Vendor Intelligence Suite

Vendor Financial Intelligence with RapidRatings

Targeted Intelligence for Vendor Onboarding and Ongoing Monitoring

ProcessUnity Vendor Financial Intelligence (VFI) with RapidRatings seamlessly incorporates RapidRatings’ financial health ratings into ProcessUnity’s Vendor Risk Management platform. VFI combines objective financial health information into third-party risk management processes to provide greater visibility into businesses for pre-and post-contract vendor due diligence. During vendor onboarding and throughout the vendor relationship, RapidRatings financial health information combined with ProcessUnity’s assessment engine provides continuous insight into the validity of vendors’ financial posture and overall risk to the business.

Accelerated Vendor Onboarding

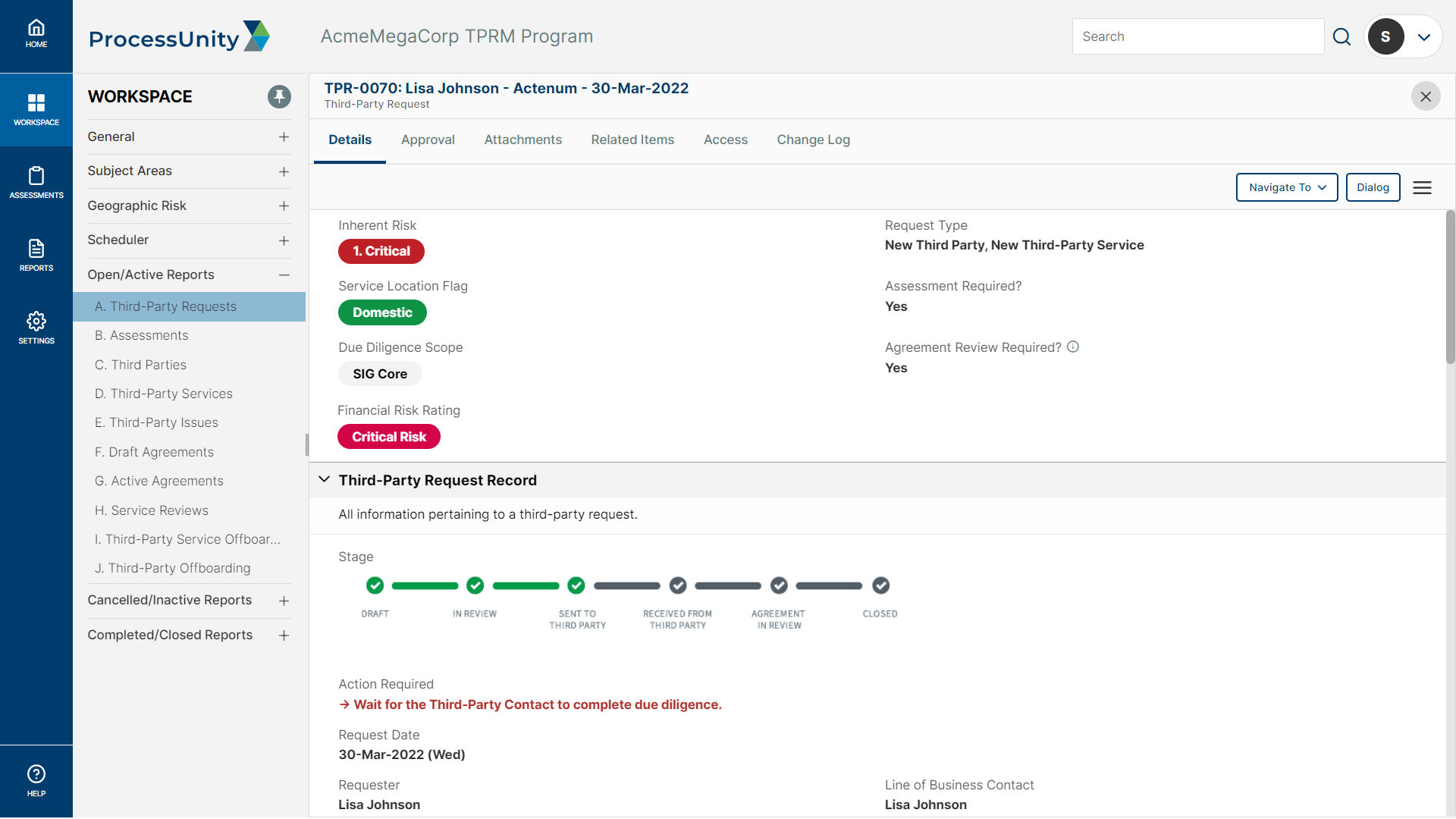

Third-party risk managers significantly reduce time-to-onboard third parties by identifying relevant, contextual warnings early in cycle and gain a more comprehensive view of a vendor’s financial posture during onboarding via due diligence integrated with financial risk data.

Objective & Accurate Assessments

RapidRatings’ Financial Health Ratings provide analysts with clear guidance (on a 0-100 scale) as to the likelihood that a third party will face disruption. The integrated financial ratings factor into inherent risk scoring, resulting in validation and high-quality data for analysis that will aid in key decision-making processes.

Thorough Vendor Evaluation

The financial lens provided by VFI, coupled with the risk intelligence from the SIG questionnaire, gives analysts a wider view of potential risks for a more thorough vendor evaluation. The streamlined processes also allows for reduced analyst review time and more informed analyst reviews.

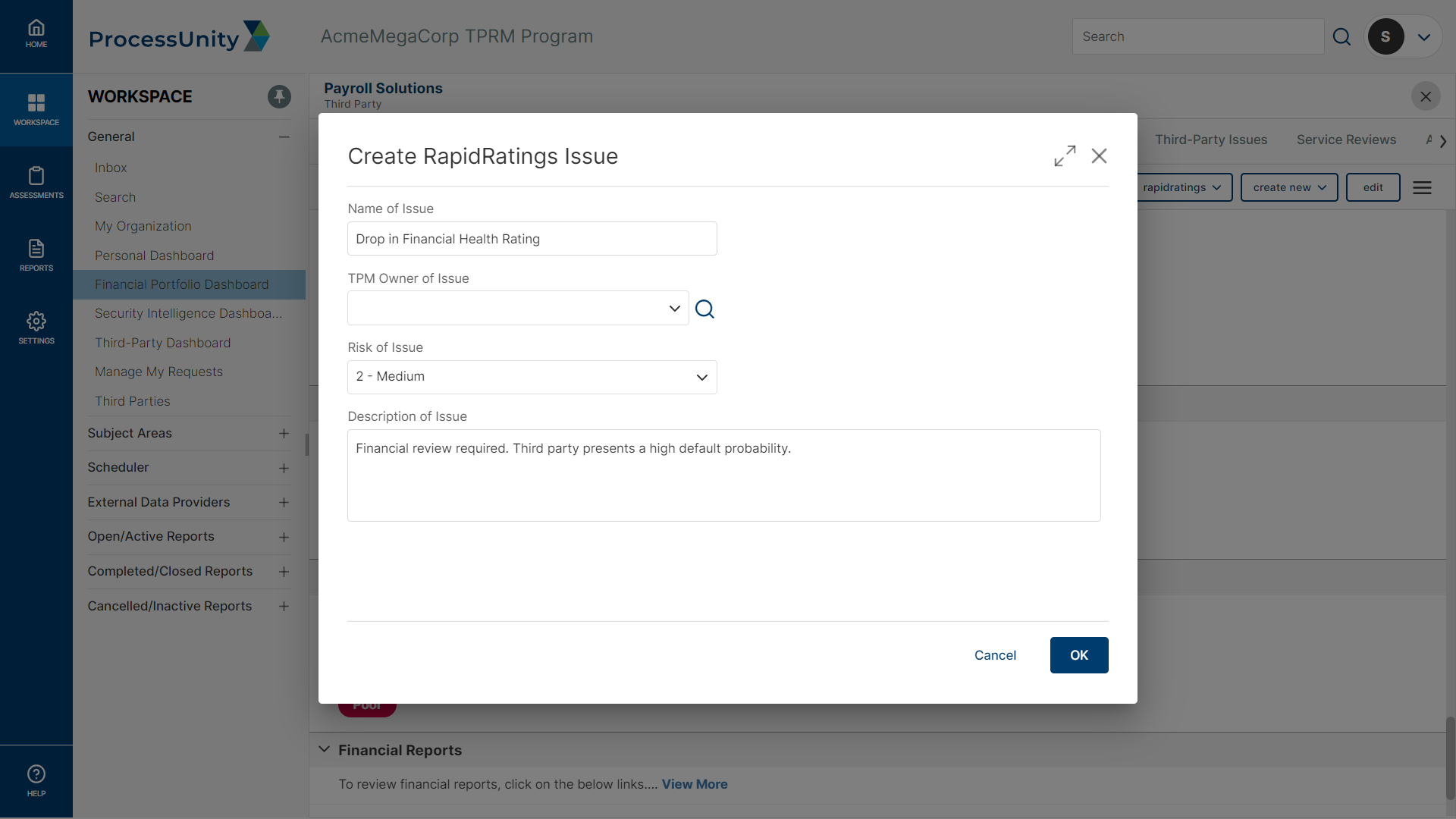

Real-Time Updates & Issue Management

Automated workflows immediately notify third-party risk managers of changes in a vendor’s financial posture for continuous, ongoing vendor monitoring. Real-time issue management reduces the time third-party risk managers take in creating, tracking and remediating issues and systematizes the issue creation process to reduce subjectivity.

Three-Minute Demo: Vendor Financial Intelligence

Solution Components

Vendor Financial Intelligence is comprised of four key components: ProcessUnity Vendor Risk Management, RapidRatings financial health information, the ProcessUnity RapidRatings Connector, and a combination of pre-built workflows, notifications, reports and dashboards that power enhanced third-party due diligence, vendor assessments, issue management and ongoing monitoring processes.

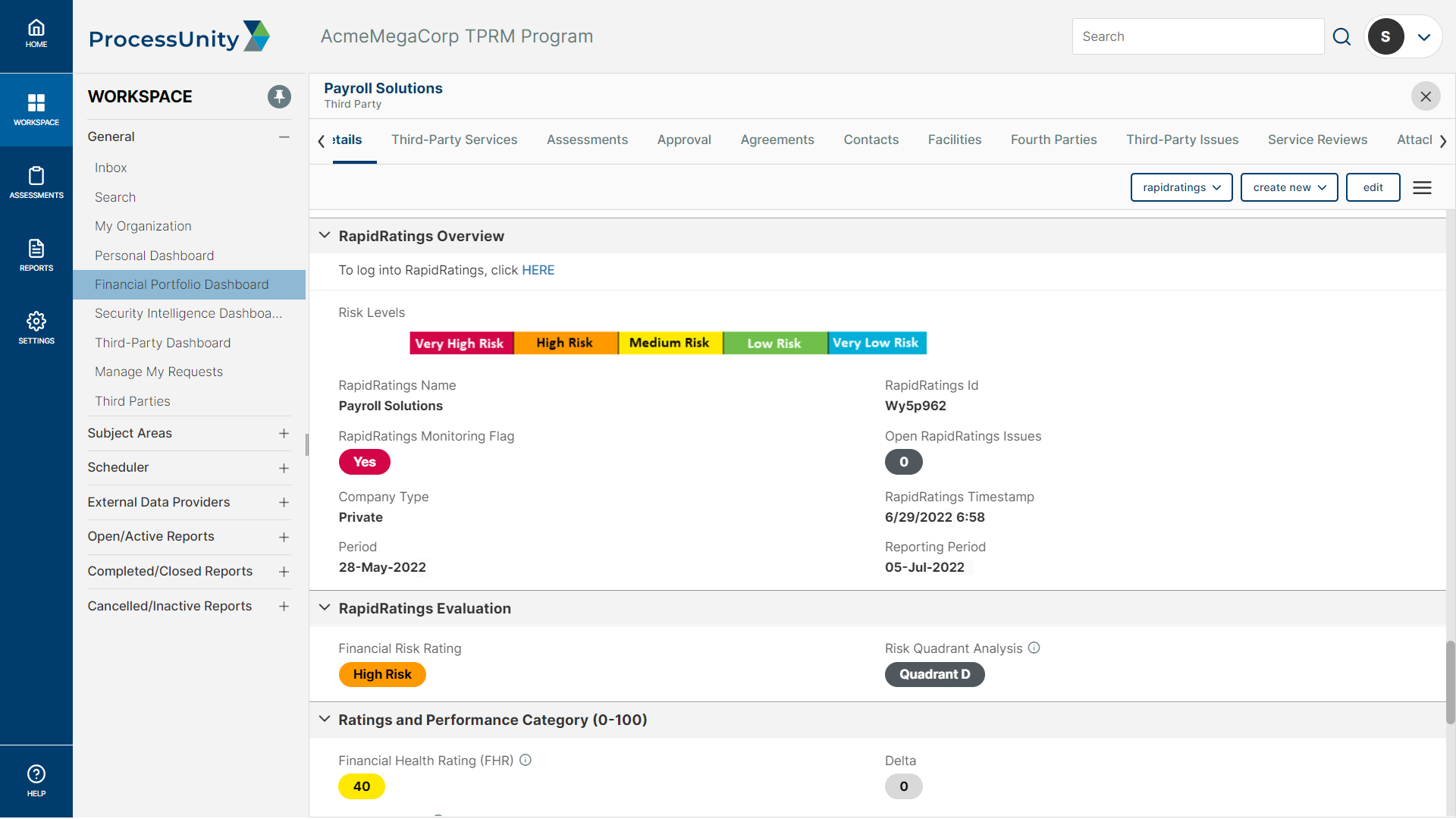

RapidRatings provides empirical ratings — uninfluenced by company bias — which serve as accurate and predictive indicators of a company’s financial viability, operational efficiency and resilience. Using a combination of advanced analytics and proprietary algorithms, RapidRatings produces two key measures of both public and private company’s financial health:

- Financial Health Rating (FHR®): A single number from 0-100 that indicates the probability of default within 12 months

- Core Health Score: A measurement that reflects operational efficiency and long-term sustainability

RapidRatings uses a unique quantitative analytics model to measure the financial health of public and private companies. This objective insight into the financial viability of third parties informs business decisions and helps companies meet regulatory requirements. Integrating RapidRatings data into the ProcessUnity Vendor Risk Management platform provides forward-looking visibility into the financial risks associated with doing business with third-party public and privately held organizations.

ProcessUnity’s connector seamlessly integrates RapidRatings Financial Health Rating and Core Health Score using a vendors’ ID. The connector presents these financial ratings directly within the ProcessUnity platform, eliminating the need to access multiple applications or manually enter risk information and calculations for each organization. The scores obtained from RapidRatings are incorporated into inherent risk scores to help inform assessment scoping and frequency to inject more intelligence and objectivity into the onboarding process. Third-party risk managers are notified of any changes in the vendor’s financial ratings and automated workflows are initiated for continuous, ongoing vendor monitoring, issue creation and management.

Vendor Financial Intelligence is built on ProcessUnity’s Best Practices Configuration for Vendor Risk Management – a complete, proven third-party risk program with turn-key workflows, assessments, calculations, risk analysis and reporting. Developed by Third-Party Risk Management subject matter experts and perfected via hundreds of successful customer implementations, Best Practices Configuration delivers a complete, “out-of-the-box” program with a high-quality, systematic and repeatable assessment process that improves communication between lines of business, third-party risk analysts and third-party contacts to ultimately drive risk out of an organization. ProcessUnity’s Best Practices Configuration employs industry-standard questionnaires to further streamline the vendor assessment process. The financial intelligence provided by VFI, coupled with the risk intelligence from the questionnaire, gives analysts a wider view of potential risks for a more thorough vendor evaluation.

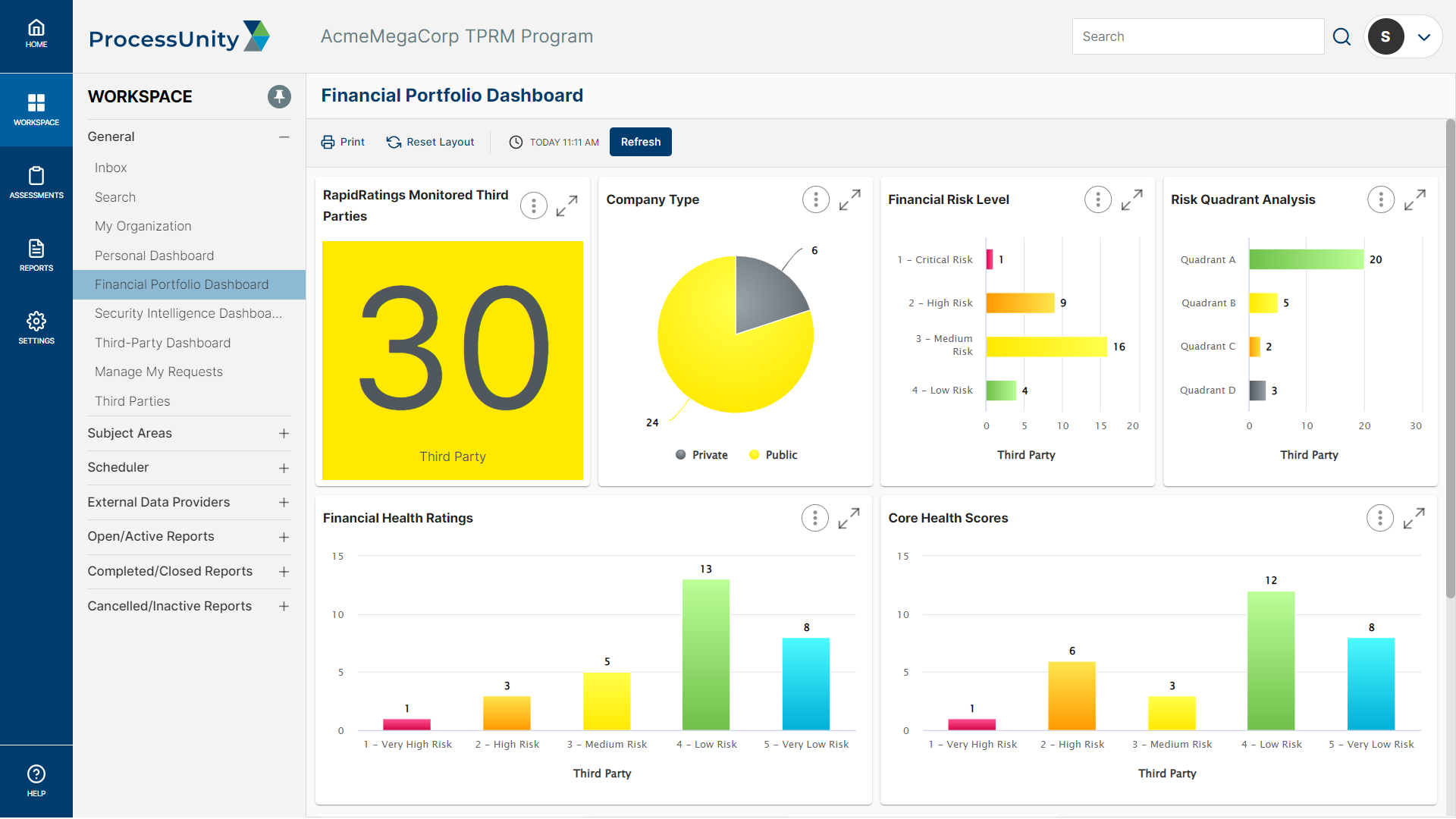

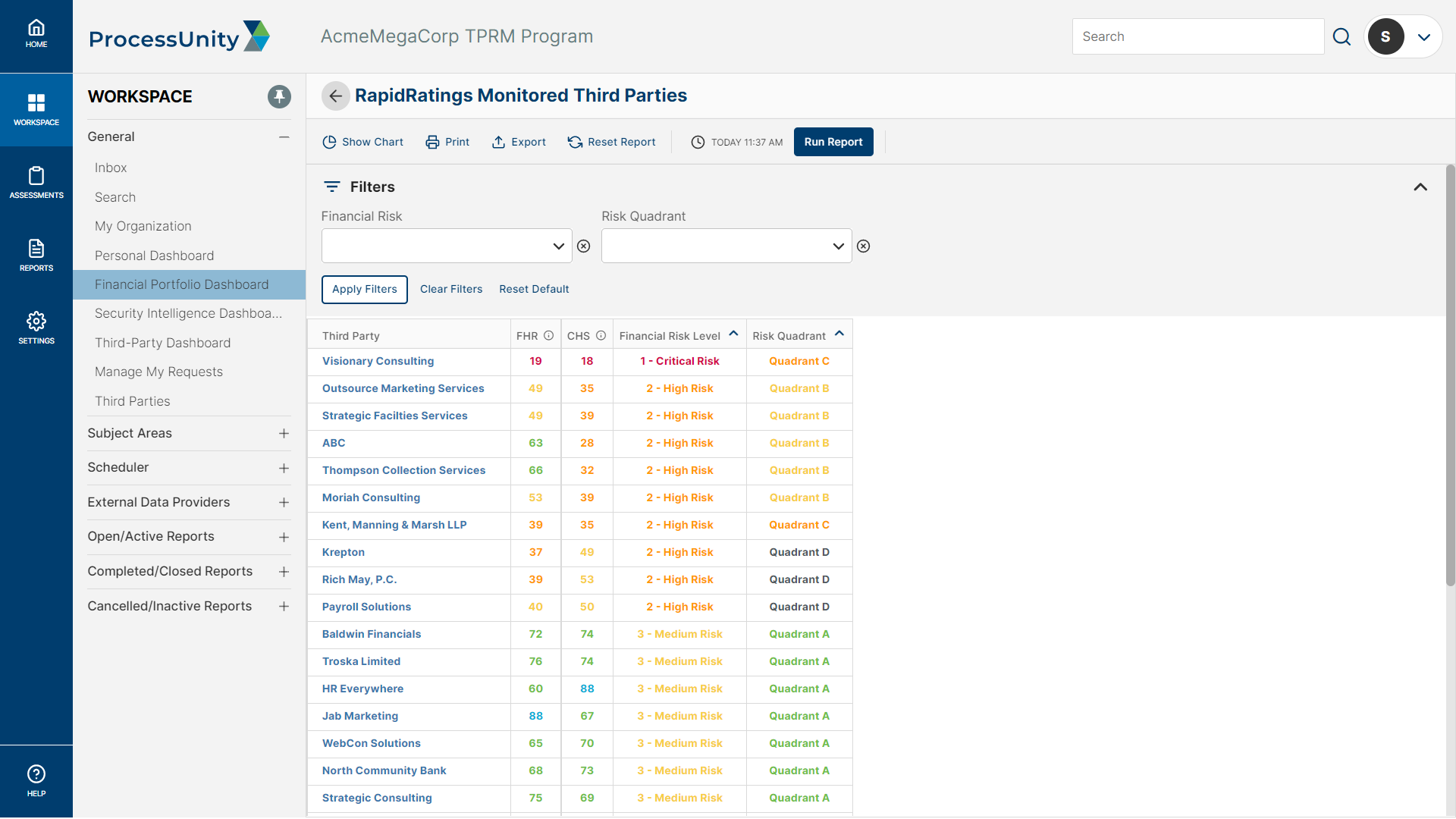

Interactive Dashboards & Reports

ProcessUnity Vendor Financial Intelligence provides a real-time, wholistic view of the financial risk across vendor populations through pre-built interactive reports and dashboards. Drill-down capabilities allow users to quickly find the details in any areas of concern while ProcessUnity’s extensive custom reporting capabilities enable the creation of role-specific reports to demonstrate to executives and regulators the existence of a consistent, reliable and repeatable program.

With built-in integration to RapidRatings’ financial health ratings, VFI gives third-party risk teams a complete Third-Party Risk Management solution that deploys in a matter of weeks. These four components combine to provide critical insights into a third party’s financial posture, strengthening the relationship between a business and its vendors, third parties and suppliers.

Request a Demo: ProcessUnity's Vendor Risk Management

Hundreds of organizations worldwide rely on ProcessUnity to make Vendor Risk Risk Management more effective and efficient. Schedule your personalized demo of our award-winning software and start your journey to a more mature, automated vendor risk management program today!

Request a Demo: ProcessUnity's Vendor Risk Management