ProcessUnity Introduces Third-Party Risk Management Solution for Community Banks

2 minute read

November 2014

CONCORD, MASS. – November 10, 2014 – ProcessUnity today introduced Vendor Cloud Community Bank Edition (CBE), a new version of its flagship vendor risk management solution aimed at helping smaller financial institutions identify and remediate risks posed by third-party service providers.

Vendor Cloud CBE automates third-party risk activities while capturing key supporting documentation that ensures compliance and fulfills regulatory requirements. Key features include:

- Vendor Services Catalog – creates a central repository of vendor information, key documentation and related risks

- Configurable, Online Vendor Questionnaires – simplify the assessment process for organizations and their suppliers

- Dynamic Reporting – provides real-time visibility into the state of third-party risk and demonstrates to regulators the existence of an effective program

As a cloud-based application, Vendor Cloud CBE does not require hardware or IT support. Users access the secure system through their web browser. Simple import templates allow organizations to migrate their existing content.

“When it comes to third-party risk, community banks face the same level of regulatory pressures as larger financial institutions, but have fewer resources to manage their programs,” said Sean Cronin, General Manager, Risk Management Solutions at ProcessUnity. “Vendor Cloud Community Bank Edition delivers automated assessment tools and reporting capabilities that spreadsheets and homegrown databases simply cannot provide. The end result is elimination of busy work, a focus on higher-value risk mitigation activities and a repeatable, reliable program that stands up to regulatory scrutiny.”

Availability and Pricing

Vendor Cloud CBE is available immediately at a special introductory price specifically designed for financial institutions that manage less than $1 billion in assets. The annual subscription includes training, technical support, five user licenses and the ability to manage up to 300 vendors.

For more information or to schedule a live demonstration, visit www.processunity.com.

About ProcessUnity

ProcessUnity is a leading provider of cloud-based applications for risk management and service delivery management. The company’s software as a service (SaaS) platform gives organizations the control to assess, measure, and mitigate risk and to ensure the optimal performance of key business processes. For public companies and regulated industries, ProcessUnity Risk Suite delivers effective governance and control, vendor risk mitigation, and regulatory compliance. For benefit plan administrators and other financial service firms, ProcessUnity Service Delivery Risk Management (SDRM) controls complex product offerings and strengthens client service experience. ProcessUnity is used by the world’s leading financial service firms and commercial enterprises. The company is headquartered outside Boston, Massachusetts and is funded by Rose Park Advisors and other private investors. For more information, visit www.processunity.com.

Related Articles

ProcessUnity Introduces Generative AI Technology for...

Evidence Evaluator Accelerates Vendor Response Times via Automated Review of Certifications, Policies, and Other Assessment-Related..

Learn More

ProcessUnity Kicks Off UNITE 2025 San...

San Diego, CA – ProcessUnity, The Third-Party Risk Management Company, today welcomes customers, partners, and..

Learn More

ProcessUnity’s Global Risk Exchange Gains Rapid...

Concord, MA – ProcessUnity’s Global Risk Exchange is redefining third-party risk management, enabling organizations to..

Learn More

Accelerate Third-Party Assessments: ProcessUnity Global Risk...

Assess-Once, Share-Many Model Extends Third-Party Risk Management (TPRM) Resources, Eliminates Assessment Backlog Concord, MA –..

Learn More

ProcessUnity Unveils 2025 Third-Party Risk Management...

ProcessUnity Unveils 2025 Third-Party Risk Management Platform Innovation Plans On the heels of a momentous..

Learn More

ProcessUnity Introduces a Revolutionary Platform to...

Threat and Vulnerability Response Platform Utilizes Proprietary Threat Intelligence to Rapidly Identify Third-party Gaps and..

Learn More

ProcessUnity Recognized as a Leader in...

Leading research firm provides the company with the highest scores in the Current Offering and..

Learn More

ProcessUnity and Interos Partner to Enable...

Integration to unify third-party risk management across the enterprise and increase confidence in cyber and..

Learn More

ProcessUnity Introduces Industry’s All-In-One Third-Party Risk...

Completes Integration with Global Risk Exchange; Augments Resources to Extend Coverage to More Outsourced Service..

Learn More

ProcessUnity Named Winner of the Black...

Company recognized for having the potential to achieve a $1B valuation ProcessUnity, provider of comprehensive..

Learn More

ProcessUnity Achieves ISO/IEC 27001 Certification for...

Leader in helping organizations manage third-party risk verifies its data security practices with compliance for..

Learn More

ProcessUnity and CyberGRX Combine to Form...

Combined Company Integrates the Full Third-Party Risk Lifecycle, Enabling a Collaborative Risk Assessment Process Between..

Learn More

ProcessUnity Closes 2022 with Significant Growth,...

Record-Setting Year Shaped by Third-Party Risk Management Innovation, Demand for Cybersecurity Performance Management Tools Concord,..

Learn More

The Boston Globe Names ProcessUnity a...

Magazine honors the best employers in Massachusetts CONCORD, MASS - DECEMBER 07, 2022 – ProcessUnity,..

Learn More

ProcessUnity Acquires AI/NLP Technology from ISMS...

Extends Artificial Intelligence Capabilities for Analyzing Third-Party Risk Data CONCORD, MASS. – NOVEMBER 01, 2022..

Learn More

ProcessUnity 2022 Customer Summit Highlights Trends,...

Thought Leadership Conference Returns In-Person: Customers, Partners and Industry Experts Collaborate on Risk Innovation, Third-Party..

Learn More

The Boston Globe Names ProcessUnity a...

Magazine honors the best employers in Massachusetts CONCORD, MASS - DECEMBER 02, 2021 – ProcessUnity,..

Learn More

ProcessUnity Announces Significant Growth Investment from...

CONCORD, MASS – SEPTEMBER 28, 2021 – ProcessUnity, a leading provider of third-party risk and..

Learn More

ProcessUnity Wins Two Global InfoSec Awards...

Awards Validate Market Authority with Recognition in IT Vendor Risk Management, Third-Party Risk Management CONCORD,..

Learn More

ProcessUnity 2021 Virtual Customer Summit Features...

Thought Leadership Conference Goes Online to Connect Customers, Partners and Industry Experts on Risk and Compliance Innovations CONCORD, MASS. – May 18,..

Learn More

ProcessUnity Enhances Third-Party Risk Management Programs...

ProcessUnity Vendor ESG Intelligence Leverages Environmental, Social and Governance (ESG) Ratings for Informed Vendor Due..

Learn More

ProcessUnity and HCL Technologies Partner to...

ProcessUnity Vendor Risk Management Platform to Power HCL Managed Services for Third-Party Risk Management CONCORD,..

Learn More

ProcessUnity Launches Vendor Screening Intelligence Powered...

Offering Accelerates and Informs Vendor Onboarding, Due Diligence and Ongoing Monitoring CONCORD, MASS. – April..

Learn More

ProcessUnity Extends Third-Party Risk Management Market...

Demand for Next-Generation Vendor Risk Automation Tools, Partner Ecosystem Expansion Pace Fast Start to 2021..

Learn More

ProcessUnity Launches Vendor Identity Intelligence to...

Targeted Intelligence Provides Crucial Insight into Vendor Identity and Ownership for Onboarding and Due Diligence CONCORD, MASS. – April 5, 2021 – ProcessUnity, a leading..

Learn More

ProcessUnity VRM Essential Edition Brings Full-Featured...

New Offering Brings New Levels of Efficiency and Expertise to Small Vendor Risk Management Teams..

Learn More

Idaho Central Credit Union Selects ProcessUnity...

Automates Workflows, Assessments and Due Diligence with Vendor Cyber Intelligence Solution CONCORD, Mass., March 09,..

Learn More

ProcessUnity Introduces Third-Party Risk Assessment Service...

Third-Party Risk Assessment Outsourcing Service Increases Scale, Extends Risk Expertise and Reduces Risk from Vendors..

Learn More

ProcessUnity Introduces Third-Party Risk Assessment Service...

Third-Party Risk Assessment Outsourcing Expands Risk Expertise for Greater Scale, Enhances Business Insight into Vendors and..

Learn More

ProcessUnity Introduces Cybersecurity Program Management Solution

Industry's First Comprehensive, Prepackaged Solution to Effectively Manage an Organization's Cybersecurity Program CONCORD, MASS. – December 1, 2020 – ProcessUnity, a leading..

Learn More

ProcessUnity and Dun & Bradstreet Partnership...

Data Integration Provides Expanded Insight into Financial Health of Vendors and Suppliers CONCORD, MASS. – October 20, 2020 – ProcessUnity, a leading provider of cloud-based applications for..

Learn More

Meridian Bank Selects ProcessUnity to Streamline...

Automated Workflows, Assessments and Processes Modernize Third-Party Risk Management CONCORD, MASS. – October 14, 2020 – ProcessUnity, a leading provider of cloud-based applications for risk and compliance..

Learn More

ProcessUnity and RiskRecon Partner to Provide...

Partnership increases visibility into the security of key business partners Concord, MA, and Salt Lake..

Learn More

ProcessUnity Vendor Risk Management Now Available...

CONCORD, MASS. – SEPTEMBER 8, 2020 – ProcessUnity, a leading provider of cloud-based applications for..

Learn More

ProcessUnity Launches Vendor Financial Intelligence Powered...

Offering Provides Crucial Insight into Financial Health of Vendors and Suppliers CONCORD, MASS. – JULY..

Learn More

ProcessUnity’s Amanda Giroux Honored as One...

Director of Alliances at ProcessUnity Recognized as an Influential Channel Leader for the Second Consecutive..

Learn More

ProcessUnity Introduces Vendor Intelligence Suite, Launches...

First in a Series of ProcessUnity Vendor Intelligence Capabilities Integrates Cybersecurity Ratings for Complete Vendor..

Learn More

Edna Conway Joins the ProcessUnity Board...

New Appointment Adds Cybersecurity and Risk Management Expertise CONCORD, MASS. – April 22, 2020 –..

Learn More

ProcessUnity Wins Two Awards for Vendor...

ProcessUnity Named Next-Gen Leader of Third-Party Risk Management and IT Vendor Risk Management CONCORD, MASS...

Learn More

Businesses Can Quickly Assess Third Parties...

Complimentary Questionnaire Provides Baseline for Third-Party Risk Management Teams to Survey Vendor Populations CONCORD, MASS...

Learn More

ProcessUnity Expands Vendor Risk Management Software...

New Out-of-the-Box Configuration Provides Quick-to-Deploy, Comprehensive Solution for Third-Party Risk Management CONCORD, MASS. – February..

Learn More

ProcessUnity Extends Vendor Risk Management Market...

Third-Party Risk Management Automation Demand, Increased Industry Recognition Fuel 2019 Results CONCORD, MASS. – January..

Learn More

Elaine Beitler Joins the ProcessUnity Board...

New Appointment Amplifies Vendor Risk Management Momentum CONCORD, MASS. – December 17, 2019 – ProcessUnity,..

Learn More

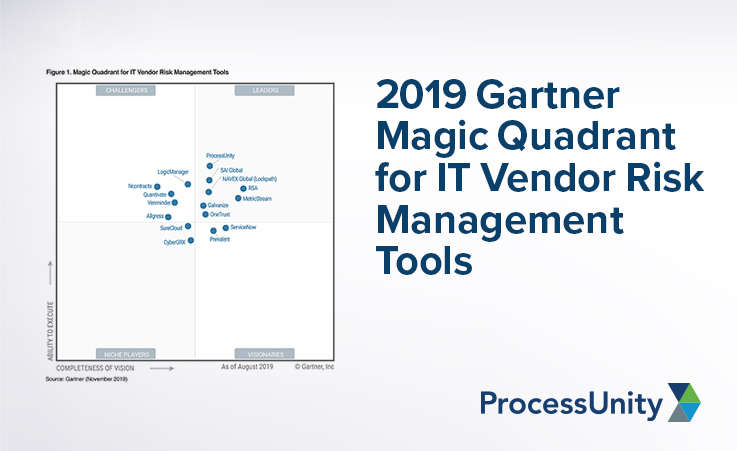

ProcessUnity Positioned by Gartner in the...

ProcessUnity Achieves the Highest Overall Position for Ability To Execute CONCORD, MASS. – December 4,..

Learn More

ProcessUnity Promotes Sean Cronin to CEO

CONCORD, MASS. – November 19, 2019 – ProcessUnity, a leading provider of cloud-based software for..

Learn More

The Boston Globe Names ProcessUnity a...

Magazine Honors the Best Employers in Massachusetts CONCORD, MASS. – November 18, 2019 – ProcessUnity,..

Learn More

ProcessUnity Awarded Two Cyber Defense Global...

Award Recognition Further Validates ProcessUnity’s Leadership in Vendor Risk Management CONCORD, MASS. – October 23,..

Learn More

ProcessUnity and Sila Partner to Deliver...

Sila Adds ProcessUnity’s Industry-Leading Third-Party Risk Management Platform to its Portfolio CONCORD, MASS. – October..

Learn More

ProcessUnity Expands Contract Management Capabilities in...

New Contract Terms Tracking Provides Greater Visibility into Vendor Commitments and Obligations CONCORD, MASS. –..

Learn More

ProcessUnity Recognized as a Leading Provider...

CONCORD, MASS. – August 29, 2019 – ProcessUnity, a leading provider of cloud-based applications for..

Learn More

Elements Alternative and ProcessUnity Announce Strategic...

Elements Alternative adds industry-leading ProcessUnity platform to its portfolio CONCORD, MASS. – July 19, 2019..

Learn More

ProcessUnity and DVV Solutions Partner to...

DVV Solutions Adds Industry-Leading ProcessUnity Platform to Its Expanding Managed Services Portfolio CONCORD, MASS. –..

Learn More

ProcessUnity Updates Intelligent Risk and Compliance...

Flexible, Powerful Automation Makes Risk and Compliance Programs More Effective and Efficient CONCORD, MASS. –..

Learn More

ProcessUnity Launches New Partner Program to...

Provides Technology and Co-Marketing Support to Help Partners Solve Business Governance Challenges CONCORD, MASS. –..

Learn More

ProcessUnity’s Amanda Giroux Honored as One...

Director of Alliances at ProcessUnity Recognized as an Influential Channel Leader CONCORD, MASS. – May..

Learn More

New Risk and Compliance Platform Release,...

ProcessUnity Customers, Partners and Industry Experts Gather to Shape Best Practices in Risk and Compliance CONCORD,..

Learn More

EY, BitSight and RapidRatings to Sponsor...

Leading Organizations to Share Expertise and Best Practices at Signature Risk and Compliance Conference CONCORD, MASS...

Learn More

ProcessUnity Vendor Risk Management Update Extends...

Industry-Standard Assessment Combined with Powerful Automation Tools Enhance Vendor Risk Management Speed and Efficiency CONCORD,..

Learn More

ProcessUnity Accelerates Growth in 2018

Demand for Third-Party Risk Management Automation, Channel Expansion Fuel Fourth-Straight Record Year CONCORD, MASS. –..

Learn More

Registration Opens for 2019 ProcessUnity Customer...

Customers, Partners and Industry Experts to Gather to Share Best Practices in Risk and Compliance..

Learn More

ProcessUnity Launches Newest Version of Its...

Enhanced Workflow Capabilities, Dashboard Visualizations, Assessment Automation and Formalized Change Management Highlight the Fall 2018..

Learn More

ProcessUnity Recognized in Gartner Critical Capabilities...

CONCORD, MASS. – November 14, 2018 – ProcessUnity, a leading provider of cloud-based applications for..

Learn More

ProcessUnity Appoints New Board Members to...

CONCORD, MASS, -- October 30, 2018 - ProcessUnity, a leading provider of cloud-based solutions for..

Learn More

ProcessUnity Announces Majority Growth Capital Investment...

CONCORD, MASS. – September 18, 2018 – ProcessUnity, a leading provider of cloud-based software for..

Learn More

ProcessUnity Vendor Risk Management Update Adds...

Industry-Standard Assessment Combined with Powerful Automation Tools Enhance Vendor Risk Management Speed and Efficiency CONCORD,..

Learn More

ProcessUnity Continues Fast Growth in 2017

Partner Ecosystem and Demand for Third-Party Risk Management Automation Fuel Third-Straight Record Year CONCORD, MASS...

Learn More

Farmer Mac Selects ProcessUnity for Third-Party...

CONCORD, MASS. – October 31, 2017 – ProcessUnity, a leading provider of cloud-based solutions for..

Learn More

ProcessUnity Introduces New Version of its...

Fall 2017 Release Includes More Configuration Options, Tools to Reduce Vendor Risk Management Fatigue CONCORD,..

Learn More

New Risk and Compliance Platform Release,...

ProcessUnity Customers, Partners and Industry Experts Gather to Discuss Best Practices in Risk and Compliance..

Learn More

ProcessUnity Extends 2017 Customer Summit with...

CONCORD, Mass., September 22, 2017 - ProcessUnity, a leading provider of cloud-based solutions for risk management,..

Learn More

ProcessUnity Appoints Sean Cronin, Richard Wastcoat...

CONCORD, Mass., September 7, 2017 - ProcessUnity, a leading provider of cloud-based solutions for risk management,..

Learn More

BitSight Provides ProcessUnity Customers Access to...

CAMBRIDGE and CONCORD, Mass., August 2, 2017 - BitSight, the Standard in Security Ratings, and ProcessUnity,..

Learn More

VyStar Credit Union Selects ProcessUnity Vendor...

CONCORD, MASS. – July 25, 2017 – ProcessUnity, a leading provider of cloud-based solutions for..

Learn More

ProcessUnity Recognized by Gartner as a...

CONCORD, MASS. – July 20, 2017 – ProcessUnity, a leading provider of cloud-based solutions for..

Learn More

RapidRatings, ProcessUnity Partnership Helps Organizations Gain...

Technology integration delivers Financial Health analytics to the third-party due diligence process NEW YORK, NY..

Learn More

ProcessUnity and NominoData Partner to Enrich...

CONCORD, MASS. – MAY 2, 2017 – ProcessUnity, a leading provider of cloud-based solutions for..

Learn More

Cadence Bank, N.A. Selects ProcessUnity Vendor...

CONCORD, MASS. – March 14, 2017 – ProcessUnity, a leading provider of cloud-based solutions for..

Learn More

ProcessUnity Updates Risk and Compliance Management...

Newest Version of Cloud-based Suite Expands Reporting and Dashboard Capabilities; Increases Configuration Options CONCORD, MASS...

Learn More

SecurityScorecard Provides ProcessUnity Vendor Risk Customers...

Technology partnership offers, within one single platform, a comprehensive look into risk of doing business..

Learn More

Demand for Third-Party Risk Management and...

Cloud-Based Risk Solutions Drive Record Customer and Revenue Growth in 2016 CONCORD, MASS. – January..

Learn More

ProcessUnity Updates Risk and Compliance Management...

Newest Version of Cloud-based Suite Adds SLA Tracking, Customer-Defined Subject Areas and Microsoft Word Integration..

Learn More

ProcessUnity to Host TRID Compliance and...

CONCORD, MASS. – May 10, 2016 – ProcessUnity, a leading provider of cloud-based applications for..

Learn More

ProcessUnity Hosts Inaugural Customer Summit

Industry Experts and Customers Gather to Discuss Top Trends in Third-Party Risk and Offer Management..

Learn More

ProcessUnity Integrates its Third-Party Risk Management...

SIG Integration Improves Assessment Accuracy, Shortens Response Times and Reduces Administrative Burdens for Both Organizations..

Learn More

Global Lending Services Selects ProcessUnity for...

CONCORD, MASS. – March 22, 2016 – ProcessUnity, a leading provider of cloud-based applications for..

Learn More

ProcessUnity and Argos Risk Partner to...

Integration Delivers 24/7 Real-Time Risk Mitigation for Vendor Risk Management MINNEAPOLIS, MN AND CONCORD, MA..

Learn More

ProcessUnity and CastleHill Partner to Deliver...

CONCORD, MASS. – February 16, 2016 – ProcessUnity and CastleHill Managed Risk Solutions today announced..

Learn More

ProcessUnity Introduces Cloud-Based Policy and Procedure...

Online System Streamlines Policy Creation, Distribution, Certification and Updates CONCORD, MASS. – January 25, 2016..

Learn More

Demand for Third-Party Risk Management, Product...

Cloud-Based Risk Solutions Power Record Customer and Revenue Growth in 2015 CONCORD, MASS. – January..

Learn More

ProcessUnity Names Sean Cronin President

Promotion Reflects Record 2015 Results and Customer Success Metrics Concord, Mass. — January 5, 2016..

Learn More

Safety Insurance Group Selects ProcessUnity for...

CONCORD, MASS. – December 16, 2015 – ProcessUnity, a leading provider of cloud-based solutions for..

Learn More

Viewpost Selects ProcessUnity Vendor Cloud for...

CONCORD, MASS. – December 15, 2015 – ProcessUnity, a leading provider of cloud-based applications for..

Learn More

Vendor Risk Management Portal, Analytics Database...

Newest Version of Cloud-based Risk and Compliance Platform Streamlines Vendor Self-Assessments, Powers Advanced Analytics CONCORD,..

Learn More

Gateway Mortgage Group Selects ProcessUnity for...

CONCORD, MASS. – November 10, 2015 – ProcessUnity, a leading provider of cloud-based applications for..

Learn More

ProcessUnity Launches Newest Version of its...

Salesforce and Microsoft Office Integration, Third-Party Risk Management Enhancements Highlight Summer 2015 Release CONCORD, MASS...

Learn More

ProcessUnity Infographic: Where are Benefit Plan...

CONCORD, MASS. – December 4, 2014 – ProcessUnity today introduced a visual guide to help..

Learn More

NTFN Selects ProcessUnity Vendor Cloud for...

CONCORD, MASS. – November 18, 2014 – ProcessUnity, a leading provider of cloud-based applications for..

Learn More

ProcessUnity and Deloitte to Co-Present at...

Presentation will outline steps for achieving service delivery excellence for retirement services providers WHO: ProcessUnity..

Learn More

Survey: Understanding Service Value is the...

Executives from Retirement, Health and Insurance, and Equity Compensation Organizations Sound Off to Improve Client..

Learn More

GRC Expert Sean Cronin Joins ProcessUnity...

Signals Growing Market Demand for Vendor Risk Management Solutions CONCORD, MA — ProcessUnity, a leading..

Learn More

ProcessUnity Expands SDRM Team With Key...

ProcessUnity, a leading provider of cloud-based application software, today announced key additions to its team..

Learn More

ProcessUnity to Host “The Vendor Manager’s...

Enterprise risk management expert John Nye will examine ways to manage vendor risk and implement..

Learn More

Andrew Cacossa Joins ProcessUnity to Lead...

Prominent GRC Sales Leader Accelerates Company Expansion ProcessUnity, a leading provider of cloud-based application software,..

Learn More

John Nye to Speak on Risk...

Session will highlight the importance of improving and refining enterprise security processes WHO: John Nye,..

Learn More

OCC Risk Management Guidance October 2013

The Office of the Comptroller of Currency recently sent a bulletin regarding third party relationship..

Learn More

Risk Management Expert John Nye Joins...

Risk Assessment and Security Industry Veteran to Lead Risk Suite Business Concord, MA — September..

Learn More

ProcessUnity Introduces SDRM Service Delivery Risk...

SDRM Delivers an Innovative Platform for Financial Service Providers to Control Service Offerings for Greater..

Learn More

Lisa Weil Named to SPARK Institute’s...

ProcessUnity Vice President Will Help Shape National Policy for the Retirement Services Industry Washington, DC..

Learn More

Lisa Weil Joins ProcessUnity Leadership Team

Financial services industry executive to lead SDRM business Concord, MA — April 30, 2013 —..

Learn More

“Venture Funding Arrives On Time for...

The Worcester Business Journal covered ProcessUnity’s recent funding announcement: For the first time in its..

Learn More

ProcessUnity Raises $5 Million, Round Led...

Funding to Boost Marketing and Distribution of Company’s Risk Management Solutions Concord, MA — April..

Learn More

ProcessUnity & KLC Consulting Offer Integrated...

Concord, MA, April 23, 2012 – ProcessUnity and KLC Consulting today announced a partnership to..

Learn MoreAbout Us

ProcessUnity is a leading provider of cloud-based applications for risk and compliance management. The company’s software as a service (SaaS) platform gives organizations the control to assess, measure, and mitigate risk and to ensure the optimal performance of key business processes. ProcessUnity’s flagship solution, ProcessUnity Vendor Risk Management, protects companies and their brands by reducing risks from third-party vendors and suppliers. ProcessUnity helps customers effectively and efficiently assess and monitor both new and existing vendors – from initial due diligence and onboarding through termination. Headquartered outside of Boston, Massachusetts, ProcessUnity is used by the world’s leading financial service firms and commercial enterprises. For more information, visit www.processunity.com.