ProcessUnity Digital Operational Resilience Act (DORA)

Digital Operational Resilience Act (DORA) Compliance

The Digital Operational Resilience Act (DORA) is not just a regulatory mandate—it’s a crucial framework for safeguarding your organization against third-party risk. Mature your third-party risk management (TPRM) program and ensure compliance with DORA without disrupting your day-to-day operations with ProcessUnity.

Key Features and Benefits:

Standardized DORA Third-Party Risk Management

-

Streamlined Onboarding:

Quickly validate the alignment of new third parties with DORA standards using pre-built onboarding steps, ensuring a complete risk profile.

-

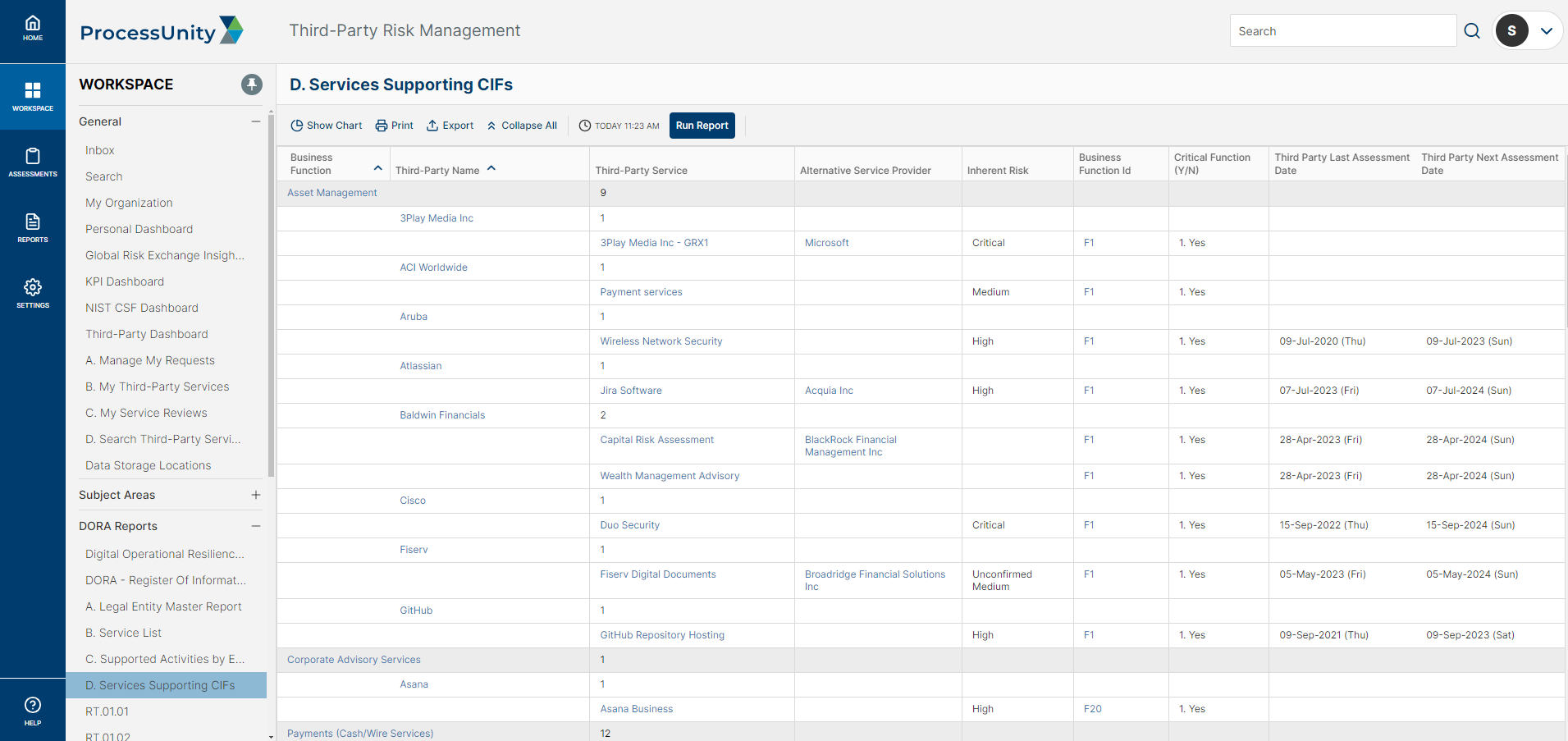

Critical Third-Party Identification:

Leverage a configurable questionnaire to identify and risk-rank your most critical third-party service providers, with streamlined identification of ICT services supporting critical functions.

-

Automated Third-Party Assessments:

Capture essential information required by DORA through automated workflows, including organizational data, intra-company relationships, contractual language, and critical business functions.

-

Continuous Monitoring:

Automate annual due diligence reviews and supplement assessment data with insights into weak third-party controls, ensuring ongoing compliance with DORA.

Incident Response and Reporting

-

Rapid Incident Response:

Develop a mechanism for swift incident response using incident management workflows. Track third-party incidents through to remediation, ensuring compliance with DORA’s strict incident reporting timelines.

-

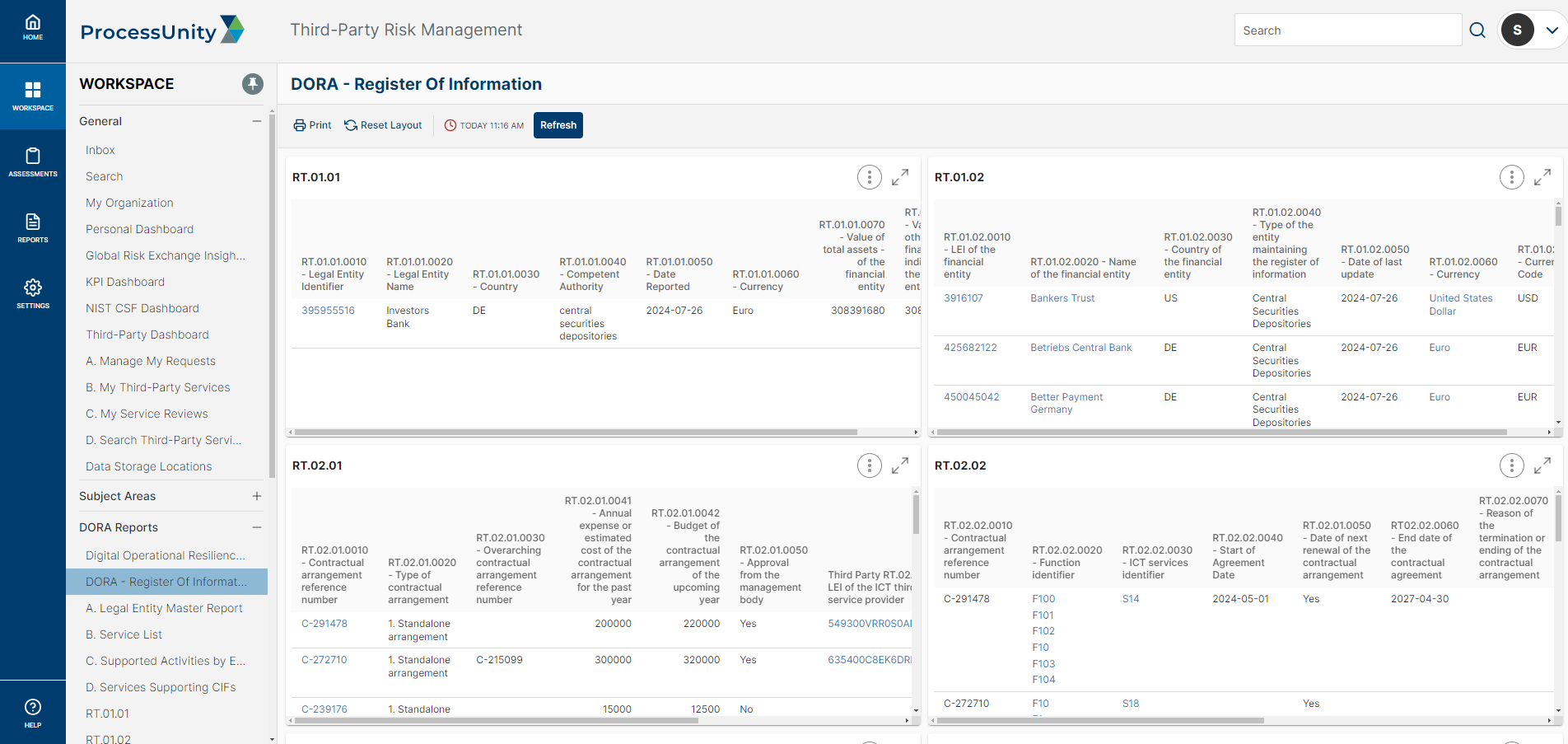

Register of Information:

Simplify the process of collecting, preparing, and presenting data in the Register of Information by automatically populating it from key sources and exporting it with a click.

ProcessUnity’s DORA Components

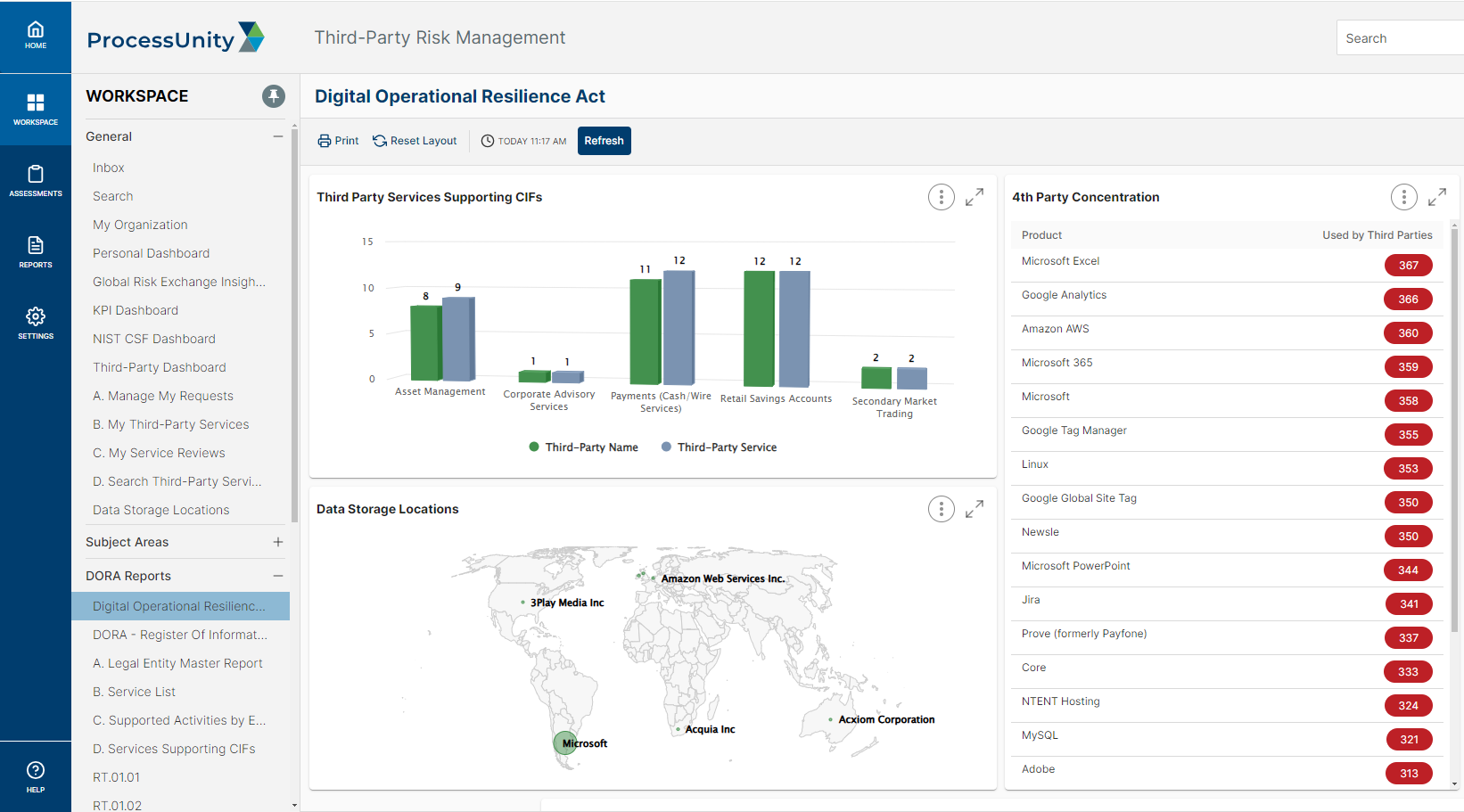

- Centralized ICT Risk Framework

- Register of Information

- Third-Party Control Assessments

- Standardized TPRM Workflow

- CIF Third Party Identification and Substitutability Planning

- Subcontractor / Nth Party Risk Evaluation

- Continuous Third-Party Control Gap Identification

- Rapid Incident Response and Reporting

- Automated Data Preparation and Export for the Register of Information

Why Choose ProcessUnity for DORA Compliance?

- Efficiency: Reduce the time and effort needed to prepare for DORA compliance.

- Resilience: Maintain resilient operations in the event of a third-party failure and make operational resilience a competitive advantage.

- Trust: Strengthen trust with customers and business partners through robust third-party risk management.

Ready to Learn More? Contact us to discuss your requirements and learn how ProcessUnity DORA enables you to achieve compliance and strengthen your third-party risk management program

Request a Demo: ProcessUnity's DORA Third Party Risk Management Solution

ProcessUnity for DORA streamlines your adherence to new ICT security mandates. Schedule a call today to learn how ProcessUnity for DORA can help you implement cybersecurity risk management best practices internally and throughout your supply chain.

Request a Demo: ProcessUnity's DORA Third Party Risk Management Solution

Frequently Asked Questions

The Digital Operational Resilience Act (DORA) is an EU regulation that standardizes ICT risk management and third-party control requirements across the financial sector. It aims to strengthen cybersecurity practices and ensure operational resilience across financial institutions and their critical third parties, ultimately protecting consumer data and finances.

To achieve DORA compliance, financial institutions must implement a robust third-party risk management (TPRM) program. This includes:

- Automated third-party risk assessments

- Continuous third-party monitoring

- Incident response workflows

- An exportable Register of Information as outlined by DORA standards

Under DORA, third parties — especially critical ICT service providers — must comply with strict requirements, and be able to demonstrate controls in place related to:

- Risk management

- Incident reporting

- Resilience testing

- Subcontractor oversight

These controls ensure operational continuity and regulatory alignment for the financial institutions they support.

DORA compliance strengthens operational resilience, reduces third-party risk, improves audit readiness, and builds trust with customers and regulators by safeguarding sensitive data and ensuring business continuity (not to mention avoiding financial penalties for your business).