Cut Risk, Not Corners: Streamlining the Third-Party Lifecycle with Risk Assessment Data

5 minute read

July 2025

The modern organization relies on a larger, more integrated network of third parties and suppliers now compared to any point in history, a dependence that cuts both ways. On one hand, the vast third-party ecosystem that powers modern business allows companies to act nimbly, and do more with their current resources. At the same time, it can be a serious challenge to keep up with the demands of an expanding network of third parties, each with their own risks and lifecycle requirements.

The Third-Party Risk Lifecycle

This growing vulnerability gap begs the question: how can the third-party risk management (TPRM) teams that oversee growing networks, manage growing risk across the third-party lifecycle for each of their relationships?

One increasingly popular solution is a third-party risk exchange network, or a central repository of standardized, validated third-party assessments that risk teams can use to eliminate the need to build and send a full questionnaire to each individual third party. An effective risk exchange eliminates time-consuming, inefficient manual processes, including piles of documents to review, data managed in spreadsheets, and communication only through email, that hold organizations back from taking complete control of their third-party risk posture. A third-party risk exchange enables faster, more reliable decision-making at each step of the third-party lifecycle.

Let’s dive into each step of the lifecycle, and explore how a third-party risk exchange can help your team work smarter, faster, and more effectively.

1. Prioritizing the Right Third Parties

One of the best ways to maximize your risk team’s output is to ensure your efforts are directed at the third parties that matter the most. Not all third parties should be given the same resources and attention; i.e. a custodial service with limited data access will require fewer information security controls than a cloud service provider with access to sensitive customer and employee information.

A risk exchange network makes deciding which third parties to prioritize more efficient in two ways:

- It enables your team to quickly assess inherent risk for each third party, ensuring that you have a complete a picture of each third party’s importance to business operations, and the potential harm a vulnerability or outage could cause.

- If further scrutiny is needed based on inherent risk, your team can use the library of attested risk assessments found in an exchange to immediately evaluate the third party’s risk posture.

2. Identifying and Assessing Third-Party Risk

The time it takes your team to gather and decipher risk assessment data is a key metric for determining how efficient your TPRM program is. In a third-party ecosystem made up of increasingly large and interconnected relationships, inefficiencies quickly multiply to the point where you’re forced to leave third parties unassessed and potentially risky.

A risk exchange remediates this challenge by:

- Granting your team access to a repository of instantly available third-party assessments, eliminating the pressure to fully assess your entire network with your internal resources.

- Providing your team with automated risk profiles for third parties not yet on the exchange, based on similar vendors and the third party’s publicly available data. This reduces the need for manual assessment work and potentially difficult vendor communication.

3. Conducting Due Diligence

Conducting due diligence is time-consuming and resource intensive. To add to the pressure, while your team conducts due diligence, there’s sure to be another internal business unit waiting on you to finish. The less efficient the process, the longer your organization has to wait to enlist the third party’s services or product.

With a third-party risk exchange, the due diligence process is made more efficient, reducing resource expenditure and granting access to third parties in a timely fashion. An exchange includes a repository of attested and validated risk data, plus the option to access external data through the platform, further validating the assessment.

4. Ongoing Monitoring and Emerging Threats

Like organizations themselves, third-party relationships never stay static; the risk posed by a given third party will wax and wane with developing trends and threats. Your organization can’t rely on outdated, point-in-time data to make ongoing decisions. You need to be able to trust that your TPRM tools will keep you updated on the threats and challenges posed to your organization as they emerge, so you won’t be caught unprepared by a major risk development.

This is why you need a risk exchange with ongoing monitoring and assessment capabilities. By providing real-time alerts into threats as they emerge, a risk exchange enables your organization to proactively address risks before they escalate.

5. Periodic Reporting, Metrics and Analytics

Third-party risk management often relies on internal collaboration between different functions and departments, making your ability to address risk only as strong as your ability to quickly and accurately communicate your organization’s risk posture. Your team needs to be ready to generate ad hoc, monthly, and quarterly reporting on the status of each third party in its portfolio, as well as overall risk and efficiency metrics that represent your program.

A risk exchange platform aids in this process by automatically producing data visualizations that communicate actionable insights, reducing the time necessary to both compile and analyze data across teams, departments, and functions. With reports that go as deep as a technical analyst needs, or stay high level for the board of directors, you can customize your third-party risk data to meet the needs of your business.

The ProcessUnity Global Risk Exchange

When choosing a third-party risk exchange, you need to make sure that the platform you choose provides the quality of data your organization needs, with a repository large enough to cover your entire third-party ecosystem.

With the world’s largest library of 18,000 validated third-party risk assessments, the ProcessUnity Global Risk Exchange provides accurate third-party data, validated by external risk analysis partners and continually updated by third parties themselves.

To learn more about what the ProcessUnity Global Risk Exchange can do for your organization, check out this report from GRC 20/20 that demonstrates exactly how much value our exchange can provide over time.

To speak to the ProcessUnity team about the Global Risk Exchange, and our suite of third-party risk management AI tools, contact us today.

Related Articles

Accelerate Control Reviews with ProcessUnity’s Evidence...

Third-party risk assessments are becoming increasingly complex and resource-intensive. Manual evidence reviews create bottlenecks, inconsistent..

Learn More

5 Cybersecurity Frameworks Financial Institutions Can’t...

Regulatory pressure is intensifying — and financial institutions are feeling the heat. In 2024, the..

Learn More

ProcessUnity Evidence Evaluator: AI-Based Third-Party Controls...

See how ProcessUnity’s GenAI-powered feature simplifies third-party risk assessments. In just 60 seconds, discover how..

Learn More

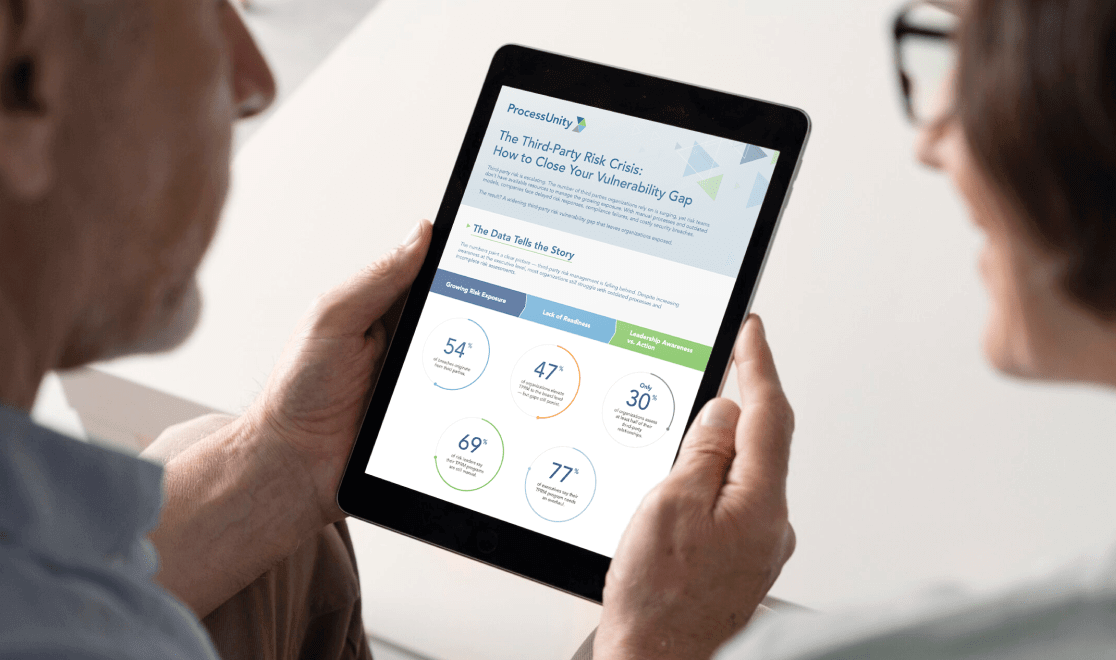

How to Close Your Third-Party Risk...

Is your organization exposed to hidden third-party risks that could create dangerous blind spots in..

Learn More

8 Ways Your Business Benefits from...

Cyber threats are intensifying. Regulatory scrutiny is increasing. Legacy assessments simply can’t keep pace. To..

Learn More

5 Critical Regulations Reshaping TPRM in...

The pressure on financial institutions to manage third-party risk is mounting — and the stakes..

Learn More

How Third-Party Vendor Risk Disrupts Business...

Your third-party vendors are delivering on time, business operations are efficient and planned, and customers..

Learn More

10 Critical Third-Party Risk Management Challenges...

Every vendor relationship can introduce potential vulnerabilities to your business, and in today's hyperconnected business..

Learn More

Ensure Ongoing DORA Compliance Across Your...

The Digital Operational Resilience Act (DORA) is a regulatory framework established by the European Union..

Learn More

5 Essential Steps to Modernize Your...

Third-party relationships have become a critical vulnerability point - with 54% of security breaches occurring..

Learn More

Third-party risk: Re-thinking vendor assessments

Third parties can introduce substantial risk into global supply networks, but rigorous vendor risk assessments..

Learn More

ProcessUnity Introduces a Revolutionary Platform to...

Threat and Vulnerability Response Platform Utilizes Proprietary Threat Intelligence to Rapidly Identify Third-party Gaps and..

Learn More

Revolutionizing Response to Emerging Third-Party Cybersecurity...

Introducing ProcessUnity’s New Threat and Vulnerability Response Platform to Quickly Identify Emerging Threats and Assess..

Learn More

How Organizations and Vendors Use a...

A third-party risk exchange is a transformative concept designed to make third-party risk management (TPRM)..

Learn More

ProcessUnity Introduces Industry’s All-In-One Third-Party Risk...

Completes Integration with Global Risk Exchange; Augments Resources to Extend Coverage to More Outsourced Service..

Learn More

Mature Your Cyber Program with a...

Risk-based cybersecurity risk management is the process of identifying, tracking and mitigating the risks to..

Learn More

Controls-Based Versus Risk-Based Cybersecurity Programs

In the face of an escalating regulatory burden and increasingly common data breaches, many teams..

Learn More

Manage Cybersecurity Risk with the SCF...

The Secure Controls Framework (SCF) Risk Management Model can be a powerful tool for teams..

Learn More

Optimize Vendor Onboarding by Aligning with...

During the vendor onboarding process, both cybersecurity and procurement manage the amount of risk brought..

Learn More

3 Takeaways about Anti-Bribery and Corruption...

Anti-bribery and corruption programs grant businesses visibility into their internal practices and third-party networks to..

Learn More

Properly Scoping Vendor Due Diligence Drives...

Properly Scoping Vendor Due Diligence Saves Both Time and Money One of the costliest mistakes..

Learn More

Security Assessments 2.0: The Next Generation...

The more things change, the more they stay the same. It's a well-worn adage that..

Learn More

How to Conduct Third-Party Due Diligence

Identifying and engaging with the right partners is essential to the success of most businesses...

Learn More

Evaluating Security Risk When Onboarding New...

In today’s tightly interwoven supply chains and highly competitive markets, organizations must continuously evaluate and..

Learn More

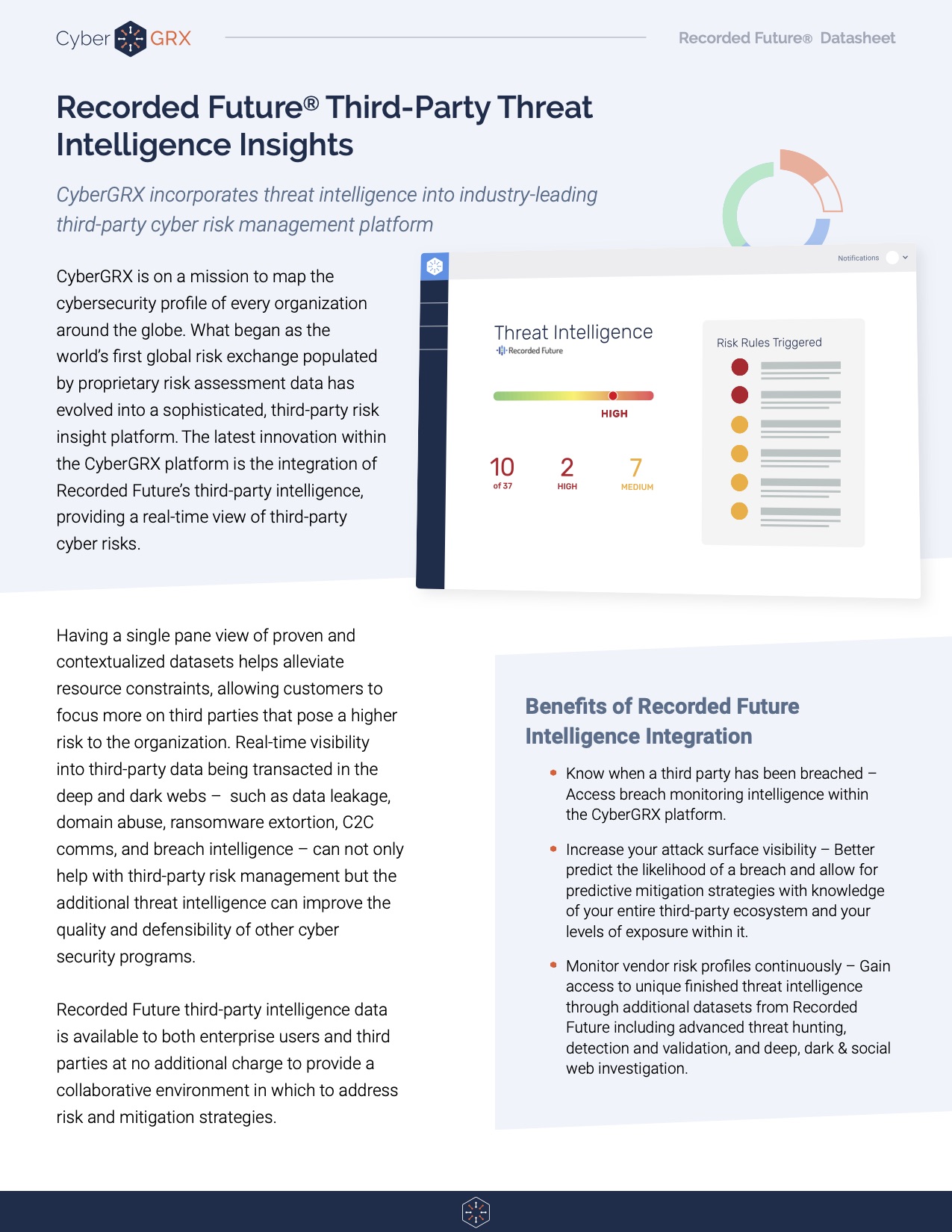

Recorded Future Third-Party Threat Intelligence Insights

Having a single pane view of proven and contextualized datasets helps alleviate resource constraints, allowing..

Learn More

5 Areas to Mitigate Risk in...

If you work within a Vendor Risk Management (VRM) team, you know that third-party risk..

Learn More

5 Tips to Improve Your Vendor...

Vendor due diligence is essential to any third-party risk management program. However, no two due diligence processes are..

Learn More

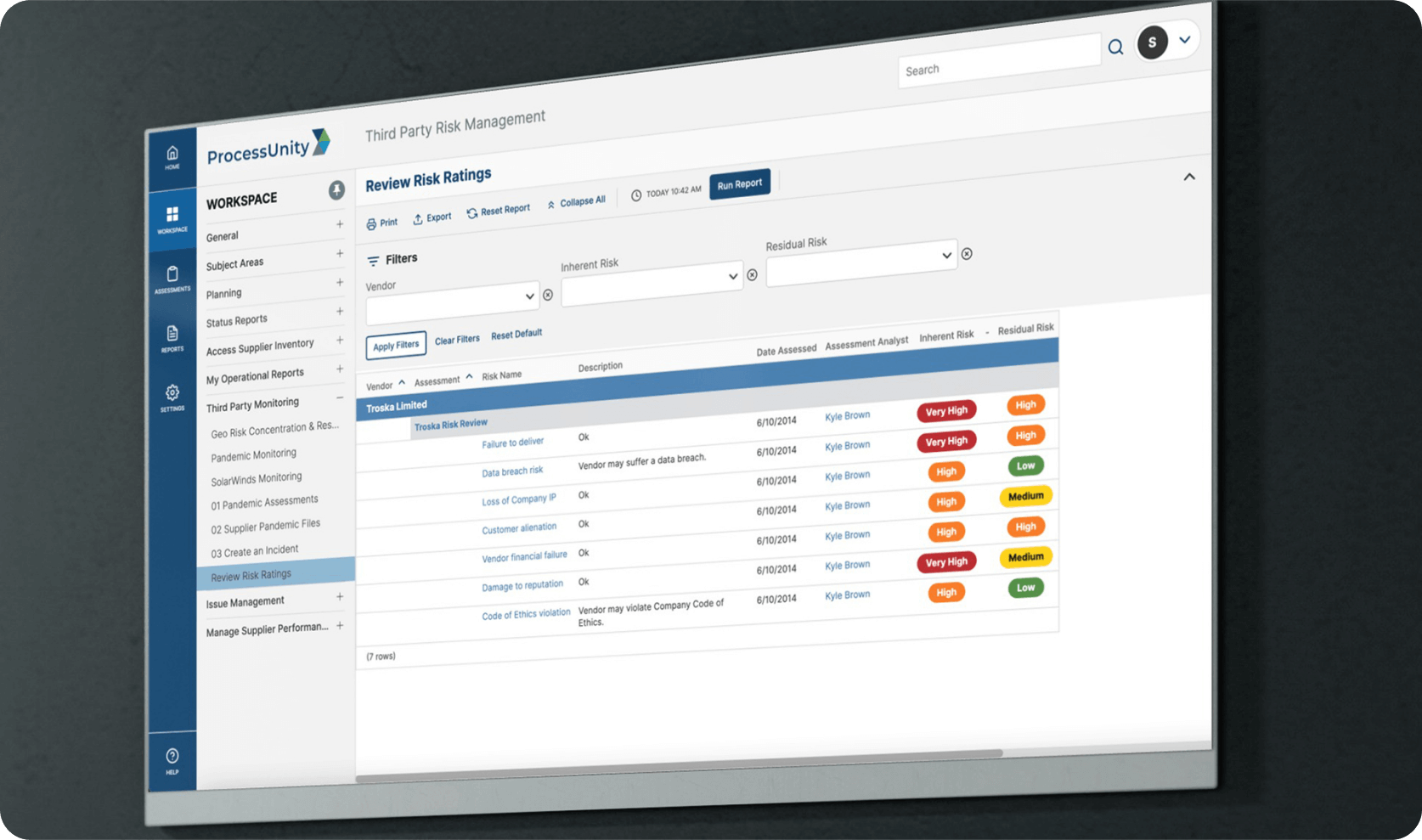

Inherent Risk vs. Residual Risk in...

Conducting a thorough vendor risk analysis is an integral step in Vendor Risk Management. However,..

Learn More

What is Third-Party Risk Management?

Third-Party Risk Management is the process of identifying, managing and mitigating risks present in a vendor relationship. This..

Learn More

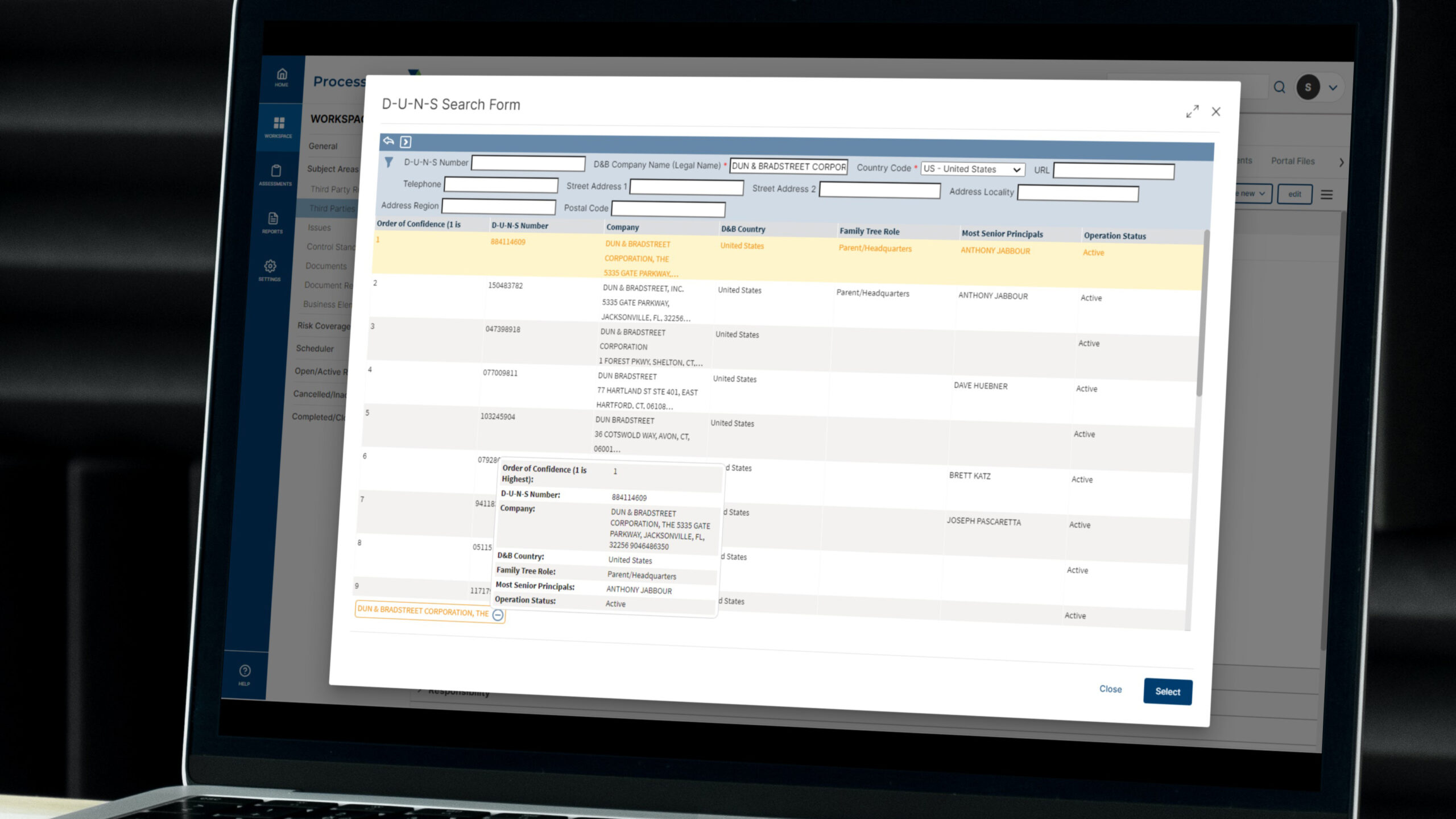

ProcessUnity Vendor Identity Intelligence with Dun...

ProcessUnity Vendor Identity Intelligence seamlessly and automatically incorporates D&B’s D-U-N-S Search and Beneficial Owner Search..

Learn More

Anti-Bribery & Corruption (ABAC) in Business...

The impacts of corruption can be very severe and have been historically well documented. On a political level, corruption – however and wherever..

Learn More

What Is Third-Party Risk Management: The...

The recent SolarWinds breach has reminded news organizations, businesses, and leadership teams around the world..

Learn More

8 Benefits of Completing a CyberGRX...

CyberGRX modernizes and streamlines redundant and inefficient processes that come with shared and static..

Learn More

Third-Party Risk Management Best Practices

New Guide Offers Expert Advice for Effective and Efficient Vendor-Risk Processes A robust, effective, and..

Learn More

Best Practice Program for ProcessUnity Vendor...

ProcessUnity Vendor Risk Management (VRM) protects companies and their brands by reducing risks from third-party vendors and..

Learn More

ProcessUnity Vendor Financial Intelligence Powered By...

ProcessUnity Vendor Financial Intelligence (VFI) with RapidRatings seamlessly incorporates RapidRatings’ financial health ratings into ProcessUnity’s Third-Party..

Learn More

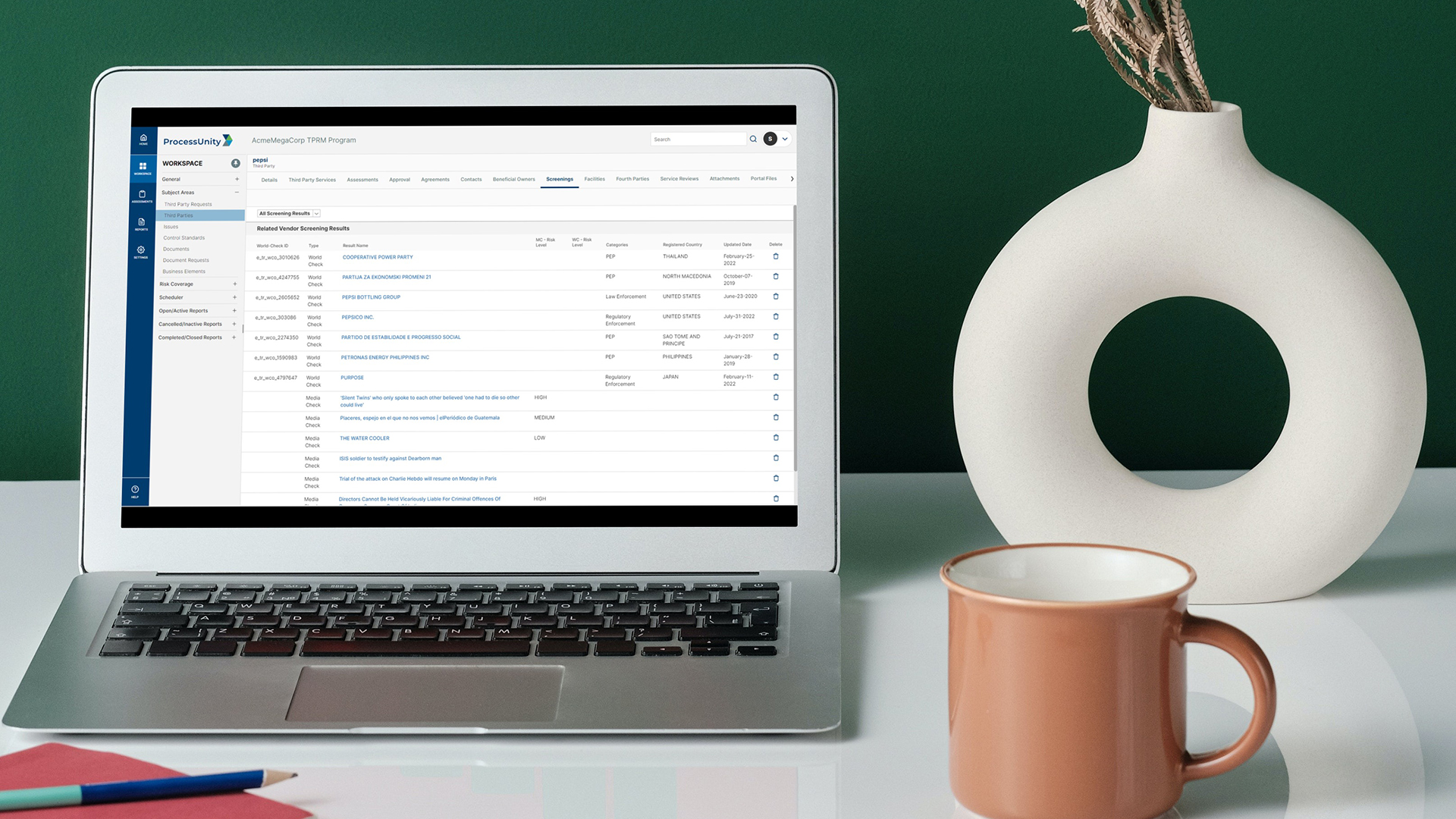

Vendor Screening Intelligence with Refinitiv

ProcessUnity Vendor Screening Intelligence (VSI) embeds LSEG World-Check One’s third-party screening capabilities into ProcessUnity’s Third-Party Risk..

Learn More

How to Stay Ahead of Risk...

Managing risk through pre-contract vendor due diligence in a digitally connected world Thanks to increasing..

Learn MoreAbout Us

ProcessUnity is a leading provider of cloud-based applications for risk and compliance management. The company’s software as a service (SaaS) platform gives organizations the control to assess, measure, and mitigate risk and to ensure the optimal performance of key business processes. ProcessUnity’s flagship solution, ProcessUnity Vendor Risk Management, protects companies and their brands by reducing risks from third-party vendors and suppliers. ProcessUnity helps customers effectively and efficiently assess and monitor both new and existing vendors – from initial due diligence and onboarding through termination. Headquartered outside of Boston, Massachusetts, ProcessUnity is used by the world’s leading financial service firms and commercial enterprises. For more information, visit www.processunity.com.