Turn TPRM Data Challenges into Opportunities

Managing an effective Third-Party Risk Management (TPRM) program is a significant challenge for any organization. As your network of third-party vendors expands, so do the complexities of assessing and mitigating risk. Common challenges include:

- Growing volumes of third parties to assess and monitor

- Limited internal resources to handle increasing reviews

- Difficulty maintaining visibility into evolving risks

- Inconsistent or incomplete data from third parties

Instead of being bogged down by manual assessments and fragmented data, empower your team with shared intelligence that streamlines your TPRM program.

The ProcessUnity Global Risk Exchange:

Assessment Data to Extend Your Team

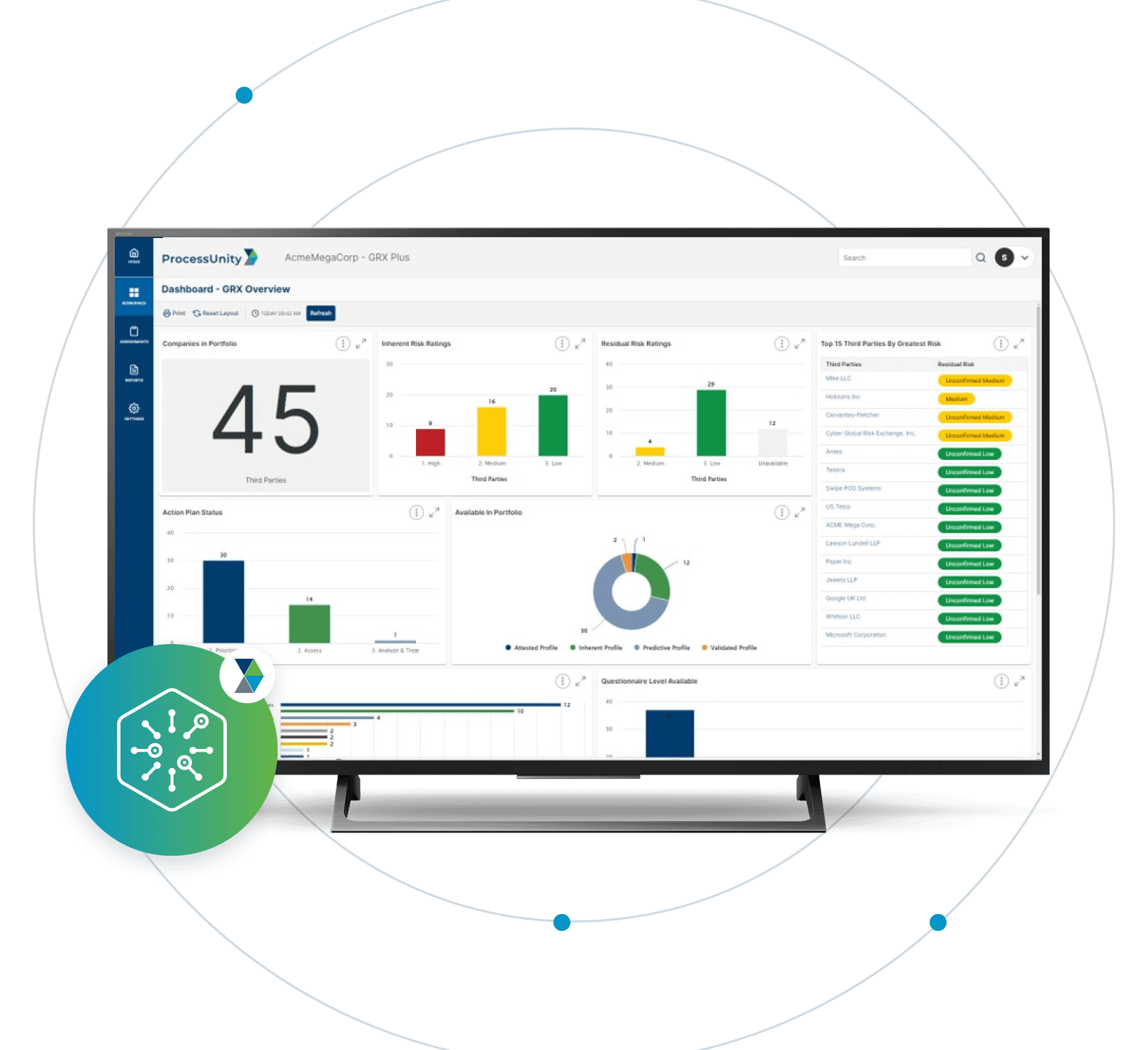

The ProcessUnity Global Risk Exchange is the world’s largest library of third-party risk management data. Our

customers access completed vendor assessments and curated vendor risk profiles to reduce assessment work

and ultimately experience a:

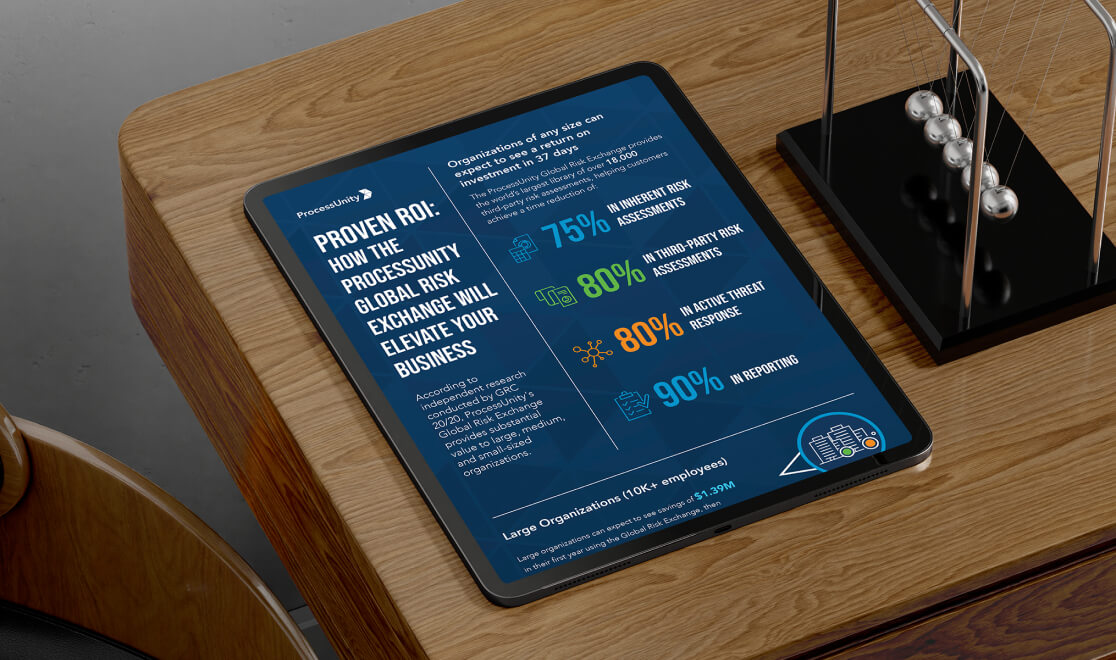

*Read the ProcessUnity Global Risk Exchange Value Perspective from GRC 20/20 for

more details on how we maximize customer return on investment.

Global Risk Exchange Highlights

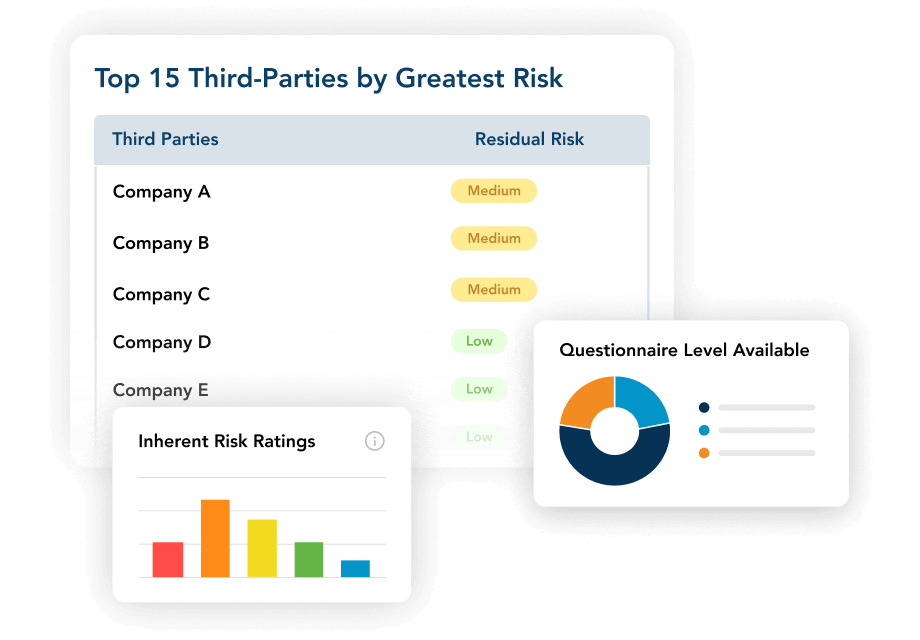

Request completed and validated assessments from more than 80% of the world’s largest and most requested third parties.

Leverage our curated Automated Risk Profiles to keep tabs on lower-risk third parties you don’t have time to assess.

Instantly tier your entire vendor portfolio based on their importance to business operations and the risk they bring to your company.

Combine the Global Risk Exchange with our powerful TPRM Platform for a complete, end-to-end TPRM solution.

Relevant Data & Powerful Insights to Extend to Your Team

Assess Hard-to-Assess Vendors

The Global Risk Exchange library features more than 18,000 assessments including large, hard-to-assess third parties that typically don’t respond to assessment requests. This vast array of accessible evaluations not only accelerates the TPRM lifecycle but also enhances its efficacy. By providing detailed insights into third-party risks, the Exchange eliminates the time-consuming and complex task of having to individually assess each third party.

Validated third parties in the Global Risk Exchange include:

- 80% of Fortune 1000 companies

- 4 of the top 5 cloud providers

- 12 of the top 20 law firms

- 4 of the top 5 private equity firms

- The top 4 accounting firms

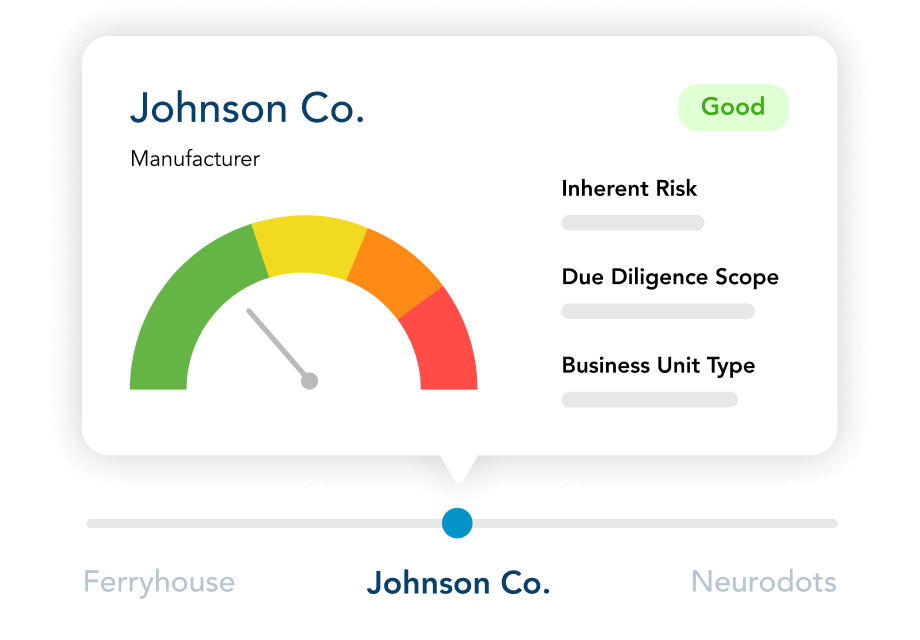

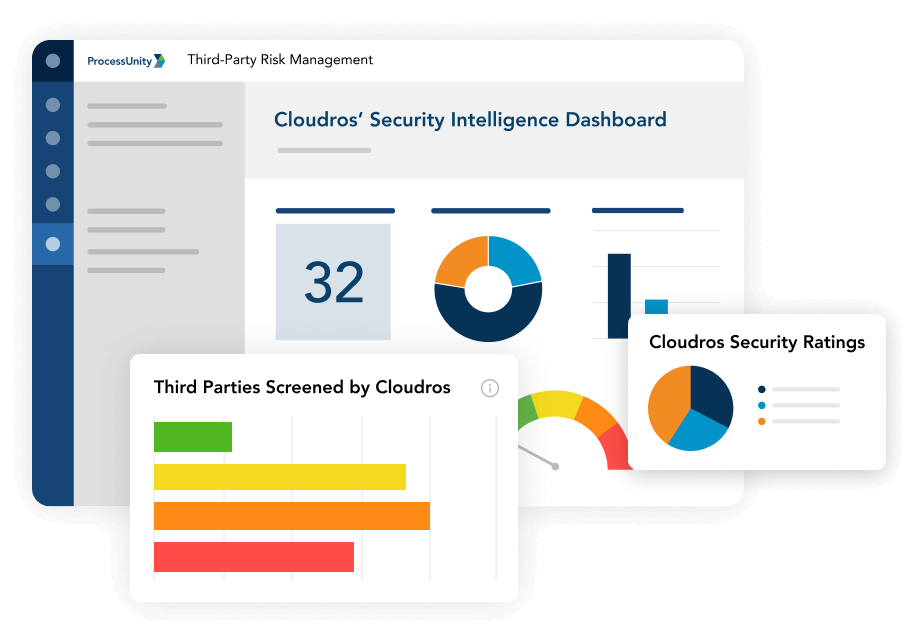

Monitor 100% of Your Third-Party Ecosystem

The Global Risk Exchange further extends your team’s capabilities with automated risk profiles for more than 370,000 global third parties. These profiles, built using intelligent algorithms and data science, enable you to foresee potential vulnerabilities and risks, encouraging proactive mitigation strategies.

This expansive coverage is equal to a vast virtual team relentlessly monitoring your entire vendor ecosystem. It eliminates the traditional challenges associated with managing many third-party relationships, optimizing your team’s efficiency, and providing a broader, more in-depth understanding of your organization’s risk landscape.

Relevant Data & Powerful Insights to Extend to Your Team

Assess Hard-to-Assess Vendors

The Global Risk Exchange library features more than 18,000 assessments including large, hard-to-assess third parties that typically don’t respond to assessment requests. This vast array of accessible evaluations not only accelerates the TPRM lifecycle but also enhances its efficacy. By providing detailed insights into third-party risks, the Exchange eliminates the time-consuming and complex task of having to individually assess each third party.

Validated third parties in the Global Risk Exchange include:

- 80% of Fortune 1000 companies

- 4 of the top 5 cloud providers

- 12 of the top 20 law firms

- 4 of the top 5 private equity firms

- The top 4 accounting firms

Monitor 100% of Your Third-Party Ecosystem

The Global Risk Exchange further extends your team’s capabilities with automated risk profiles for more than 370,000 global third parties. These profiles, built using intelligent algorithms and data science, enable you to foresee potential vulnerabilities and risks, encouraging proactive mitigation strategies.

This expansive coverage is equal to a vast virtual team relentlessly monitoring your entire vendor ecosystem. It eliminates the traditional challenges associated with managing many third-party relationships, optimizing your team’s efficiency, and providing a broader, more in-depth understanding of your organization’s risk landscape.

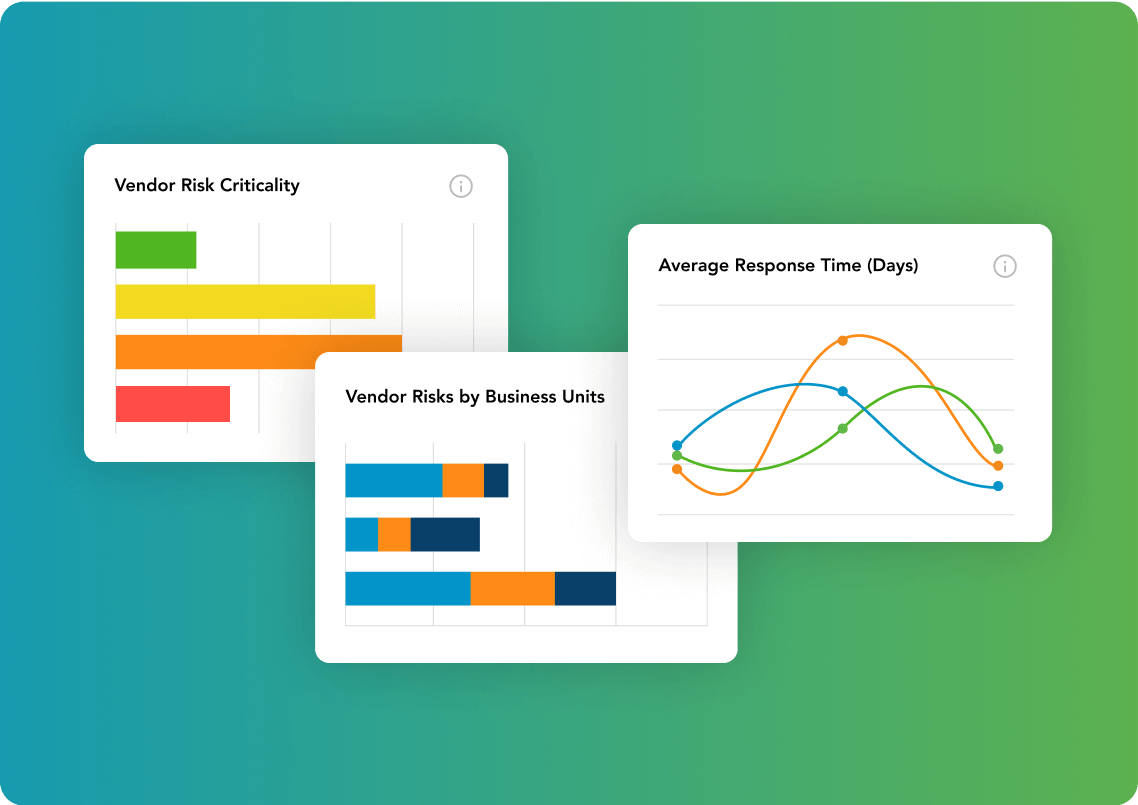

Extend Your TPRM Platform with Global Risk Exchange

Extend the power of the ProcessUnity TPRM Platform with a subscription to the Global Risk Exchange, the world’s largest database of third-party risk assessments and curated risk profiles. Tap into our library of more than 18,000 attested assessments and 370,000 vendor profiles to reduce your team’s assessment workload while gaining access to assessment data from large, hard-to-assess third parties that typically don’t respond to your questionnaire requests.

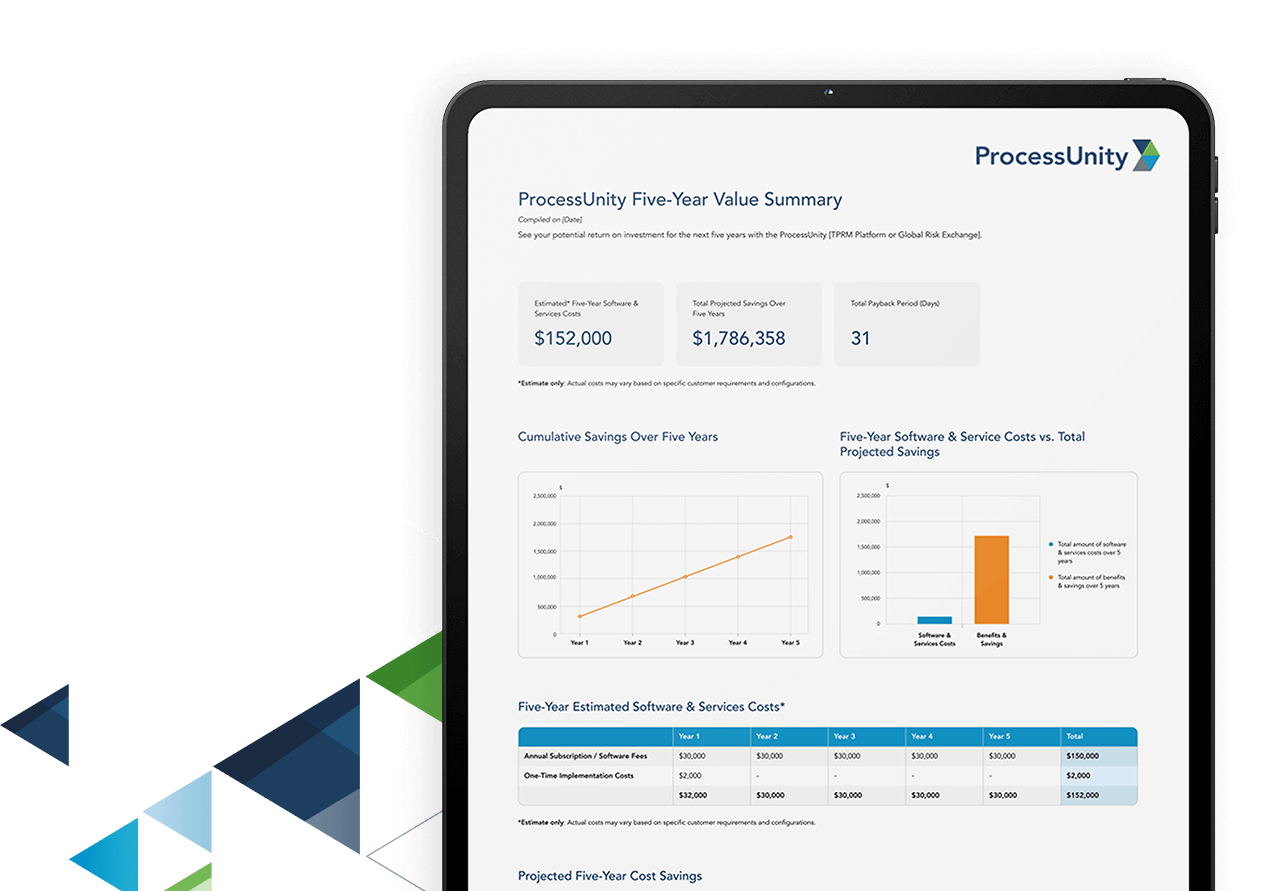

Calculate Your Potential Savings with ProcessUnity

Build a business case to uplevel your Third-Party Risk Management program. Answer a few short questions and generate your custom savings report.

Calculate Your ROI Now

Frequently Asked Questions

A third-party risk assessment is the process of evaluating a third party’s potential risk to the business across areas such as cybersecurity, regulatory compliance, and operational practices to ensure they align with your organization’s standards.

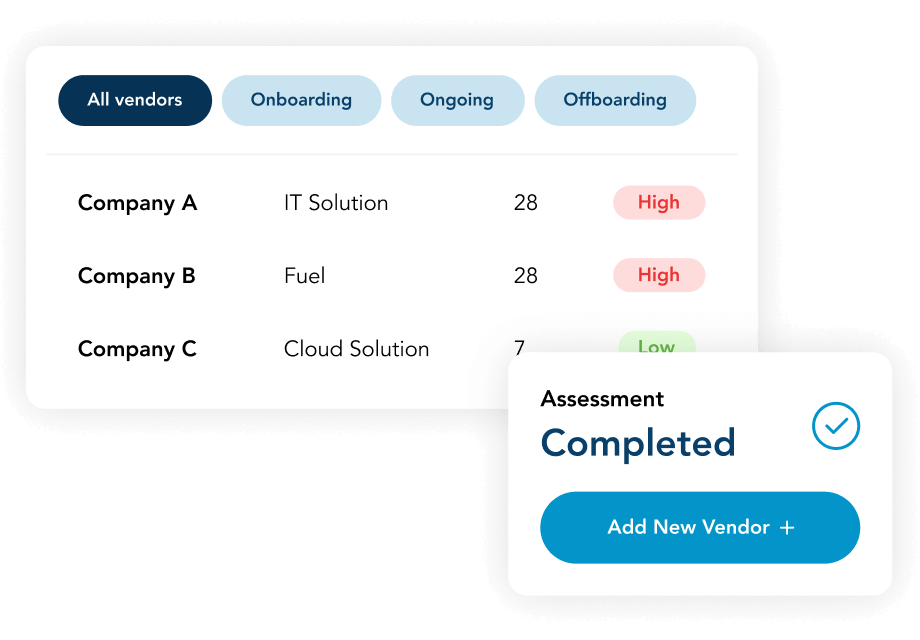

The five phases of third-party risk management are:

- Planning and Scoping – Identify critical third parties and define risk management goals.

- Due Diligence and Selection – Assess third-party risk before onboarding.

- Contract Negotiation – Set clear expectations for compliance, security, and performance.

- Ongoing Monitoring – Continuously assess third-party risk and performance.

- Termination and Transition – Manage offboarding with plans for continuity and compliance.

A third-party risk assessment exchange contains validated risk assessments, completed questionnaires, vendor risk profiles, and supporting documentation. It provides fast, reliable access to third-party risk data, even for hard-to-reach third parties, and accelerates risk decision-making.

Monitoring third-party risk involves continuous assessments, integration of external risk data, real-time alerts, and regular third-party performance reviews to identify and address emerging threats proactively.

Here’s how to perform a third-party risk assessment:

- Define the scope and objectives of your assessment based on the third party’s inherent risk levels.

- Gather third-party information through tailored questionnaires.

- Leverage a third-party risk assessment library to systematically evaluate and verify specific risk areas.

- Analyze assessment results to identify potential vulnerabilities.

- Develop targeted remediation plans to address identified risks.

- Document the process for future reference and compliance purposes.

Next Steps:

Schedule a ProcessUnity Platform Demo

Our team is here to show you how forward-thinking organizations are elevating their

Third-Party Risk Management programs and practices to maximize risk reduction. Start

your journey with ProcessUnity today.