Third-Party Risk Management Software

Vendor Due Diligence & Ongoing Monitoring

Establish an objective pre-contract process and post-contract cadence with ProcessUnity's vendor due diligence software.

Unfortunately, facts rarely speak for themselves during the vendor due diligence process. By itself, a set of accurate data and truthfully answered questions—sourced from requestors, independent reviewers, or your internal due diligence team—remains open to interpretation. Subjectivity can insert itself into what should be a standardized process, creating inconsistencies that undermine the integrity of vendor due diligence.

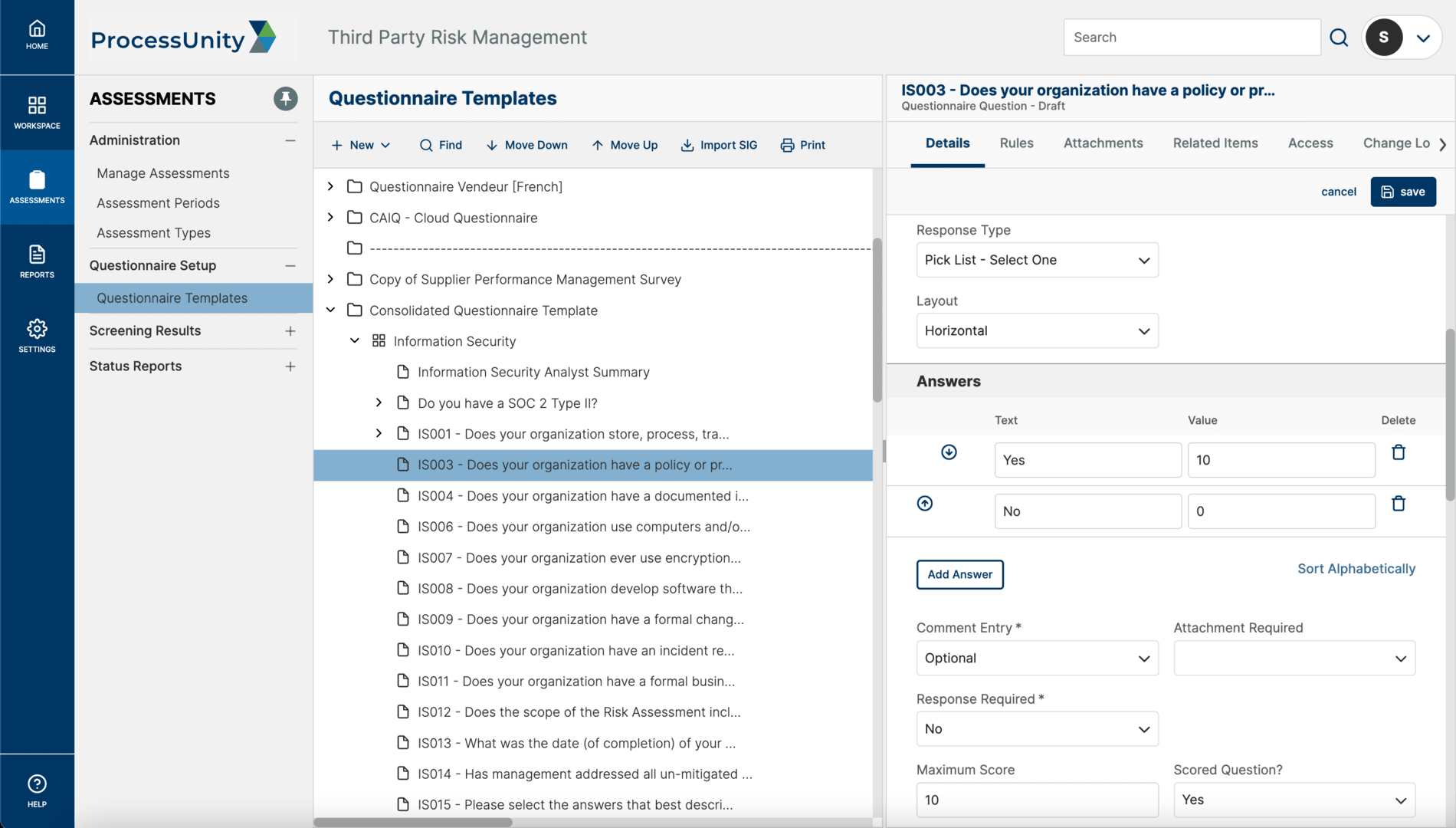

ProcessUnity Vendor Risk Management enforces objectivity within your vendor due diligence process. Our business rules engine clarifies the review process in two ways:

- Questions Lead to Precise Data Points

Our system helps you create questions that produce specific data points the can be meaningfully evaluated. For example, instead of asking for a credit score, it produces inquiries that determine whether the vendor’s credit score falls within an acceptable range.

- Risk Evaluation Based on Company Policy

The criteria for evaluation—pass, fail, or request clarification—is based on parameters consistent with company policy. Following the previous example, a submitted credit score would be automatically examined and assessed objectively against the company’s formal policy demands.

In addition, ProcessUnity VRM integrates information from key enterprise applications and external content providers to bring all critical data together for comprehensive evaluations for third- and even fourth-party partners.

Vendor Due Diligence Software + Targeted Vendor Intelligence

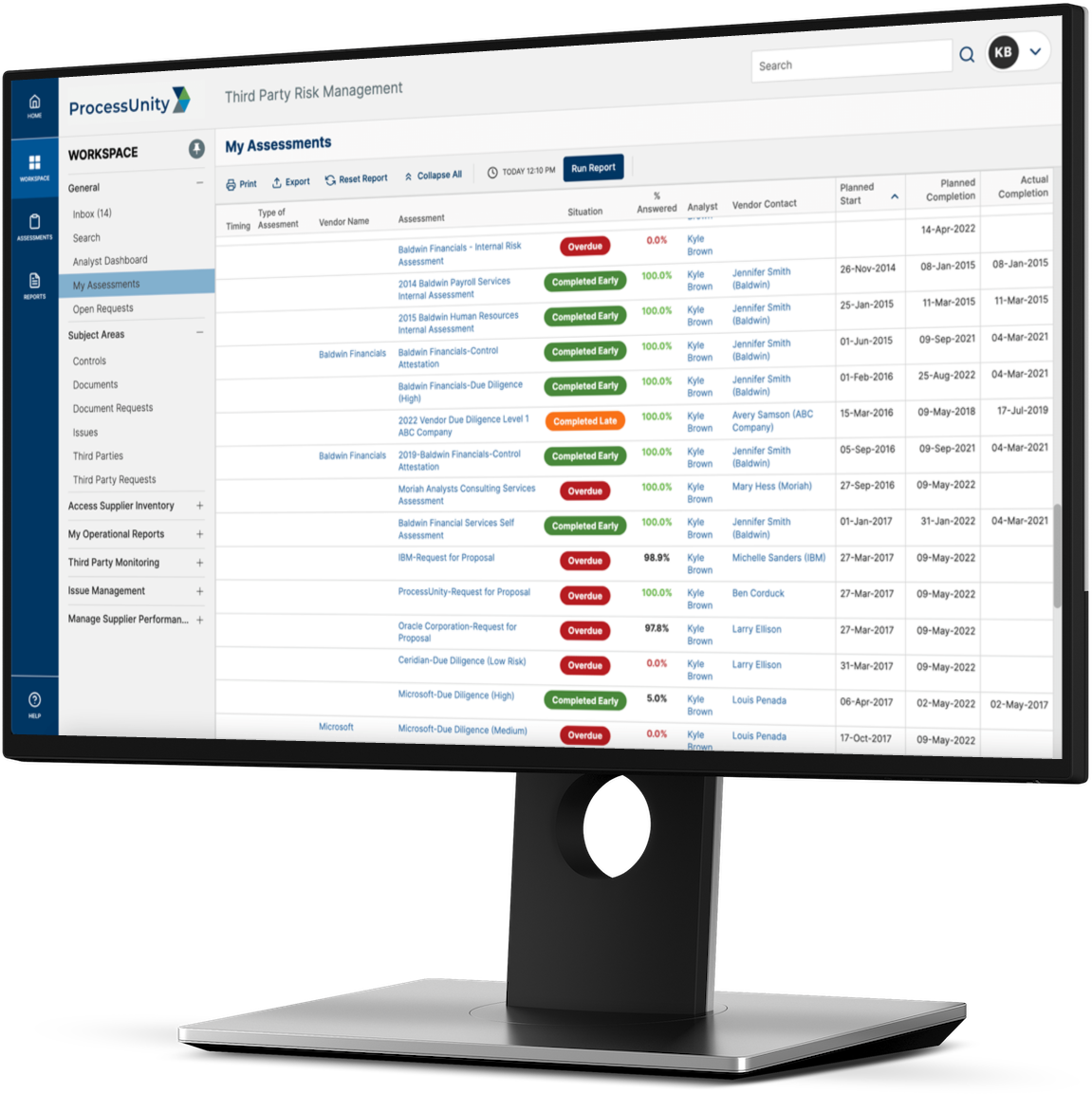

Reduce your burden: ProcessUnity Vendor Risk Management Vendor Intelligence Suite seamlessly integrates targeted vendor intelligence into Third-Party Risk Management processes to accelerate vendor due diligence reviews and perform continuous vendor monitoring.

ProcessUnity Vendor Intelligence Suite (VIS) enhances pre-contract due diligence and ongoing monitoring with:

- Cybersecurity Ratings

- Financial Ratings

- Automated Vendor Identification and Beneficial Owner Processes

- Reputational and Regulatory Risk Screening

- Business Sustainability Ratings

Request a Demo: ProcessUnity's Vendor Risk Management

Hundreds of organizations worldwide rely on ProcessUnity to make Vendor Risk Risk Management more effective and efficient. Schedule your personalized demo of our award-winning software and start your journey to a more mature, automated vendor risk management program today!

Request a Demo: ProcessUnity's Vendor Risk Management