content Services into Your Vendor...

Companies are continually searching for ways to improve the quality of their third-party risk due..

Learn More

Regulatory and Management Reporting for Vendor...

In working with prospects and customers, one of the questions I get asked the most..

Learn More

SLAs and Vendor Performance Management

Not all business relationships require a service-level agreement (SLA), but good vendor performance management is..

Learn More

Formalizing Vendor Risk Management - Keep...

When starting to build a formal Vendor Risk Management program, it’s important not to overcomplicate..

Learn More

Six Tips for Building Effective Vendor...

A well-designed vendor risk assessment questionnaire is vital for a successful Vendor Risk Management program...

Learn More

The 2017 State of Third Party...

How does your program rate? Take the Third-Party Risk Management survey and find out! There..

Learn More

eBook: 8 Reports for Effective and...

The foundation for an effective and efficient Vendor Risk Management program is solid reporting. The..

Learn More

The Top Policy and Procedure Management...

Corporate policies – from HR guidelines to pricing rules -- set the standards, outline the..

Learn More

How to Stay Ahead of Risk...

Managing risk through pre-contract vendor due diligence in a digitally connected world Thanks to increasing..

Learn More

Mitigating the CFPB Audit Process

In the mortgage industry, the potential for an audit by the Consumer Financial Protection Bureau..

Learn More

Why Cloud Works for Third-Party Risk...

If you are running a Vendor Risk Management program, odds are that you either have:..

Learn More

The State of Third-Party Risk Management

Today, organizations are bombarded by new regulatory guidance, daily occurrences of cybercrime and data breaches,..

Learn More

45-Minute Executive Web Clinic: Offer Management...

You’ve probably heard: The sky is falling in the benefits industry. (Or should we say..

Learn More

FFIEC Cybersecurity Assessment Tool: What You...

Cybercrime is a hot topic among GRC practitioners these days. It should be. According to..

Learn More

Case Study: Offer Management Revitalizes a...

A large Benefits Provider was facing major customer service and implementation challenges. The company provides..

Learn More

Change Your SOX: Next-Gen Sarbanes-Oxley Compliance

It’s been more than a decade since Sarbanes-Oxley became the law of the land—and..

Learn More

Introducing ProcessUnity’s Summer 2015 Release

Salesforce and Microsoft Office Integrations, plus a Whole New Look! The ProcessUnity Summer 2015 product..

Learn More

Channel Your Inner Regulator to Improve...

If you are like most banks and financial service companies, then chances are you outsource..

Learn More

Five Keys to Conducting Effective Vendor...

Risk exposure is indiscriminate. Whether you are a large multinational, a non-profit institution, an agency..

Learn More

A Roadmap for Implementing Product and...

“Benefit plan providers are turning to Offer Management initiatives and systems to reduce risk, cost..

Learn More

Plan Providers: Use Offer Management to...

In today’s intensely competitive benefit plan market, getting your teams aligned creates a dramatic competitive..

Learn More

Does Your Pre-Contract Due Diligence Leave...

Today’s global, digital economy opens up a world of opportunities—and a whole new world of..

Learn More

Welcome to the ProcessUnity Blog

On behalf of the ProcessUnity team, I am excited to welcome you to the new..

Learn MoreAbout Us

ProcessUnity is a leading provider of cloud-based applications for risk and compliance management. The company’s software as a service (SaaS) platform gives organizations the control to assess, measure, and mitigate risk and to ensure the optimal performance of key business processes. ProcessUnity’s flagship solution, ProcessUnity Vendor Risk Management, protects companies and their brands by reducing risks from third-party vendors and suppliers. ProcessUnity helps customers effectively and efficiently assess and monitor both new and existing vendors – from initial due diligence and onboarding through termination. Headquartered outside of Boston, Massachusetts, ProcessUnity is used by the world’s leading financial service firms and commercial enterprises. For more information, visit www.processunity.com.