Third-Party Risk Management is the process of identifying, managing and mitigating risks present in a vendor relationship. This form of risk management helps organizations ensure that their vendors (often referred to as suppliers, partners, third parties or service providers) add value without threatening business continuity.

Poor vendor management and working with risky third-party vendors increase the likelihood of a data breach, potentially negatively impacting an organization’s revenue, reputation and legal compliance—all of which can set a company back for a long time. Third-Party Risk Management helps organizations understand their vendors to make informed decisions about appropriate security controls.

Third-party risk management is the most commonly used term for this practice, but vendor risk management and supplier risk management are often used interchangeably. Third-party risk management processes are unique to every organization based on industry focus, vendor population size and program resources.

Why Implement a Third-Party Risk Management Program?

Only 52% of companies have security standards for third parties, and an average of 89 vendors are accessing a company’s network every week.

Globalization has created a dependence on critical activities outsourced to an increasing number of partners and vendors; this in turn has fueled a dramatic rise in the third-party ecosystem. It’s highly likely that your company now outsources significant aspects of its business to outside providers. With outsourcing an unavoidable part of business, vendors have access to your intellectual property or to sensitive customer information.

Recent events such as the COVID-19 pandemic and SolarWinds hack demonstrate how easily disruptions can have a cascading effect throughout the supply chain. With significant security compromises making headlines, most organizations require vendors to abide by their internal standards and governmental regulations surrounding privacy and security.

A vendor risk management program is a formal way to evaluate, track and measure third-party risk, assess the organization’s risk appetite, and develop vendor controls to lessen the impact on your business should an incident occur. A third-party risk management program provides consistent workflows for vendor monitoring and risk reporting over time.

Managing vendor risk is an ongoing process. As your company embarks on or advances this process, you want to ensure that the information you gain is used to advance your program, strengthening the organization and its relationships.

What are the Basic Steps of Third-Party Risk Management?

The basic workflows in a third-party risk management program align with the third-party lifecycle. Though it varies across each organization, the process is typically owned by a Chief Information Security Officer (CISO), Chief Procurement Officer (CPO) or Chief Risk Officer. Other departments involved may include Legal, Information Technology and Information Security.

The phases of the third-party lifecycle include:

Vendor Onboarding: Prior to entering a third-party relationship, your organization will need to collect as much information as possible about the vendor. Organizations may choose to integrate intelligent vendor identification data to streamline this process, collecting information such as:

- Security certifications

- Relationship contacts

- Security practices

- Criticality of shared data

- Relationship scope

This information can be leveraged to classify vendors based on their inherent risk, informing the scope and frequency of vendor risk assessments, reporting and due diligence. Establishing criticality tiers for vendors allows organizations to monitor the riskiest vendors throughout the vendor lifecycle.

Vendor Due Diligence / Vendor Risk Assessments: Vendors need to be constantly assessed within the context of evolving regulations and changing practices. Organizations take several approaches to this process:

- Vendor Assessment Questionnaires: Targeted vendor questionnaires determine vendor risk against a set of “preferred responses,” standards set by your organization or other regulatory bodies.

- Onsite Control Assessments: Tangible proof of your vendor’s security controls can reassure your organization that critical data is maximumly protected. Onsite control assessments allow the organization to gain visual verification of a vendor’s security practices.

Ongoing Vendor Monitoring: Keeping tabs on a vendor with ongoing monitoring practices allows the organization to stay ahead of risks. After all, a vendor risk assessment is merely a snapshot in time that can’t account for how risk might evolve. Organizations need to look out for the effects of potential changes, such as acquisitions, regulatory changes and industry developments. Third-party risk can be continuously monitored with the following practices:

- Due Diligence Questionnaires: Vendor questionnaires tailored to an organization’s specific concerns can reveal risks as they evolve.

- Vendor Performance Reviews: Regular evaluation of how a vendor meets contractual obligations provides insight into KPIs and other important metrics.

- SLA Tracking: Monitor and track the progress of Service-Level Agreements (SLAs) as the vendor relationship progresses.

Vendor Risk Reporting: Proving compliance and risk mitigation is a critical function of an effective third-party risk management program. Organizations achieve this by compiling data collected throughout the vendor risk lifecycle into reports. Vendor risk reports aid in building program maturity and gaining board-level support. A typical report includes information on:

- Risk trends over time

- Vendors by criticality

- Vendor contract progression

- Vendor risk assessment progression

- Issue response

Vendor Issue Management: The ultimate goal of any third-party risk management program is to mitigate risk with security measures. Organizations prepare for incidents by implementing vendor controls at the onset of the relationship based on the vendor’s criticality. These controls may be adjusted as third-party risk evolves or incidents necessitate it.

Benefits of Automated Third-Party Risk Management Software

By automating vendor onboarding and streamlining vendor due diligence, organizations can save hundreds (or thousands) of hours, redirecting them to more critical tasks.

Consider these benefits of implementing an intelligent, automated Vendor Risk Management tool:

- Consistency: Often, there are five or more stakeholder groups involved in vendor onboarding. An automated third-party risk management tool keeps them all on track, in real-time, with a predefined workflow.

- Speed: Aspects of a program – vendor risk assessments, vendor performance management, etc. – can take significantly longer than they should in manual processes. Automation dramatically reduces this time, freeing up your team to perform other tasks.

- Scalability: As an organization grows, the number of vendors does too. Growth should feel rewarding, not punishing – a tool will help scale to more vendors without adding extra tasks to a vendor risk manager’s plate.

- Clean data: To protect the data shared with vendors, monitor threats and keep track of records, risk managers need a way to keep this data clean and accessible. Automated tools help facilitate better data visibility through reports and dashboards, allowing your organization to make better decisions.

- More Trust: Relationships are all about trust. Proving that customer data is protected with a robust third-party risk management program helps build consumer confidence in your brand. Additionally, automation helps strengthen your vendor relationships by providing much-needed visibility into their security practices.

Make Your Job Easier with Third-Party Risk Management Automation

As seen from statistics on data breaches and vendor vulnerability, the need for quality third-party risk management is on the rise, and it will continue to grow as more incidents arise. The emerging complexities of third-party data and vendor due diligence require better processes. The best strategy for organizations to streamline these processes is to adopt an automated third-party risk management tool.

ProcessUnity can help. Learn how ProcessUnity Vendor Risk Management can streamline and automate all of your third-party risk activities while ensuring TPRM compliance and reducing costs. Schedule a demo with one of our subject matter experts today.

Schedule Your Demo Today: https://www.processunity.com/about-us/contact-us-processunity/

Related Articles

Cut Risk, Not Corners: Streamlining the...

The modern organization relies on a larger, more integrated network of third parties and suppliers..

Learn More

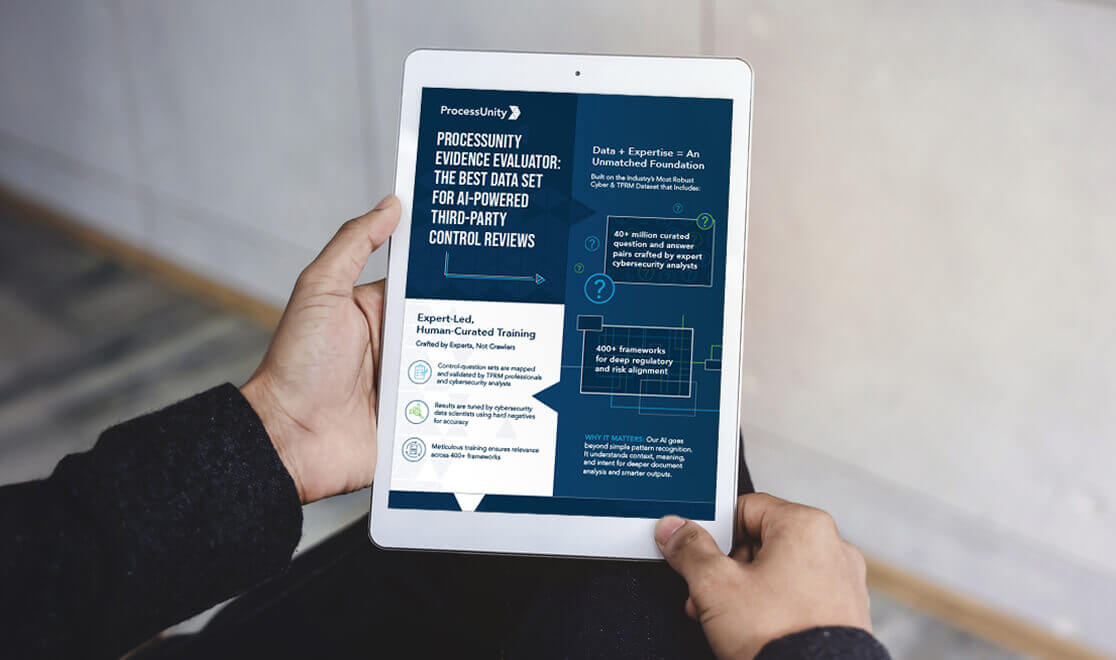

Accelerate Control Reviews with ProcessUnity’s Evidence...

Third-party risk assessments are becoming increasingly complex and resource-intensive. Manual evidence reviews create bottlenecks, inconsistent..

Learn More

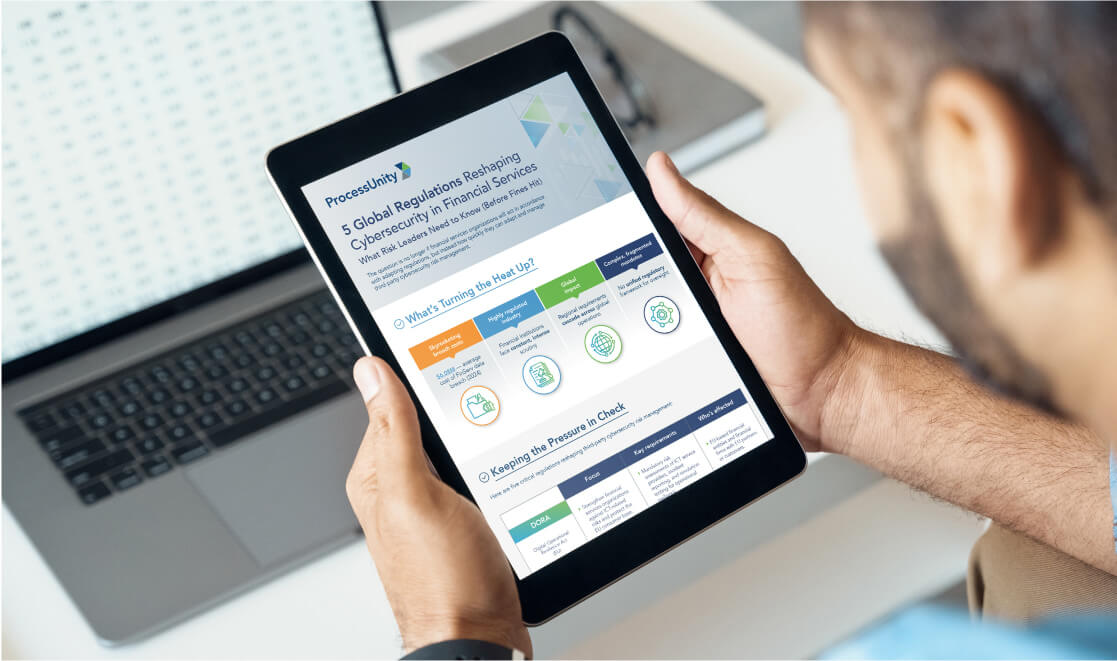

5 Cybersecurity Frameworks Financial Institutions Can’t...

Regulatory pressure is intensifying — and financial institutions are feeling the heat. In 2024, the..

Learn More

ProcessUnity Evidence Evaluator: AI-Based Third-Party Controls...

See how ProcessUnity’s GenAI-powered feature simplifies third-party risk assessments. In just 60 seconds, discover how..

Learn More

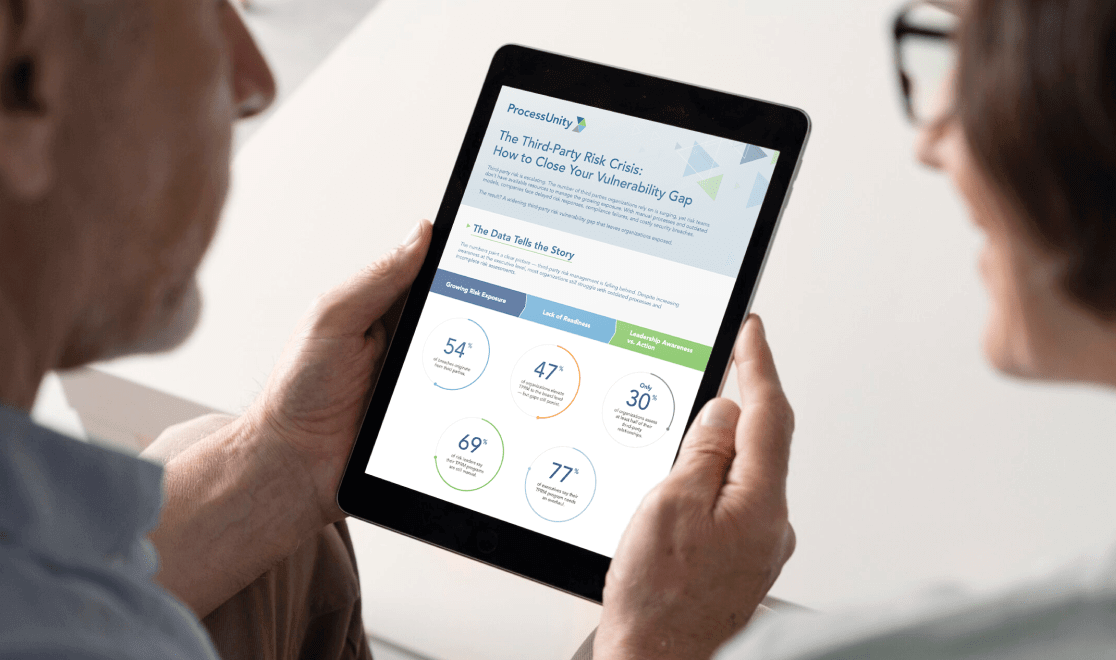

How to Close Your Third-Party Risk...

Is your organization exposed to hidden third-party risks that could create dangerous blind spots in..

Learn More

8 Ways Your Business Benefits from...

Cyber threats are intensifying. Regulatory scrutiny is increasing. Legacy assessments simply can’t keep pace. To..

Learn More

5 Critical Regulations Reshaping TPRM in...

The pressure on financial institutions to manage third-party risk is mounting — and the stakes..

Learn More

How Third-Party Vendor Risk Disrupts Business...

Your third-party vendors are delivering on time, business operations are efficient and planned, and customers..

Learn More

10 Critical Third-Party Risk Management Challenges...

Every vendor relationship can introduce potential vulnerabilities to your business, and in today's hyperconnected business..

Learn More

Ensure Ongoing DORA Compliance Across Your...

The Digital Operational Resilience Act (DORA) is a regulatory framework established by the European Union..

Learn More

5 Essential Steps to Modernize Your...

Third-party relationships have become a critical vulnerability point - with 54% of security breaches occurring..

Learn More

Third-party risk: Re-thinking vendor assessments

Third parties can introduce substantial risk into global supply networks, but rigorous vendor risk assessments..

Learn More

ProcessUnity Introduces a Revolutionary Platform to...

Threat and Vulnerability Response Platform Utilizes Proprietary Threat Intelligence to Rapidly Identify Third-party Gaps and..

Learn More

Revolutionizing Response to Emerging Third-Party Cybersecurity...

Introducing ProcessUnity’s New Threat and Vulnerability Response Platform to Quickly Identify Emerging Threats and Assess..

Learn More

How Organizations and Vendors Use a...

A third-party risk exchange is a transformative concept designed to make third-party risk management (TPRM)..

Learn More

ProcessUnity Introduces Industry’s All-In-One Third-Party Risk...

Completes Integration with Global Risk Exchange; Augments Resources to Extend Coverage to More Outsourced Service..

Learn More

Mature Your Cyber Program with a...

Risk-based cybersecurity risk management is the process of identifying, tracking and mitigating the risks to..

Learn More

Controls-Based Versus Risk-Based Cybersecurity Programs

In the face of an escalating regulatory burden and increasingly common data breaches, many teams..

Learn More

Manage Cybersecurity Risk with the SCF...

The Secure Controls Framework (SCF) Risk Management Model can be a powerful tool for teams..

Learn More

Optimize Vendor Onboarding by Aligning with...

During the vendor onboarding process, both cybersecurity and procurement manage the amount of risk brought..

Learn More

3 Takeaways about Anti-Bribery and Corruption...

Anti-bribery and corruption programs grant businesses visibility into their internal practices and third-party networks to..

Learn More

Properly Scoping Vendor Due Diligence Drives...

Properly Scoping Vendor Due Diligence Saves Both Time and Money One of the costliest mistakes..

Learn More

Security Assessments 2.0: The Next Generation...

The more things change, the more they stay the same. It's a well-worn adage that..

Learn More

How to Conduct Third-Party Due Diligence

Identifying and engaging with the right partners is essential to the success of most businesses...

Learn More

Evaluating Security Risk When Onboarding New...

In today’s tightly interwoven supply chains and highly competitive markets, organizations must continuously evaluate and..

Learn More

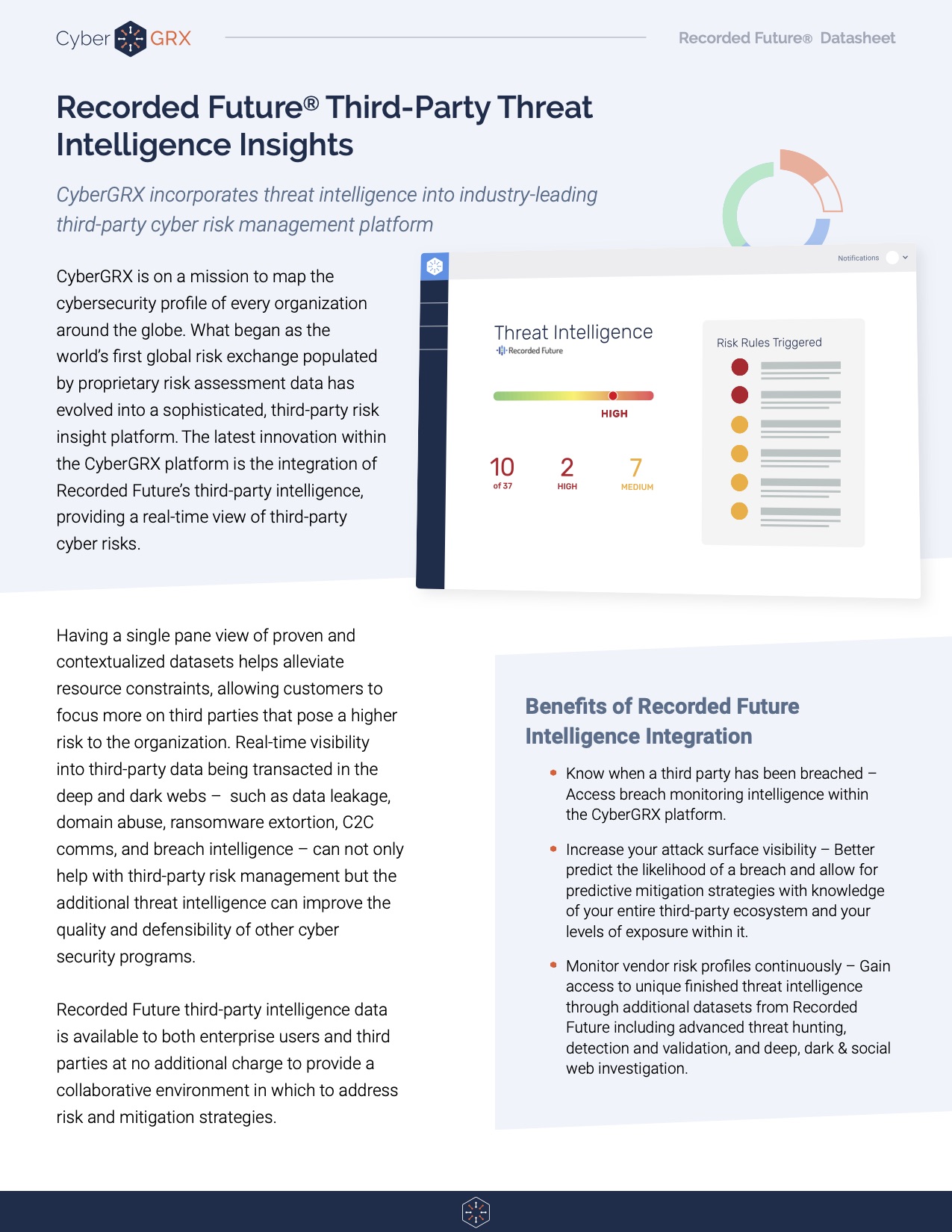

Recorded Future Third-Party Threat Intelligence Insights

Having a single pane view of proven and contextualized datasets helps alleviate resource constraints, allowing..

Learn More

5 Areas to Mitigate Risk in...

If you work within a Vendor Risk Management (VRM) team, you know that third-party risk..

Learn More

5 Tips to Improve Your Vendor...

Vendor due diligence is essential to any third-party risk management program. However, no two due diligence processes are..

Learn More

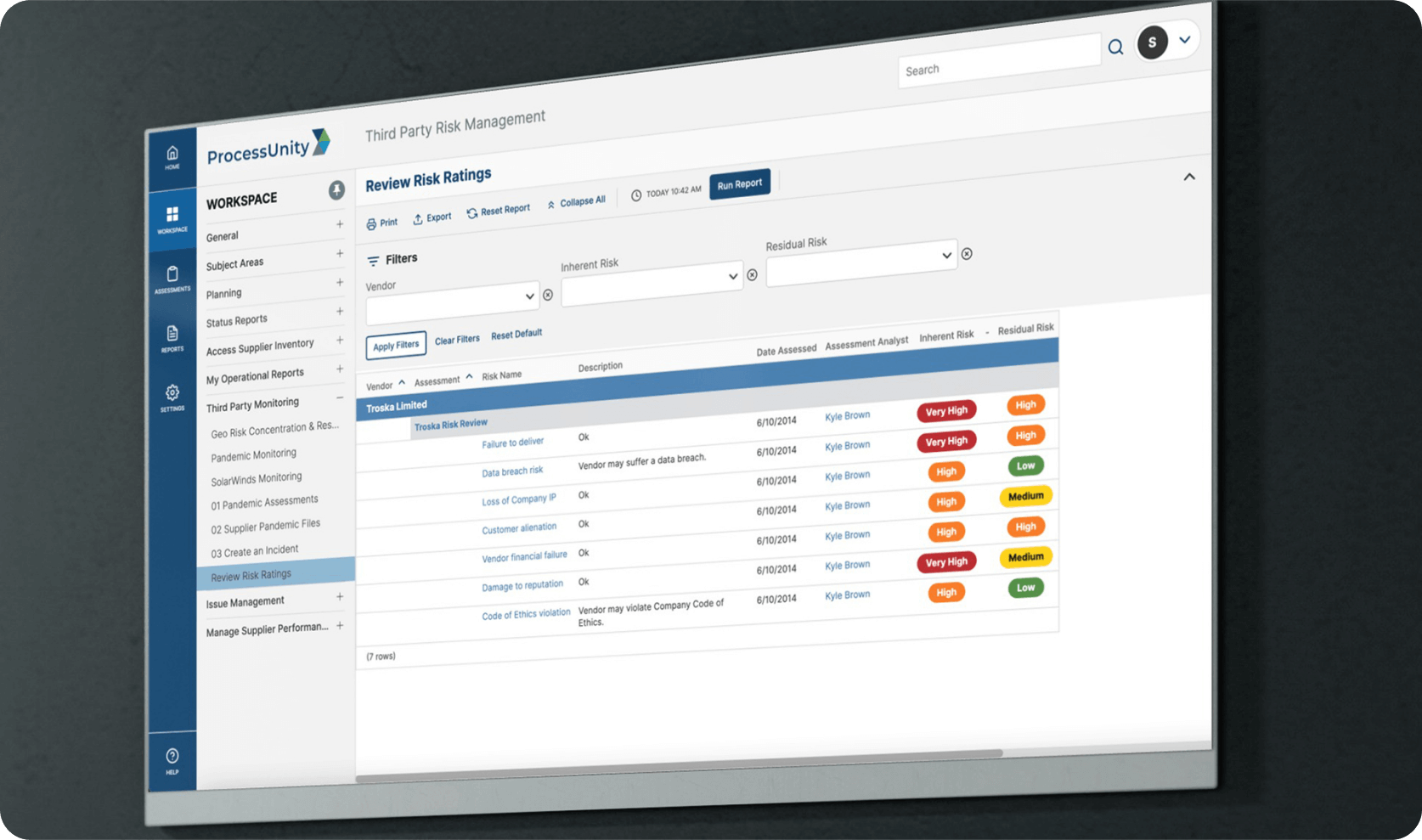

Inherent Risk vs. Residual Risk in...

Conducting a thorough vendor risk analysis is an integral step in Vendor Risk Management. However,..

Learn More

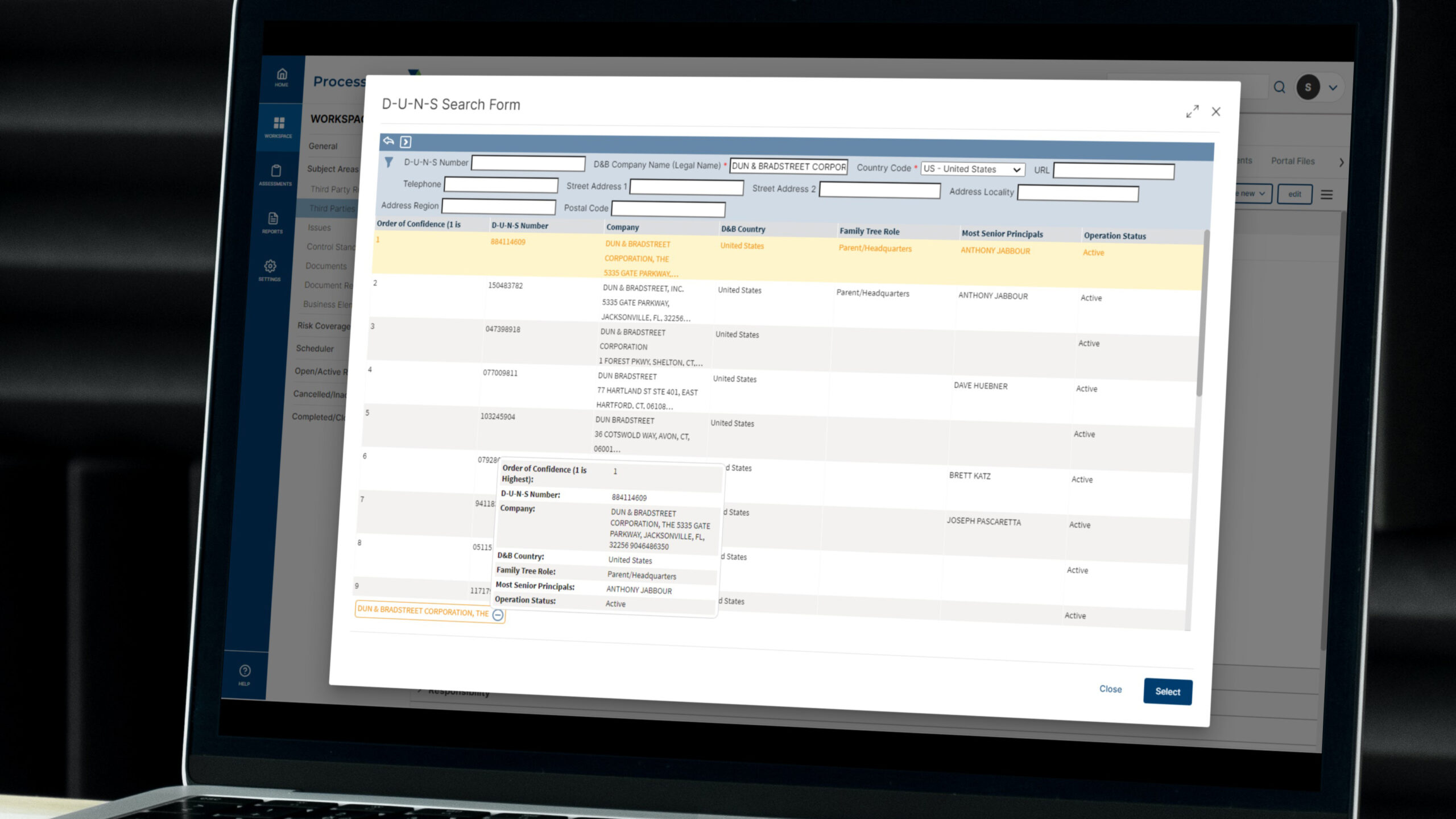

ProcessUnity Vendor Identity Intelligence with Dun...

ProcessUnity Vendor Identity Intelligence seamlessly and automatically incorporates D&B’s D-U-N-S Search and Beneficial Owner Search..

Learn More

Anti-Bribery & Corruption (ABAC) in Business...

The impacts of corruption can be very severe and have been historically well documented. On a political level, corruption – however and wherever..

Learn More

What Is Third-Party Risk Management: The...

The recent SolarWinds breach has reminded news organizations, businesses, and leadership teams around the world..

Learn More

8 Benefits of Completing a CyberGRX...

CyberGRX modernizes and streamlines redundant and inefficient processes that come with shared and static..

Learn More

Third-Party Risk Management Best Practices

New Guide Offers Expert Advice for Effective and Efficient Vendor-Risk Processes A robust, effective, and..

Learn More

Best Practice Program for ProcessUnity Vendor...

ProcessUnity Vendor Risk Management (VRM) protects companies and their brands by reducing risks from third-party vendors and..

Learn More

ProcessUnity Vendor Financial Intelligence Powered By...

ProcessUnity Vendor Financial Intelligence (VFI) with RapidRatings seamlessly incorporates RapidRatings’ financial health ratings into ProcessUnity’s Third-Party..

Learn More

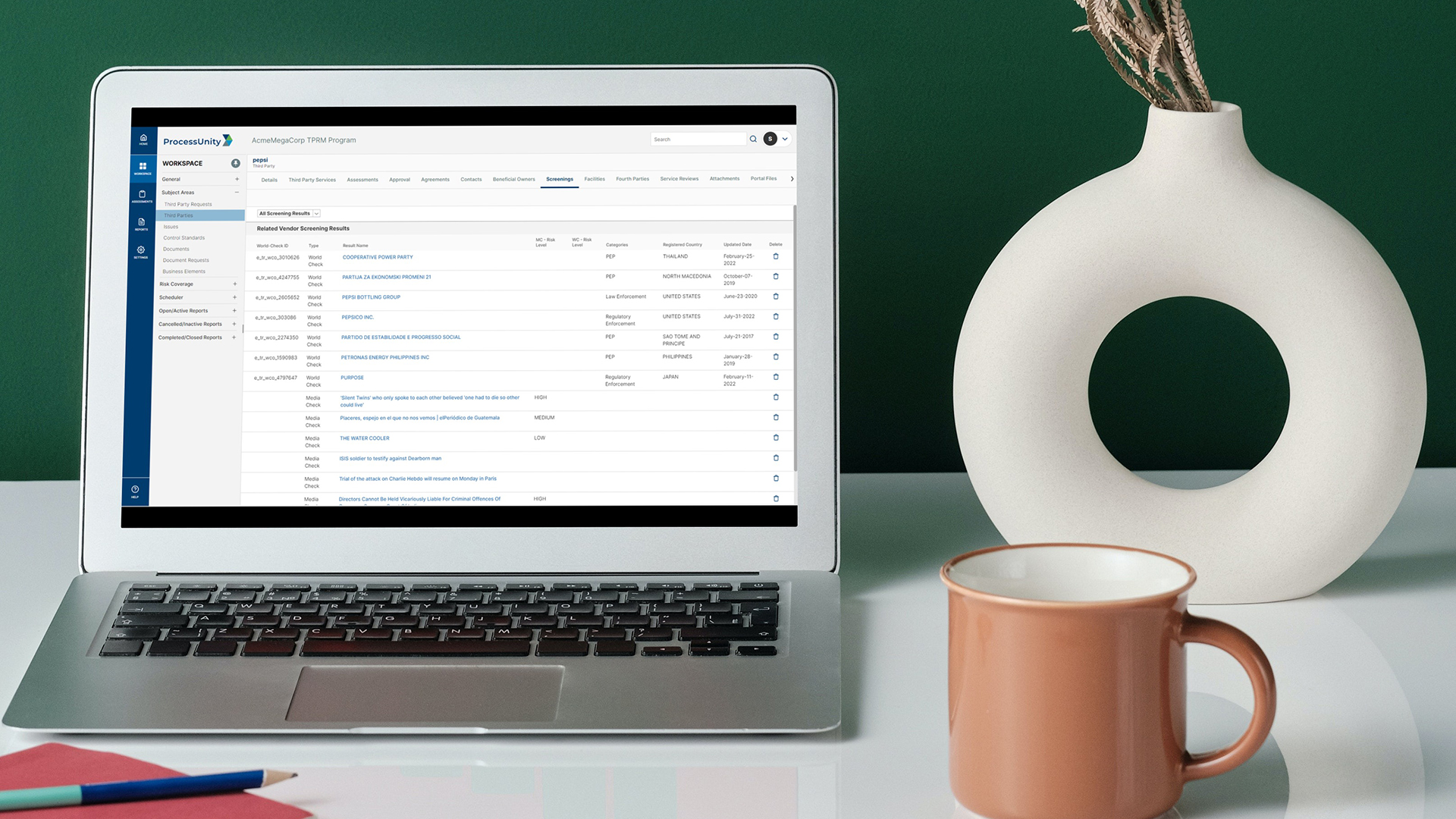

Vendor Screening Intelligence with Refinitiv

ProcessUnity Vendor Screening Intelligence (VSI) embeds LSEG World-Check One’s third-party screening capabilities into ProcessUnity’s Third-Party Risk..

Learn More

How to Stay Ahead of Risk...

Managing risk through pre-contract vendor due diligence in a digitally connected world Thanks to increasing..

Learn MoreAbout Us

ProcessUnity is a leading provider of cloud-based applications for risk and compliance management. The company’s software as a service (SaaS) platform gives organizations the control to assess, measure, and mitigate risk and to ensure the optimal performance of key business processes. ProcessUnity’s flagship solution, ProcessUnity Vendor Risk Management, protects companies and their brands by reducing risks from third-party vendors and suppliers. ProcessUnity helps customers effectively and efficiently assess and monitor both new and existing vendors – from initial due diligence and onboarding through termination. Headquartered outside of Boston, Massachusetts, ProcessUnity is used by the world’s leading financial service firms and commercial enterprises. For more information, visit www.processunity.com.