ProcessUnity Digital Operational Resilience Act (DORA)

Digital Operational Resilience Act (DORA) Compliance

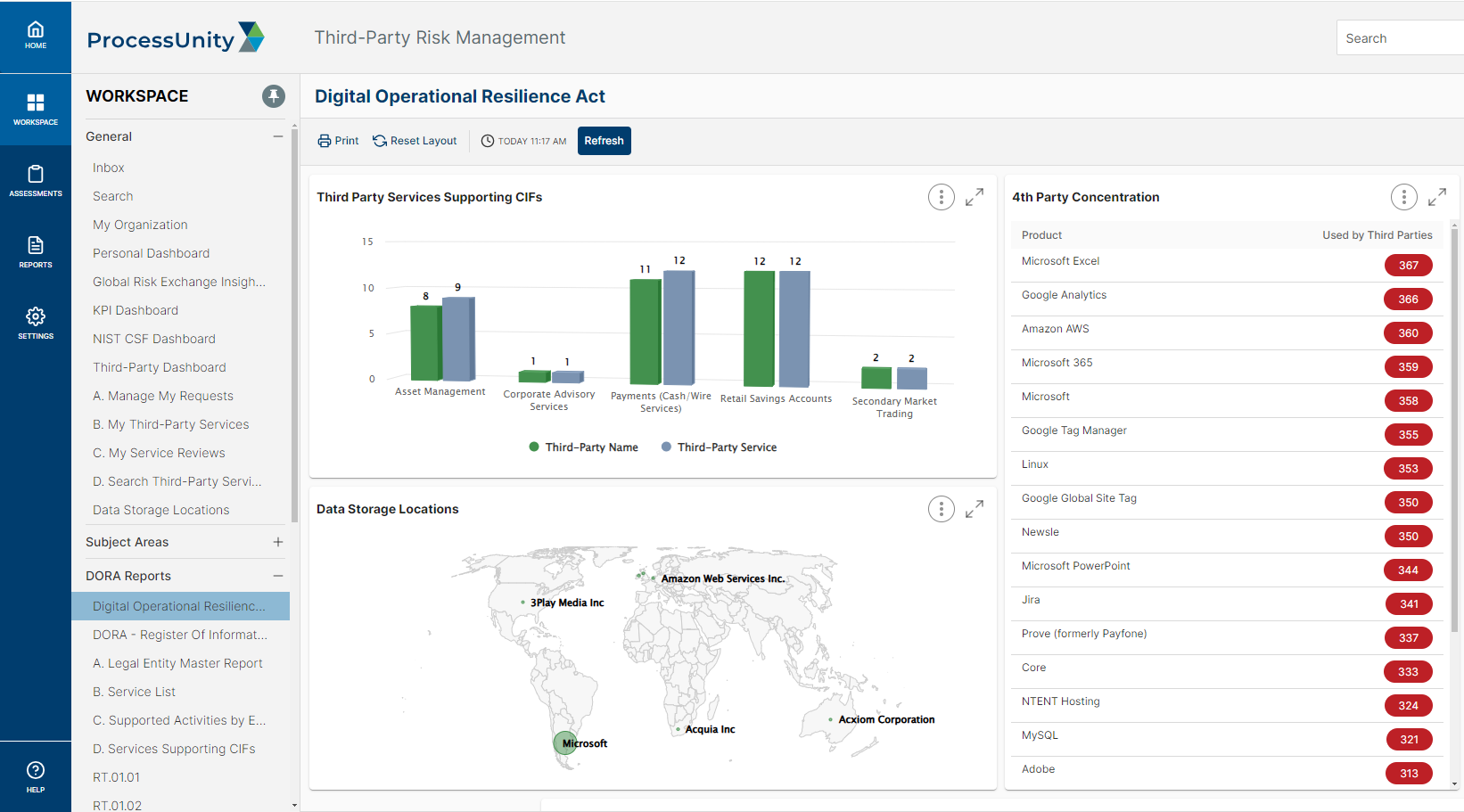

The Digital Operational Resilience Act (DORA) is not just a regulatory mandate—it’s a crucial framework for safeguarding your organization against third-party risk. Mature your third-party risk management (TPRM) program and ensure compliance with DORA without disrupting your day-to-day operations with ProcessUnity.

Key Features and Benefits:

Standardized DORA Third-Party Risk Management

-

Streamlined Onboarding:

Quickly validate the alignment of new third parties with DORA standards using pre-built onboarding steps, ensuring a complete risk profile.

-

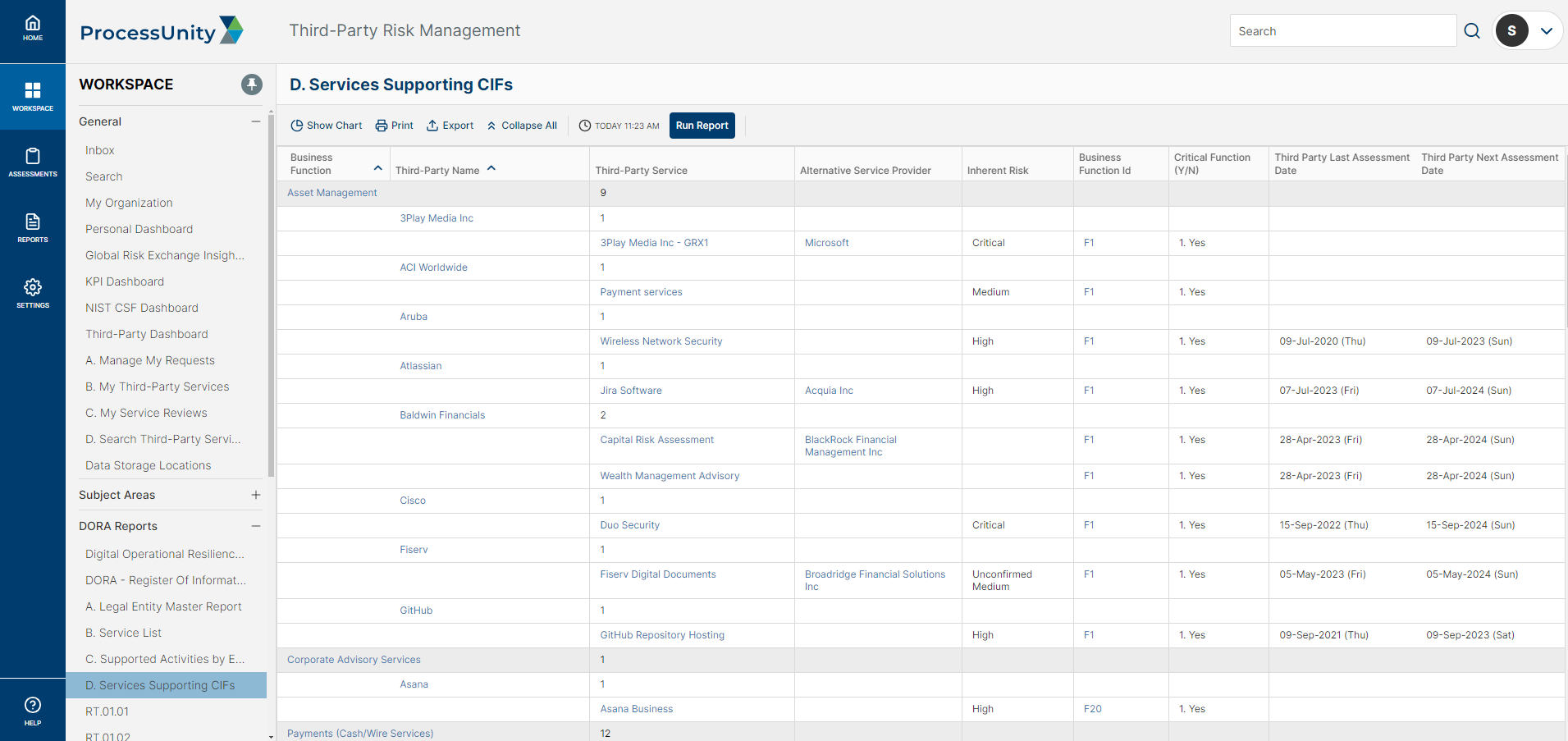

Critical Third-Party Identification:

Leverage a configurable questionnaire to identify and risk-rank your most critical third-party service providers, with streamlined identification of ICT services supporting critical functions.

-

Automated Third-Party Assessments:

Capture essential information required by DORA through automated workflows, including organizational data, intra-company relationships, contractual language, and critical business functions.

-

Continuous Monitoring:

Automate annual due diligence reviews and supplement assessment data with insights into weak third-party controls, ensuring ongoing compliance with DORA.

Incident Response and Reporting

-

Rapid Incident Response:

Develop a mechanism for swift incident response using incident management workflows. Track third-party incidents through to remediation, ensuring compliance with DORA’s strict incident reporting timelines.

-

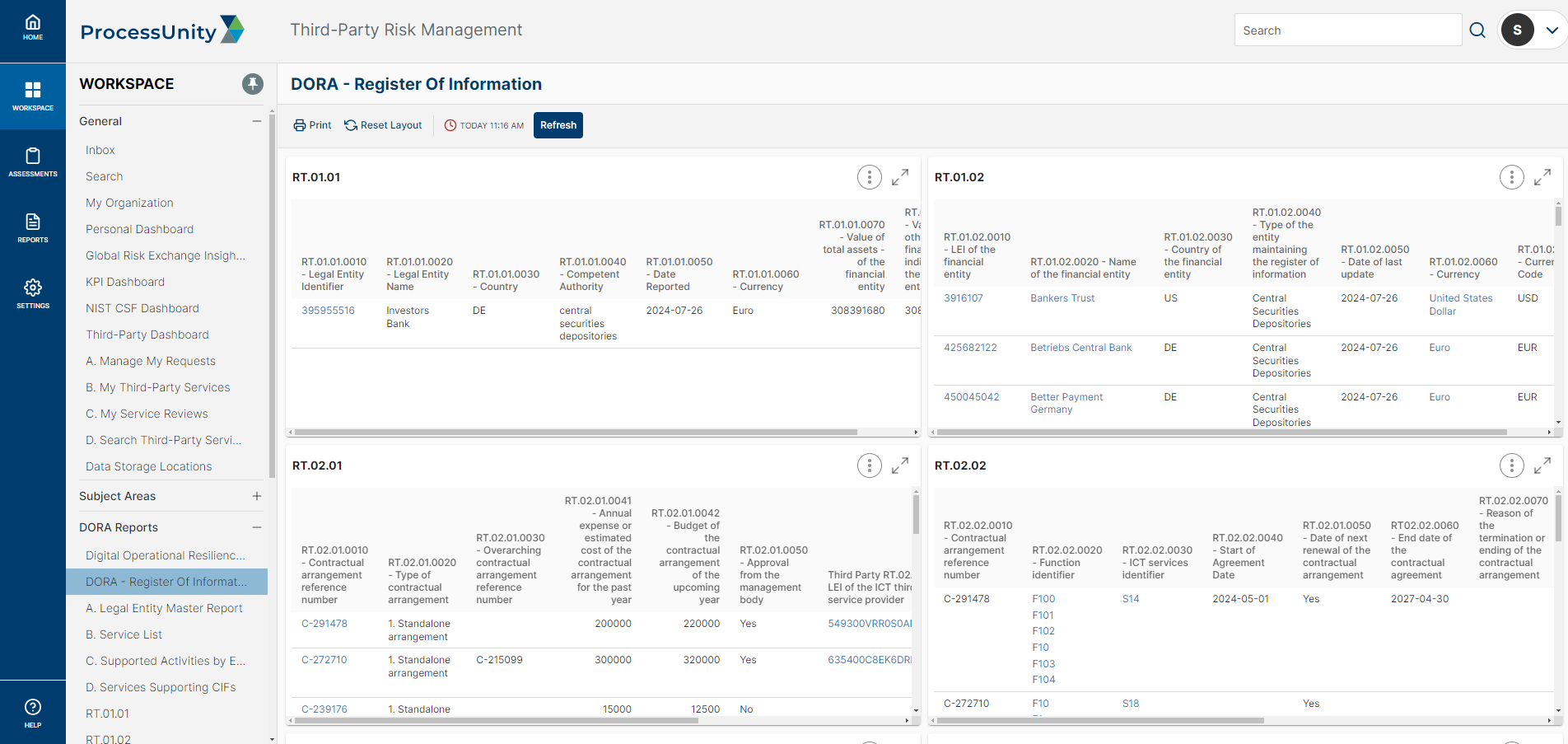

Register of Information:

Simplify the process of collecting, preparing, and presenting data in the Register of Information by automatically populating it from key sources and exporting it with a click.

ProcessUnity’s DORA Components

- Centralized ICT Risk Framework

- Register of Information

- Third-Party Control Assessments

- Standardized TPRM Workflow

- CIF Third Party Identification and Substitutability Planning

- Subcontractor / Nth Party Risk Evaluation

- Continuous Third-Party Control Gap Identification

- Rapid Incident Response and Reporting

- Automated Data Preparation and Export for the Register of Information

Why Choose ProcessUnity for DORA Compliance?

- Efficiency: Reduce the time and effort needed to prepare for DORA compliance.

- Resilience: Maintain resilient operations in the event of a third-party failure and make operational resilience a competitive advantage.

- Trust: Strengthen trust with customers and business partners through robust third-party risk management.

Ready to Learn More? Contact us to discuss your requirements and learn how ProcessUnity DORA enables you to achieve compliance and strengthen your third-party risk management program

Request a Demo: ProcessUnity's DORA Third Party Risk Management Solution

ProcessUnity for DORA streamlines your adherence to new ICT security mandates. Schedule a call today to learn how ProcessUnity for DORA can help you implement cybersecurity risk management best practices internally and throughout your supply chain.

Request a Demo: ProcessUnity's DORA Third Party Risk Management Solution